Tether Releases Audit Report Results for Gold-Backed Altcoin XAUT

Tether has released its Q3 2025 validation report for its gold-backed token, Tether Gold (XAUT). The report states that each XAUT token is fully backed by physical bullion stored in Switzerland.

According to a report prepared by El Salvador-based TG Commodities SA de CV, Tether's reserves stood at 375,572 ounces of pure gold as of September 30. This amount, based on the end-of-quarter reference price, is valued at approximately $1.44 billion. The company has 522,089 XAUT tokens in circulation, while 139,751 are available for sale.

With the recent surge in gold prices, XAUT's market capitalization has reached $2.1 billion, more than doubling from its August level of less than $850 million.

Tether CEO Paolo Ardoino stated, “Tether Gold proves that real-world assets can thrive on-chain without any compromises.” Ardoino argued that record gold prices and the growing interest of institutional investors in tokenization projects present a major opportunity for XAUT.

Tether Gold and its competitor, PAX Gold, account for 90% of the total $3.7 billion tokenized gold market. XAUT has become one of the largest real-world asset (RWA) products on-chain. The tokenization trend is a growing topic among financial institutions and regulators, with U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce stating that tokenization is currently a “major focus” for the agency.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

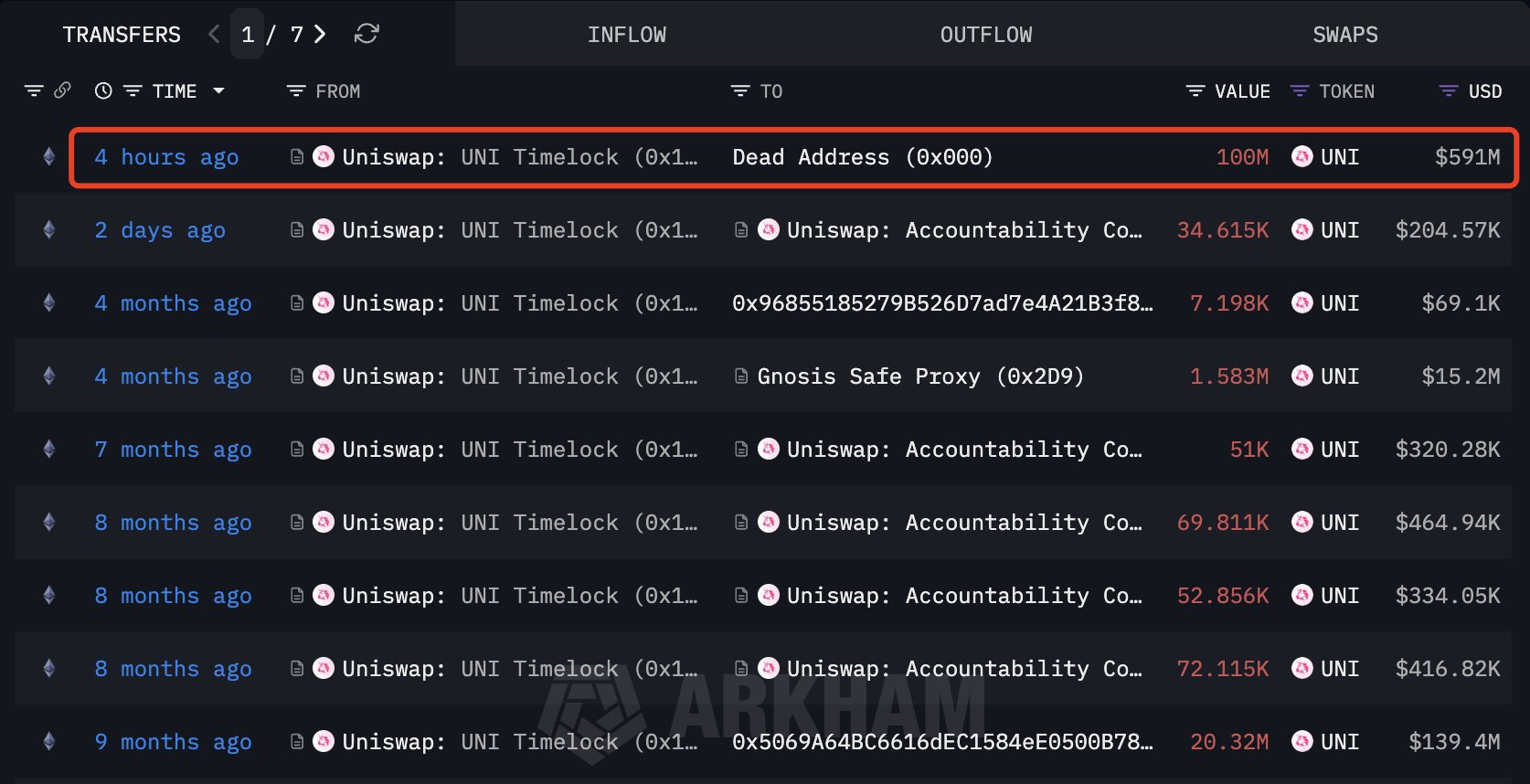

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Top 6 BNB Chain DApps on BNB Chain With Highest User Activity in the Past 7 Days

PENGU Surges Against the Odds as Pudgy Penguins Hit the Las Vegas Sphere

Trump–Zelensky Meeting in Florida Moved to 1:00 PM ET at Mar-a-Lago to Discuss Ukraine Conflict