Date: Wed, Oct 29, 2025 | 12:15 PM GMT

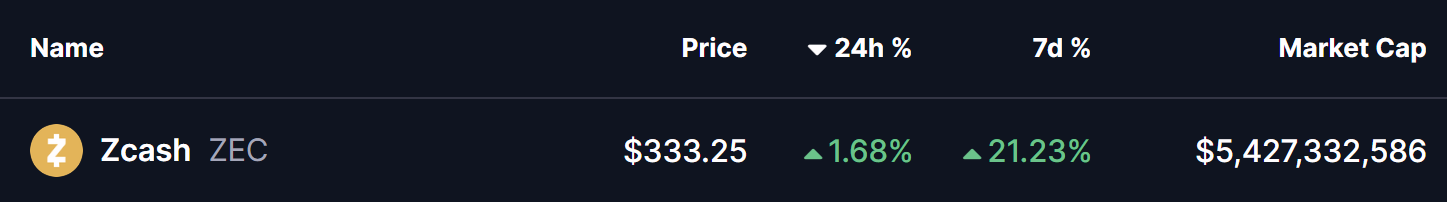

The cryptocurrency market remains in cautious tone ahead of today’s Federal Reserve meeting, where investors eagerly await clarity on a potential rate cut decision. While both Bitcoin (BTC) and Ethereum (ETH) are trading slightly in the red, several altcoins continue to show relative strength — and Zcash (ZEC) is one of them.

The privacy-focused cryptocurrency has gained over 21% this week, outperforming most major assets. More importantly, its latest chart formation suggests that a larger bullish move could be underway, driven by a classic breakout-and-retest setup often seen before major trend extensions.

Source: Coinmarketcap

Source: Coinmarketcap

Ascending Triangle Breakout Retest

On the 4-hour chart, ZEC recently completed an ascending triangle breakout, a pattern that typically signals bullish continuation after a consolidation phase. The token had been coiling tightly below a major resistance level around $310, which acted as a ceiling for several weeks.

After multiple attempts, ZEC finally broke above this resistance, surging to a local high near $375. As expected, the strong rally prompted short-term profit-taking, causing a healthy pullback toward the breakout zone.

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

Now, ZEC has successfully retested the $310 breakout level, as confirmed on the chart, and is trading around $332 — staying firm above the previous resistance-turned-support zone. This behavior indicates that buyers are defending the breakout level, signaling that bullish momentum remains intact.

What’s Next for ZEC?

If ZEC holds above $310 and manages to build on current strength with increasing volume, the technical picture favors a continuation toward higher levels. A decisive move above $375, the recent swing high, would confirm renewed bullish pressure and potentially trigger the next leg upward.

The measured move target derived from the ascending triangle projects an upside toward $434, representing roughly a 30% gain from current levels if momentum persists.

However, if ZEC slips below the $310 support, it could signal a temporary failed retest, leading to a short-term pullback before any new breakout attempt.

For now, the structure remains constructive, and the combination of breakout confirmation and retest validation strongly hints that ZEC may be gearing up for another bullish phase in the coming sessions.