Changpeng Zhao’s $2M Aster Investment Boosts DeFi Market Confidence

Aster, a decentralized perpetuals exchange, surged over the weekend after Binance founder Changpeng “CZ” Zhao revealed a personal investment of more than $2 million in its native token. His entry into the project reignited market excitement, drawing investors back to the fast-growing DeFi platform and reaffirming his lasting influence over digital-asset markets.

In brief

- CZ invests over $2M of personal funds in Aster, sending its price soaring from $0.91 to above $1.20 within an hour.

- Aster surpasses Hyperliquid with $70B in weekly trading, cementing its place as a top decentralized perpetuals exchange.

- CZ’s post-pardon comeback boosts sentiment across DeFi, signaling a revival of institutional and retail crypto confidence.

- Aster’s transparency tools and Layer-2 integrations enhance credibility, driving renewed trust and trading activity.

Changpeng Zhao’s Personal Investment Triggers Aster Price Rally

Zhao announced the purchase in a post on X, saying he had bought Aster with his own funds on Binance and that he viewed himself as a long-term holder rather than a trader.

Following his post, Aster’s price jumped from around $0.91 to over $1.20 within an hour, according to market data. A surge in trading volume accompanied the sharp rise as market participants quickly followed CZ’s lead.

Aster’s close ties to YZi Labs—Zhao’s family office—drew additional attention to the project. The connection strengthened investor confidence in Aster’s foundations and its expanding role in decentralized perpetual trading.

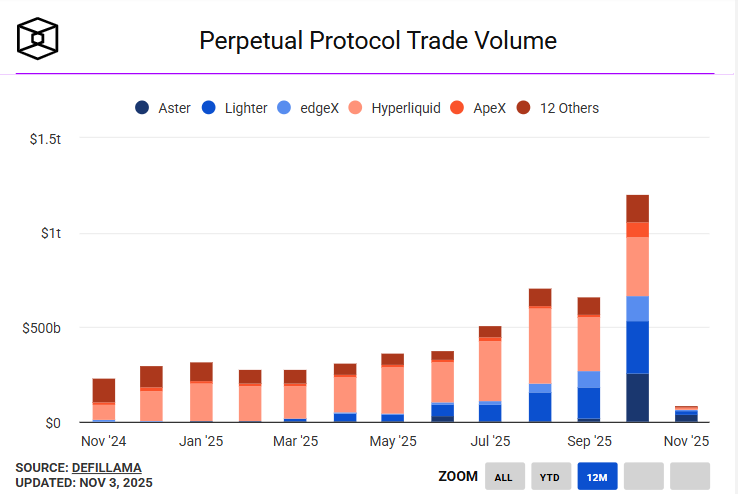

Aster Emerges as a Leader in the Expanding Perpetuals Market

Perpetual exchanges have emerged as one of 2025’s standout growth sectors, and Aster is now positioned among the leaders . It recently surpassed Hyperliquid in reported trading volumes, logging more than $70 billion in transactions over a seven-day span, according to The Block data.

Earlier this year, questions over data accuracy surfaced when DefiLlama founder 0xngmi temporarily removed Aster’s metrics, citing verification challenges . The data was later reinstated after new monitoring systems were deployed to improve the tracking of decentralized-exchange volumes.

As scrutiny eased, traders began to reassess Aster’s strength and market position. Zhao’s investment amplified that focus, highlighting several key factors behind the protocol’s rise:

- High trading throughput: Processes billions in daily volume through on-chain settlement.

- Deepening liquidity: Growing participation from major market makers supports stronger price stability.

- Community governance: Token holders have direct input on protocol fees and incentive structures.

- Cross-chain compatibility: Integrations with leading Layer-2 networks improve access and efficiency.

- Transparency upgrades: New verification tools help validate reported trading data.

These features have strengthened Aster’s credibility and helped it capture a larger share of the perpetual-trading market.

Market Sentiment Shifts as CZ Reclaims Spotlight Following Pardon

Zhao’s return to the public stage represents a significant turning point for crypto. After resigning as Binance CEO and serving a four-month U.S. prison sentence for banking-law violations, he received a presidential pardon from Donald Trump on October 23—a move that swiftly reshaped sentiment toward both him and his affiliated projects.

White House Press Secretary Karoline Leavitt described the pardon as the end of what she called the previous administration’s “war on cryptocurrency.” Market analysts viewed it as a signal of easing regulatory pressure and a potential revival of institutional interest.

Both Aster and Binance’s BNB token responded immediately. Aster climbed to $1.07, while BNB gained more than 5%, reaching $1,123. Despite Aster’s Fear & Greed Index reading of 42, investor enthusiasm appears to be returning.

Sunday’s surge reinforced Zhao’s continuing ability to move markets. With his re-emergence in the public eye and Aster’s growing momentum, the decentralized-perpetuals sector may be entering a new phase of renewed confidence and attention.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Secret Script of the Crypto Market: How Whales Manipulate 90% of Traders, and How You Can Stop Being "Liquidity"

Polymarket, Kalshi Hit Record Volumes as Sports Betting Dominates Prediction Markets

One of Tesla's top ten shareholders challenges Musk's trillion-dollar compensation plan

Ahead of Tesla's annual shareholders meeting, Norway's sovereign wealth fund, with assets totaling 1.9 trillion, has publicly opposed Elon Musk's 100 million compensation package. Musk previously threatened to resign if the proposal was not approved.

Bitcoin falls to its lowest point since June, with the "after-effects" of October's flash crash still lingering!

Multiple negative factors are weighing on the market! Trading sentiment in the cryptocurrency market remains sluggish, and experts had previously warned of a potential 10%-15% correction risk.