Is This the Start of Ethereum’s November Crash?

The Federal Reserve just delivered its second consecutive interest rate cut, lowering the benchmark rate to a 3.75–4% range. On paper, looser monetary policy should fuel risk assets like crypto. But the market’s reaction told a different story. Ethereum (ETH) price fell over 5% , signaling traders aren’t convinced this cut is a clear bullish signal. Let’s break down why.

Ethereum Price Prediction: What the Fed’s Move Really Means

The Fed’s rate cut was expected , but Chair Jerome Powell’s comments dampened enthusiasm. His refusal to commit to another cut in December introduced uncertainty. Investors had priced in aggressive easing, so the cautious tone felt like a cold shower.

The end of quantitative tightening (QT) on December 1 was also a major announcement. It means the Fed will stop shrinking its balance sheet, effectively injecting more liquidity into the system. Normally, that’s bullish for crypto, but the backdrop of weak employment data and sticky inflation complicates things.

So while the policy shift favors risk assets in the long run, short-term volatility is back—especially as markets reassess how “dovish” the Fed really is.

Ethereum Price Prediction: Bears Regain Control

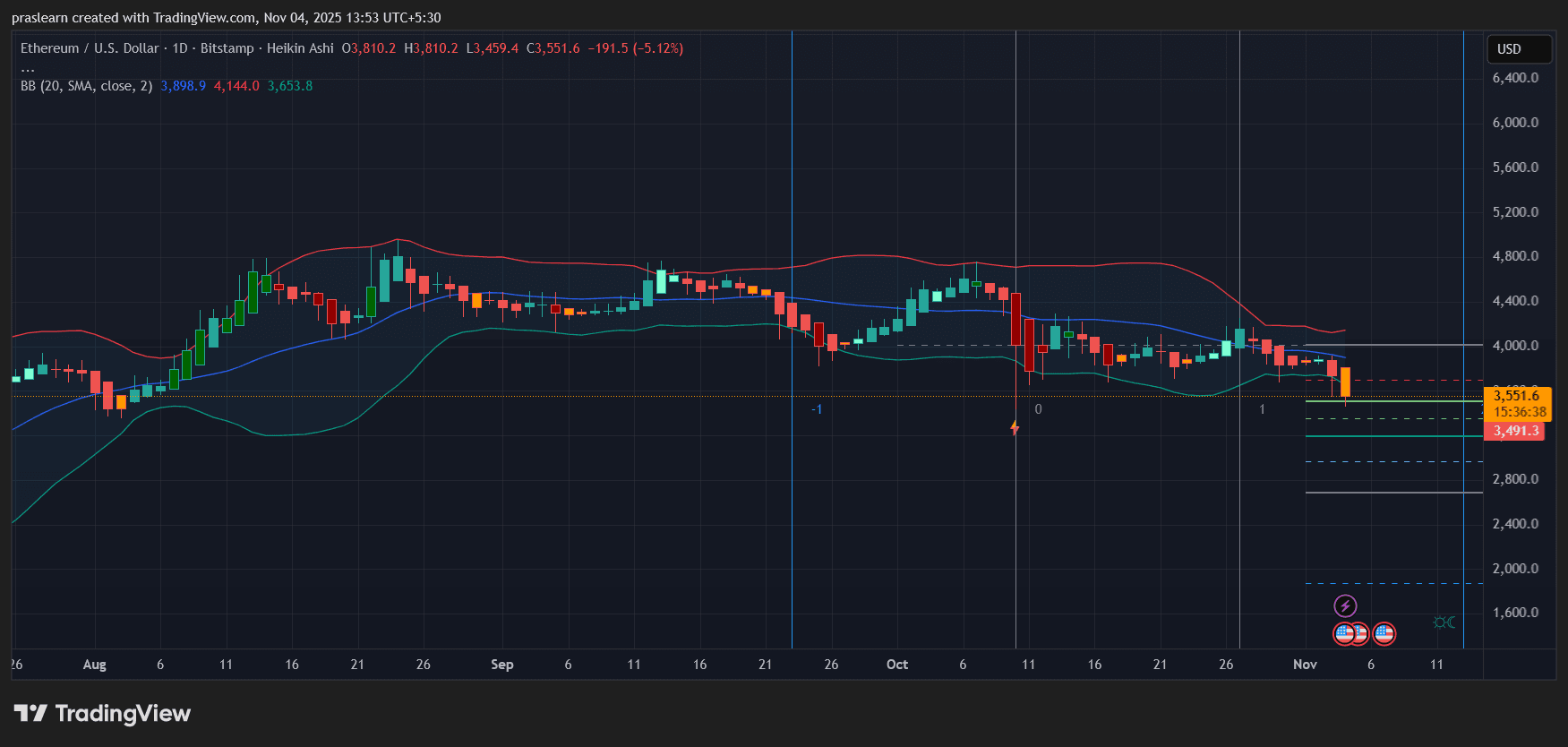

ETH/USD Daily Chart: TradingView

ETH/USD Daily Chart: TradingView

Ethereum price daily chart shows a decisive rejection near the mid-Bollinger Band (around $3,900), followed by a sharp breakdown toward $3,550. The Heikin Ashi candles turned solid red, confirming renewed bearish momentum.

The Bollinger Bands (BB) are widening—classic sign of volatility expansion—and ETH just closed below the 20-day simple moving average (SMA). This breakdown puts immediate support at the lower Bollinger band near $3,650, which has now been breached intraday. If the slide continues, the next downside targets sit near $3,490 and $3,250.

The chart also hints at a failed recovery attempt in late October, where ETH price couldn’t reclaim $4,000 resistance. That rejection reinforced a lower-high structure, suggesting sellers remain in control.

In short: the $3,500 zone is a key battleground. Lose that level convincingly, and ETH risks accelerating toward $3,000.

Macro Meets Market: Liquidity vs. Sentiment

Crypto market thrives on liquidity, and the end of QT should theoretically add fuel. But traders are wary because Powell’s tone wasn’t outright dovish. Add in labor-market weakness and inflation still above 3%, and you get uncertainty—something markets hate.

The lack of fresh economic data (due to the ongoing government data freeze) only adds to that uncertainty. Investors don’t know how deep the slowdown runs, so they’re hedging instead of rotating fully into risk assets. For Ethereum , this hesitation translates into cautious positioning and low conviction rallies.

Still, there’s a twist. If inflation data cools again before the December meeting, traders could quickly flip bullish on the next rate move. That’s the wild card to watch.

What Comes Next for Ethereum Price?

Here’s the thing: Ethereum’s longer-term structure remains intact as long as it holds above $3,200. That’s where the major trendline support from the July rally still aligns. A bounce from that level could trigger a short-covering rally back toward $3,800.

But for a sustained bullish reversal, ETH price needs two things:

- A clear signal from the Fed that further cuts are on the table.

- A decisive daily close above the mid-band (~$3,900) to reestablish bullish control.

If neither happens, $ETH could continue grinding lower through November, testing $3,250–$3,000 before buyers return.

Ethereum’s current drop isn’t just about charts—it’s about confidence. Traders wanted a clear dovish path; Powell gave them uncertainty. That combination typically leads to short-term weakness but sets up a potential rebound once clarity returns.

So while the near-term outlook looks bearish, medium-term traders should watch the $3,200–$3,000 region closely. If $Ethereum stabilizes there while the Fed signals another cut, a powerful rebound toward $4,000 could follow.

Until then, caution wins. The Fed may have cut rates, but the market isn’t celebrating just yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Secret Script of the Crypto Market: How Whales Manipulate 90% of Traders, and How You Can Stop Being "Liquidity"

Polymarket, Kalshi Hit Record Volumes as Sports Betting Dominates Prediction Markets

One of Tesla's top ten shareholders challenges Musk's trillion-dollar compensation plan

Ahead of Tesla's annual shareholders meeting, Norway's sovereign wealth fund, with assets totaling 1.9 trillion, has publicly opposed Elon Musk's 100 million compensation package. Musk previously threatened to resign if the proposal was not approved.

Bitcoin falls to its lowest point since June, with the "after-effects" of October's flash crash still lingering!

Multiple negative factors are weighing on the market! Trading sentiment in the cryptocurrency market remains sluggish, and experts had previously warned of a potential 10%-15% correction risk.