Matt Hougan of Bitwise compares Solana's potential to that of Bitcoin.

- Bitwise sees Solana repeating Bitcoin's initial trajectory.

- Solana grows with stablecoins and institutional tokenization.

- Western Union adopts Solana in new stablecoin project.

Bitwise's chief investment officer, Matt Hougan, expressed strong optimism regarding Solana (SOL), comparing the project's current stage to the early growth phase of Bitcoin (BTC). In a post on X, the executive highlighted that the best cryptocurrency investments offer "two ways to win"—through market growth and increased market share.

1/ The best crypto investments give you two ways to win. A thread exploring one reason I'm so bullish on Solana.

ðŸ§μ

— Matt Hougan (@Matt_Hougan) October 30, 2025

According to Hougan, Bitcoin has appreciated not only due to the expansion of the global store of value market, but also due to its increasing dominance over the years. He argues that Solana presents similar potential, especially within the stablecoin and real-world asset tokenization (RWA) ecosystem, sectors that have been attracting growing institutional interest.

“If I’m right, the combination of a growing market and increasing market share will be explosive for Solana. Just like what happened with Bitcoin,” stated the CIO of Bitwise, reinforcing his double valuation thesis.

Solana has established itself as one of the leading layer-1 blockchains, competing directly with Ethereum, which still dominates the tokenization market. Currently, the network represents about 14% of the global cryptocurrency market, in a sector valued at over US$768 billion. For Hougan, this proportion indicates significant room for expansion.

The executive also pointed to institutional adoption as one of the main drivers of Solana's growth. He mentioned Western Union's recent decision to develop a stablecoin project on the network, highlighting the growing confidence of traditional companies in its technology.

Hougan's positive assessment comes at a strategic moment for Bitwise, which recently launched the first Solana spot ETF in the United States, registering over $69,4 million in inflows on its first day. The product has expanded institutional exposure to SOL, reinforcing the network's role in the global blockchain infrastructure landscape.

Even with this boost, Solana is still far from matching Bitcoin's market capitalization. While BTC totals around US$2,19 trillion, SOL's capitalization is around US$102 billion, with the token trading near US$190. Still, Bitwise sees Solana's trajectory comparable to that followed by Bitcoin in its early years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

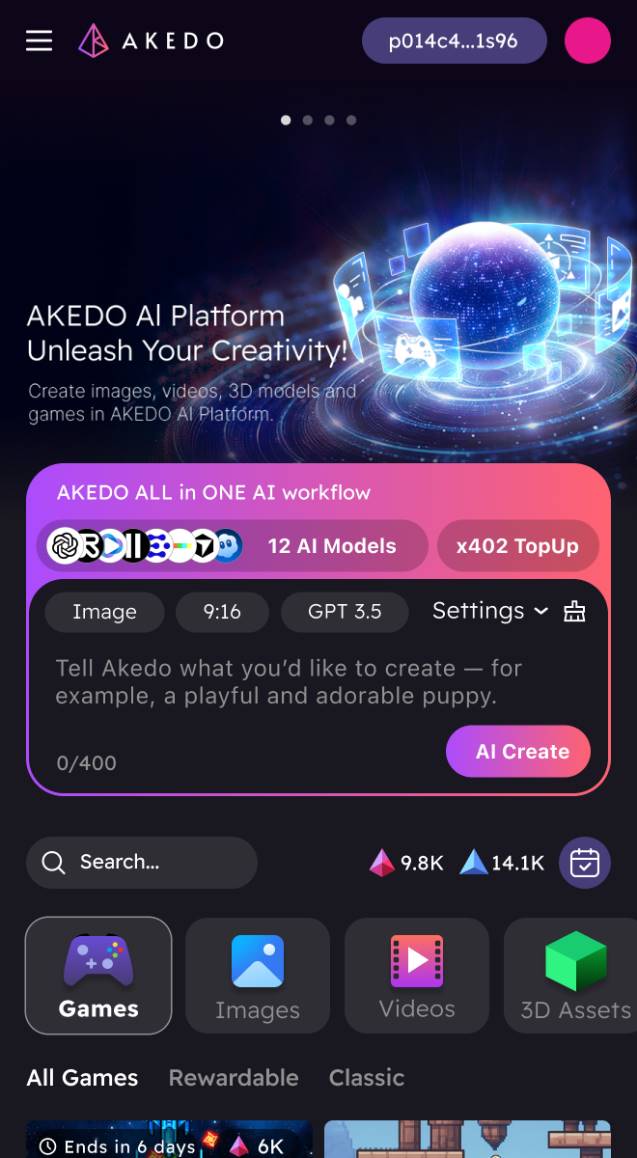

From Tool to Economic Organism: AKEDO and the x402 Protocol Ignite a Productivity Revolution

This marks the formation of the foundational infrastructure for the Agentic Economy: AI now has the ability to make payments, creators have access to an ecosystem for automatic settlements, and platforms become the stage for collaboration among all parties.

Pi Network Gains Momentum as New Features Energize the Market

In Brief Pi Network shows significant momentum with community revival and AI applications. Increased OTC volumes and key technical indicators support PI's 50% price rise. Liquidity issues and upcoming token unlocks pose potential risks to price stability.

Shiba Inu Struggles to Reach $0.0001 as Market Pressure Mounts

PENGU is on Fire: What’s Fueling the Explosive On-Chain Growth?