XRP Drops 5% to $2.47 as Bears Break Key Support Level

XRP broke below the $2.50 support during Tuesday’s session, sliding 5% to $2.47 as institutional selling pressure accelerated across major exchanges. The breakdown confirmed a decisive shift in structure following weeks of tight consolidation, with volume and chart patterns now aligning toward a deeper corrective phase.

News Background

- The token’s 24-hour session saw prices tumble from $2.60 to $2.47, marking one of the largest single-day declines this month.

- The breach of the $2.50 psychological level triggered a wave of algorithmic and institutional selling, propelling trading activity to 169 million tokens, up 158% versus the 24-hour average.

- XRP’s market underperformance contrasts with broader crypto strength, suggesting rotation away from altcoins as risk appetite cools amid waning speculative participation.

- The breakdown reinforced strong overhead resistance at $2.60, where repeated rejection points over recent weeks had capped upside momentum.

Price Action Summary

- The selloff unfolded in structured phases through Tuesday’s trading. The initial breakdown began at 13:00 UTC, when heavy sell volume drove price decisively through the $2.50 support, igniting a cascade that extended to intraday lows near $2.38.

- Subsequent price stabilization formed around the $2.43–$2.46 range, suggesting the early stages of a potential consolidation base.

- Short-term momentum readings indicated exhaustion as volume tapered into the close, a dynamic often preceding interim pauses in trending declines.

- On the microstructure level, 60-minute data showed two distinct distribution waves as XRP slipped from $2.472 to $2.466.

- Successive hourly volume spikes of 2.8M and 2.6M tokens—each exceeding 300% of hourly averages—confirmed continued institutional control over intraday flows.

Technical Analysis

- XRP’s breakdown marks a continuation of its lower-high, lower-low structure that began after the failed retest of the $2.60 resistance.

- The session’s 8.8% volatility range underscores aggressive liquidation and profit-taking from larger holders, aligning with recent on-chain signals of exchange inflows.

- Momentum indicators such as RSI have shifted into neutral-to-bearish territory, while MACD shows expanding downside divergence. The $2.40–$2.42 area now acts as immediate technical support, and a close below this band could open further downside toward $2.30–$2.33.

- Volume analytics remain pivotal— the 169M turnover during breakdown confirms institutional participation rather than retail panic, while declining late-session activity implies that the bulk of distribution may already be complete.

What Traders Should Watch

- Traders are closely monitoring whether $2.43–$2.46 can evolve into a stable accumulation zone or if a clean break below $2.40 accelerates capitulation.

- Reclaiming the $2.50 level would be required to neutralize short-term bearish momentum and reestablish a constructive setup targeting $2.60.

- Until then, rallies toward resistance are likely to face supply from trapped longs and short-term profit-takers.

- Broader sentiment remains cautious amid risk-off rotation, with derivatives positioning showing declining open interest and modest upticks in short exposure across perpetual futures markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

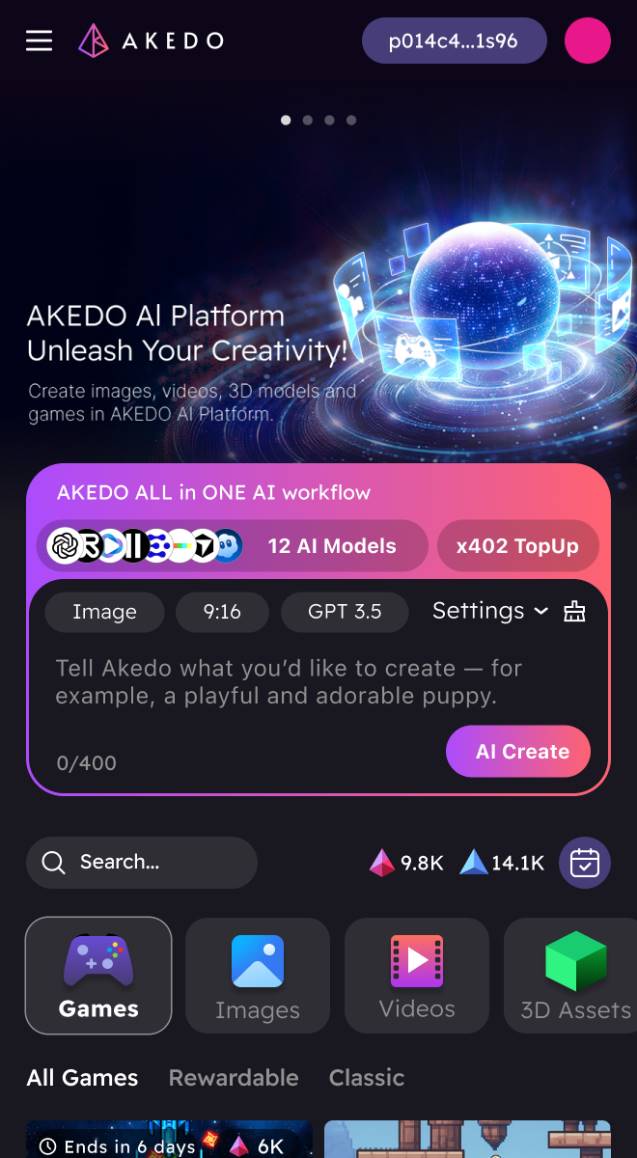

From Tool to Economic Organism: AKEDO and the x402 Protocol Ignite a Productivity Revolution

This marks the formation of the foundational infrastructure for the Agentic Economy: AI now has the ability to make payments, creators have access to an ecosystem for automatic settlements, and platforms become the stage for collaboration among all parties.

Pi Network Gains Momentum as New Features Energize the Market

In Brief Pi Network shows significant momentum with community revival and AI applications. Increased OTC volumes and key technical indicators support PI's 50% price rise. Liquidity issues and upcoming token unlocks pose potential risks to price stability.

Shiba Inu Struggles to Reach $0.0001 as Market Pressure Mounts

PENGU is on Fire: What’s Fueling the Explosive On-Chain Growth?