Key Notes

- Bitcoin ETFs saw $186.5 million in net outflows, led entirely by BlackRock’s IBIT.

- BTC price plunged to $104,500, marking an 8% weekly decline.

- Further downside is possible if short-term selling pressure spreads to long-term holders.

Bitcoin’s BTC $103 768 24h volatility: 3.7% Market cap: $2.07 T Vol. 24h: $82.33 B rocky start to November has worsened after spot ETFs tracking the cryptocurrency recorded $186.5 million in net outflows on Nov. 3. According to latest data, every Bitcoin ETF saw zero inflows, with only BlackRock’s IBIT responsible for the day’s withdrawals.

This marks the fourth consecutive trading day of capital exit from Bitcoin ETFs , with over $1.34 billion being pulled since late October. This suggests waning investor confidence as Bitcoin fell sharply to $104,500 at the time of writing, down more than 8% over the past week.

The decline triggered widespread liquidations across the market. Data shows more than 336,000 traders were wiped out within 24 hours, with a total of $1.36 billion worth of leveraged positions liquidated. This has further intensified the sell-off pressure for the top cryptocurrency .

Short-Term Holders Under Pressure, “Smart Money” Accumulates

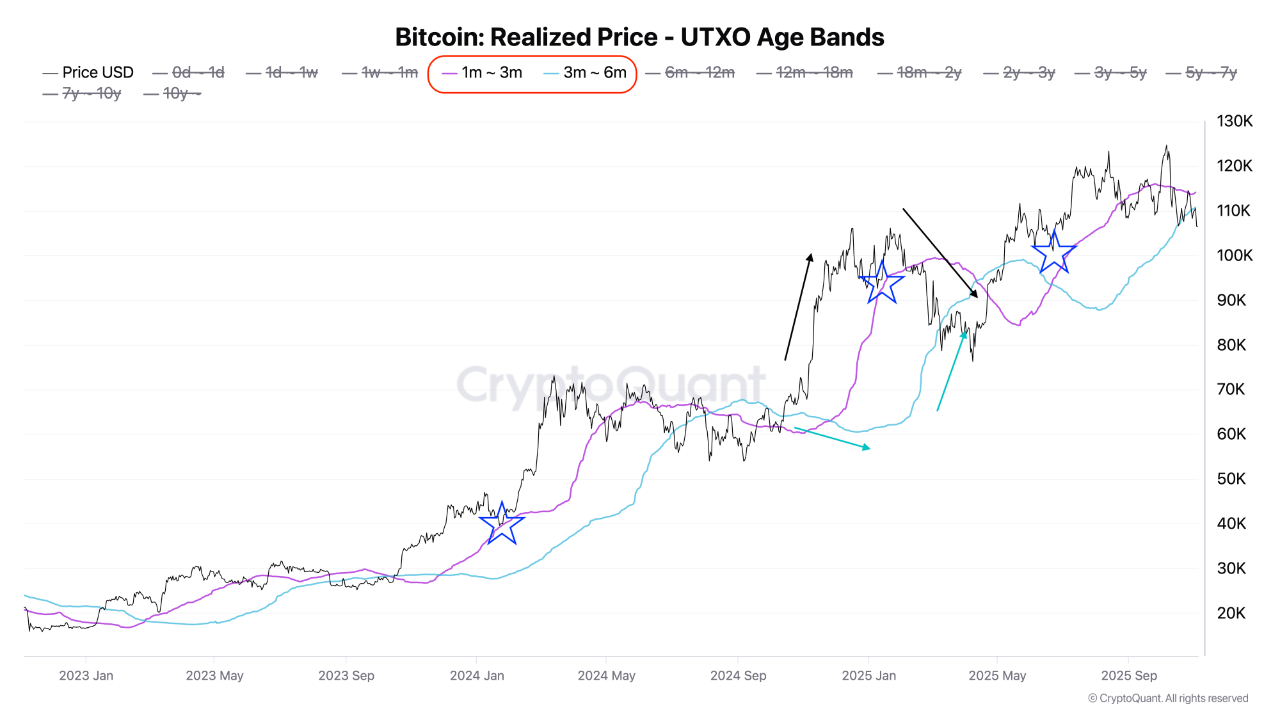

On-chain data by CryptoQuant reveals that short-term Bitcoin holders are the most active sellers since Oct. 10.

The average cost basis of Bitcoin, based on how long coins have remained unmoved, shows that the realized prices for short-term holders range from $107,160 for those held 1–3 months. This suggests that recent buyers are offloading assets as prices dip below their cost basis.

Meanwhile, coins held for longer periods, particularly the 3–6 month and 6–12 month cohorts, are showing resilience. On-chain patterns indicate that the so-called “smart money,” investors in the 3–6 month holding range, has begun accumulating again.

This could signal early repositioning for a potential BTC price rebound. However, a CryptoQuant contributor explained that this accumulation process seems incomplete. This means that mid-term holders are waiting for capitulation to fully play out before entering more aggressively.

Meanwhile, experts also caution that a deeper drop could shake even these mid-term holders. The psychological support level currently stands around $93,561, the average cost basis for the 6–12 month group.

$BTC flushes down to $104K 🚨

Looks like it's about to test the 50-week SMA for the first time in 7 months.

Need a bounce, otherwise a huge psychological flush is incoming. pic.twitter.com/55CK8CvdVq

— Ardi (@ArdiNSC) November 4, 2025

Technical analysts warn that Bitcoin may soon test its 50-week simple moving average (SMA) near $102,000 for the first time in seven months. They say that losing that level could trigger a deeper psychological correction.