Ethereum News Update: 11 Security Reviews, $128 Million Gone—The DeFi Audit Dilemma Unveiled

- StakeWise DAO recovered 5,041 osETH and 13,495 osGNO from Balancer's $128M exploit, partially addressing the breach. - Attackers exploited token invariant math in V2 Composable Stable Pools despite 11 audits by top firms since 2021. - The breach spread across Ethereum, Base, Polygon, and Arbitrum, with Ethereum suffering most losses. - StakeWise's success highlights partial asset recovery potential but underscores DeFi's vulnerability to invariant manipulation attacks. - Industry faces audit paradox as 2

StakeWise DAO has reported the successful retrieval of 5,041 osETH and 13,495 osGNO from the

The breach, initially disclosed on November 3, involved a complex manipulation of Balancer’s liquidity pools. The attacker exploited token invariants—mathematical principles that regulate token exchanges—to secure advantageous rates and withdraw funds, DLNews reported. Despite having undergone 11 audits by leading firms such as OpenZeppelin, Trail of Bits, Certora, and ABDK since 2021, the platform’s smart contracts were still compromised, as outlined in a

Balancer clarified that the incident was "limited to V2 Composable Stable Pools" and did not impact V3 or other pools, according to Cointelegraph. Nevertheless, the exploit affected several blockchains, including

The recovery of osETH and osGNO—tokens representing staked Ethereum—by StakeWise highlights the possibility of reclaiming some assets after such breaches, Weex reported. However, the DAO’s achievement does not allay wider fears about DeFi’s susceptibility to invariant manipulation, where attackers exploit pricing formulas to empty liquidity pools, DLNews observed.

This event highlights a persistent issue in crypto security: even with increased spending on audits and bug bounty programs, advanced exploits continue to target complex code. By November 2025, losses from crypto-related breaches had already surpassed $2.2 billion for the year, according to DLNews. Experts emphasize that comprehensive security approaches, including proactive monitoring and community-led response systems, may be essential to counteract emerging risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

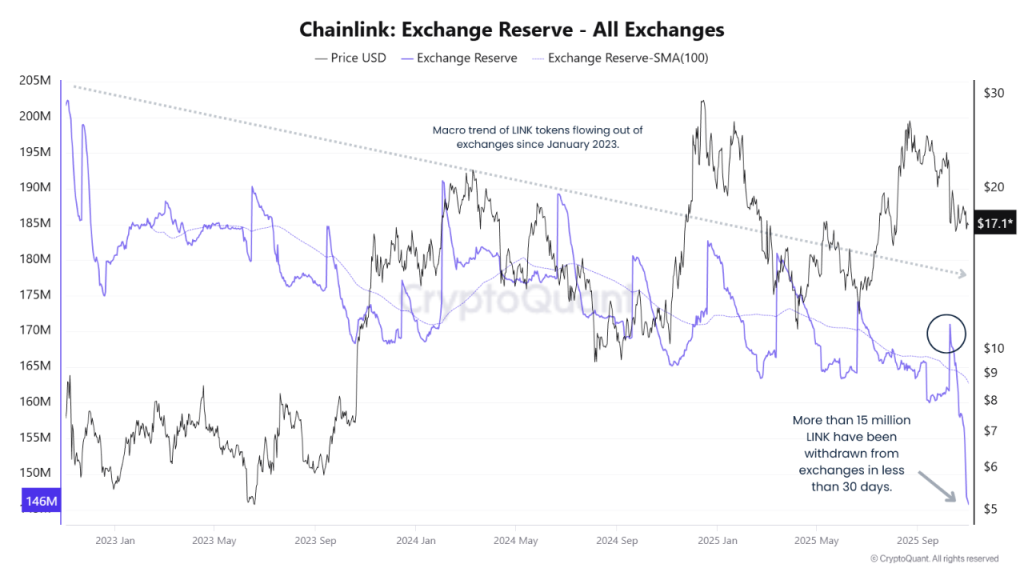

Chainlink Price Prediction 2025: Rising Institutional Adoption Eyes $100 Target

DeFi Faces Confidence Challenges: External Mismanagement Reveals Deep-Rooted Vulnerabilities

- Stream Finance halts deposits/withdrawals after $93M loss from third-party mismanagement, triggering XUSD depegging and systemic risks. - Perkins Coie investigates, highlighting DeFi governance flaws as XUSD’s 58% 24-hour drop impacts $280M in linked loans. - Industry warns of trust fragility; incident coincides with Balancer’s $116M hack, amplifying crypto sector scrutiny. - Stream’s crisis underscores risks in DeFi’s reliance on external managers amid broader economic pressures and regulatory tightenin

Solana Latest Updates: Bitcoin Falters, Solana Shows Uncertainty While MoonBull's Tokenomics Spark November Rally

- Bitcoin fell below $116,000 in late October amid cautious positioning before the Fed meeting, with on-chain metrics showing stable miner holdings. - Solana dropped 6% after Jump Crypto swapped $205M SOL for BTC, highlighting altcoin volatility despite $100B+ market cap support from ETF approvals. - MoonBull ($MOBU) surged 163% in presale with 95% APY staking, leveraging deflationary tokenomics and meme-driven adoption to outpace BNB/AVAX in 2030 ROI forecasts. - Institutional crypto infrastructure deals

Tokenized Treasuries Reach $8.7 Billion as Authorities and Competing RWA Platforms Draw Near

- Tokenized U.S. Treasuries surpassed $8.73B AUM, driven by institutional demand and yield seekers, with BlackRock and Securitize leading the market. - Regulatory scrutiny intensifies as CFTC and Hong Kong tighten oversight, while RWA rivals like tokenized gyms and education assets challenge treasury dominance. - Liquidity constraints and redemption restrictions persist, but ISO 20022 blockchain integration signals progress toward bridging TradFi and digital finance. - Market growth faces hurdles including