BTC Volatility Weekly Review (October 27 - November 3)

Key metrics (from 4:00 PM Hong Kong time on October 27 to 4:00 PM Hong Kong time on November 3): BTC/USD fell by 7.3%...

Key Metrics (October 27, 16:00 HKT – November 3, 16:00 HKT)

- BTC/USD fell 7.3% (from $115,600 to $107,200)

- ETH/USD fell 12.1% (from $4,200 to $3,690)

- The market continued to fluctuate within the $104/105k to $115/116k range. Although the absolute price range has narrowed, realized volatility remains high—indicating the market is struggling to find equilibrium, is confused by the decoupling between cryptocurrencies and tech stocks/high-beta single stocks, and is concerned about a potentially more substantial correction in gold/precious metals. From a technical perspective, we expect the market to start another downward move to complete the current flat corrective wave (which could be the first leg of a potentially multi-month—or even multi-year—three-wave flat correction), but we may also see the market continue to range trade in the coming weeks.

Market Themes

- Over the past week, the market's focus was on the FOMC meeting, US earnings reports, and the Trump-Xi Jinping meeting. The outcomes of these three events maintained a generally risk-on environment: the Federal Reserve cut rates by 25 basis points as expected/needed, and although Powell tried to downplay expectations for a December rate cut ("by no means a foregone conclusion"), this was only a minor episode and did not significantly affect market expectations; despite concerns about a slowdown in the "real economy," US corporate earnings were overall very solid; and the Trump-Xi Jinping meeting ultimately achieved a breakthrough, with tariff rates reduced and some concessions made, making a deal now seem almost certain.

- Nevertheless, cryptocurrencies once again struggled to gain a foothold, with original "whales" continuing to sell off their holdings, making it difficult for BTC and ETH to hold above $115,000 and $4,000, respectively. As the S&P and Nasdaq indices and high-beta AI stocks continue to hit new highs, the opportunity cost of holding cryptocurrencies remains high. Meanwhile, as gold fell back below $4,000, the US dollar saw a relief rally, and market expectations for a 25 basis point rate cut in December dropped from 90% to nearly 50%, with the dollar strengthening broadly against G10 currencies. Many DAT companies' net asset values have also compressed to (or below) 1.0x, causing this narrative to lose its appeal.

BTC Implied Volatility

- This week, implied volatility was generally flat, with realized volatility remaining just above 40 (on an hourly high-frequency basis), confirming the appropriateness of implied volatility resetting to this level. That said, most of the realized volatility was driven by last week's reactions to events (the FOMC meeting and the Trump-Xi Jinping summit), while on a lower-frequency basis, as price swings were suppressed to a narrower $106–112k range, realized volatility has been weakening. This brought some selling pressure to short-term gamma expiries before the weekend, but as prices returned to $107k on Monday, the selling pressure quickly disappeared, as market liquidity remains thinner than before.

- The term structure of implied volatility has largely remained unchanged, with steepness supported by macro dynamics, as November is generally light on US data (and there is no FOMC meeting), while December is gradually becoming an event-heavy month to close out the year.

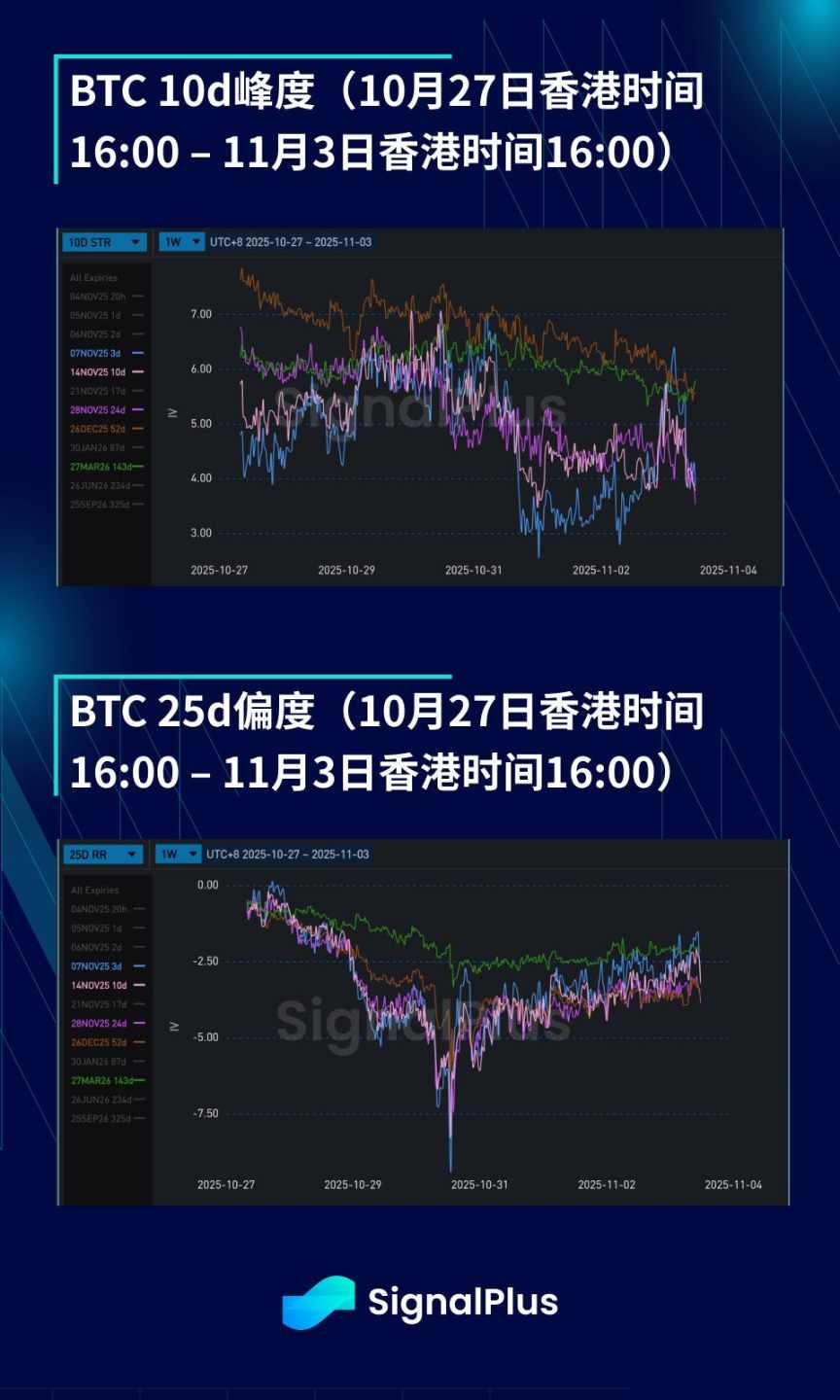

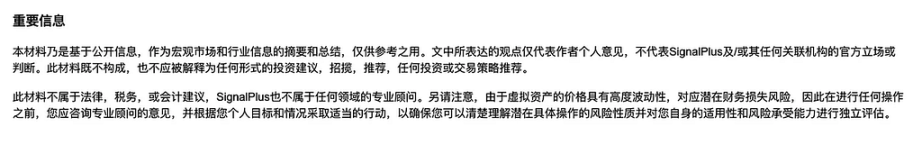

BTC/USD Skew / Kurtosis

- Last week, put option skew generally deepened, as realized volatility on the upside remained subdued, with heavy selling in the $112–116k range, while downside volatility continued to show higher realized volatility. There appears to be significant risk below $106k, causing skew to plunge to very deep levels on Thursday, but unless we see a substantial breakout from the current price range, it will be difficult for such deep levels to persist.

- As last week's spot trading range gradually locked into $106–112k, kurtosis pricing continued to decline, with good liquidity support on both sides of the range (i.e., when prices approached the edges of the range, there were no extreme price moves). There are still a large number of directional risk exposures being built through put/call spreads, which also puts selling pressure on kurtosis. Volatility of volatility remains slightly elevated locally, but not as extreme as in previous weeks, which also helps temporarily suppress kurtosis.

Wishing you a successful trading week ahead!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin falls under $101K: Analysts say BTC is ‘underpriced’ based on fundamentals

The Secret Script of the Crypto Market: How Whales Manipulate 90% of Traders, and How You Can Stop Being "Liquidity"

Polymarket, Kalshi Hit Record Volumes as Sports Betting Dominates Prediction Markets

One of Tesla's top ten shareholders challenges Musk's trillion-dollar compensation plan

Ahead of Tesla's annual shareholders meeting, Norway's sovereign wealth fund, with assets totaling 1.9 trillion, has publicly opposed Elon Musk's 100 million compensation package. Musk previously threatened to resign if the proposal was not approved.