- OceanPal invests $120 million to build privacy-focused AI using NEAR blockchain technology.

- SovereignAI plans to buy 10% of NEAR tokens to support decentralized AI systems.

- New leadership aims to expand OceanPal from shipping to digital AI and blockchain infrastructure.

OceanPal, a Nasdaq-traded firm, has secured $120 million in a private investment in equity. It will use the money to roll out its latest subsidiary, SovereignAI Services LLC, which will be focused on the development of blockchain-based infrastructure for artificial intelligence. The project will commercialize NEAR Protocol, which is a layer-1 blockchain that has been associated with AI-driven applications and decentralized computing systems.

The company plans to implement a digital asset treasury strategy under SovereignAI. It intends to acquire up to 10% of NEAR’s token supply. This marks one of the first efforts by a public firm to gain structured exposure to a crypto protocol through an operational AI venture.

Focus on Privacy and Decentralized AI Development

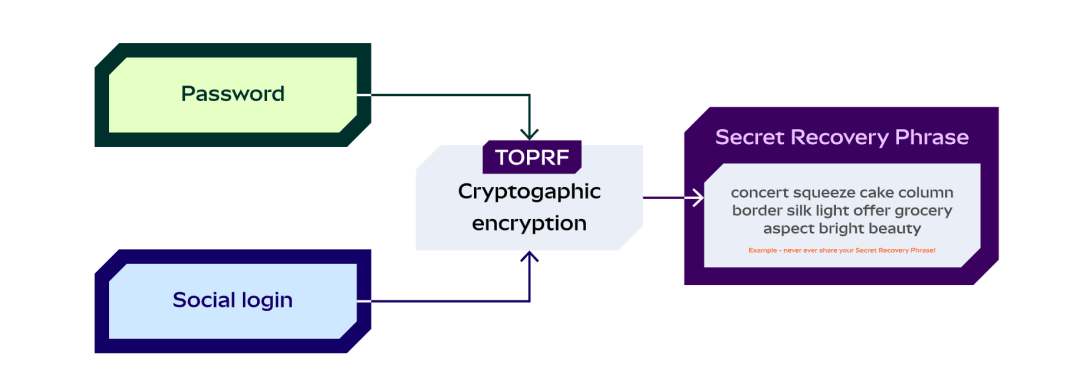

SovereignAI will apply NEAR blockchain and NVIDIA to build a privacy-conscious AI infrastructure. The aim is to facilitate safe and user-controlled AIs, which can be used independently without compromising data security. The new business intends to establish a decentralized structure in which AI agents will be allowed to transact and manage assets and make autonomous decisions free of human interference.

The project is in line with the current world’s need to use AI, which is privacy-first. OceanPal anticipates that SovereignAI will serve the finance, health, and media sectors. Such industries are also more in need of compliant AI tools that will be able to protect sensitive data without jeopardizing transparency and accountability.

Leadership Changes and Strategic Partnerships

The news comes at the time of changes in leadership at OceanPal. The firm appointed Sal Ternullo, a former State Street executive, as co-chief executive officer. David Schwed, previously with BNY Mellon, Galaxy, and Robinhood, joins as chief operating officer. Both leaders bring deep expertise in financial technology and digital asset management.

SovereignAI has also established a high-profile advisory board. The members are Illia Polosukhin, co-founder and CEO of the NEAR Foundation, Richard Muirhead of Fabric Ventures, and Lukasz Kaiser of OpenAI. Earlier, Robinhood minted 2,309 OpenAI stock tokens on the Arbitrum network. These advisors are supposed to guide the strategy of the company and contribute to its increased presence in the blockchain and AI ecosystem.

Institutional Support and Market Impact

The transaction included participation from investors such as Kraken, Fabric Ventures, and G20 Group. Kraken recently secured $500 million in funding at a $15 billion value as it plans a public listing in 2026. Financial advisors Clear Street LLC and Cohen & Company Capital Markets supported the deal. Legal counsel was provided by Reed Smith LLP and Seward & Kissel LLP.

NEAR Foundation expressed strong support for the partnership, viewing it as a step toward “AI sovereignty.” The initiative positions OceanPal as a public gateway for investors seeking exposure to NEAR’s ecosystem. While OceanPal continues its maritime operations, SovereignAI marks a strategic shift toward digital infrastructure and AI-driven commerce. Moreover, Coinbase also partnered with Perplexity AI to enhance access to crypto market intelligence.

OceanPal expects the integration of AI and blockchain to redefine how autonomous agents manage assets and execute transactions.