$1.3 billion paper loss! Tom Lee's Ethereum gamble collapses under market pressure

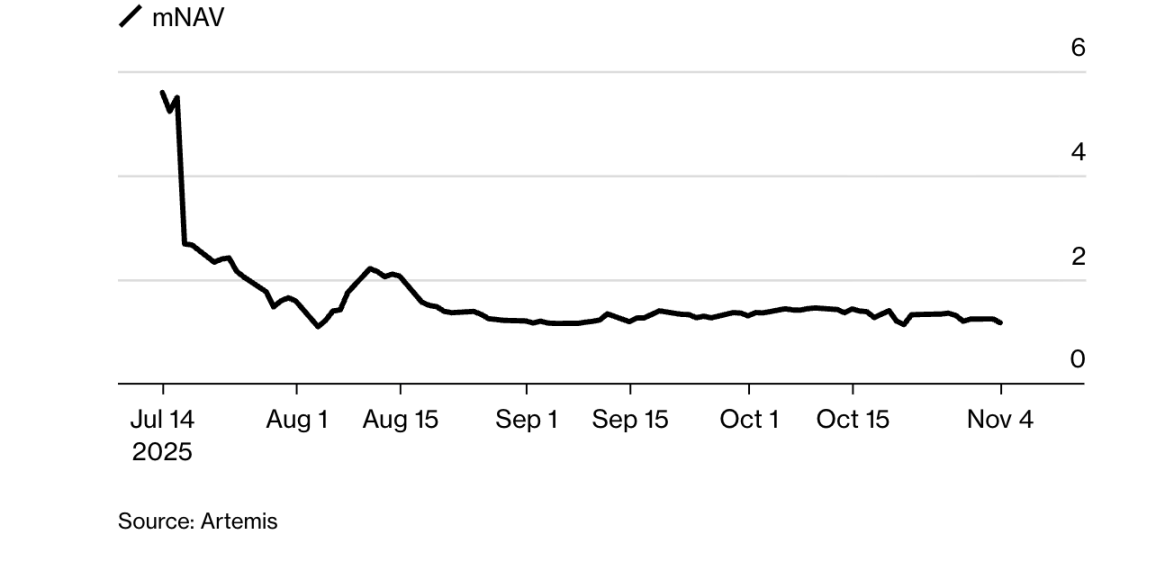

Bitmine's market capitalization to net asset value ratio has plummeted from 5.6 in July to 1.2, with its stock price down 70% from its peak.

Bitmine's market capitalization to net asset value ratio has plummeted from 5.6 in July to 1.2, with its share price down 70% from its peak.

Written by: Sidhartha Shukla

Translated by: Chopper, Foresight News

Ethereum's corporate treasury experiment is unraveling in real time.

The world’s second-largest cryptocurrency fell below $3,300 on Tuesday, dropping in tandem with market bellwether bitcoin and tech stocks. This decline has pulled Ethereum’s price down 30% from its August peak, returning it to levels before large-scale corporate accumulation, and further cementing its entry into a bear market.

According to research firm 10x Research, this reversal has left Ethereum’s most aggressive corporate backer—Bitmine Immersion Technologies Inc.—facing more than $1.3 billions in paper losses. This publicly traded company, backed by billionaire Peter Thiel and led by Wall Street forecaster Tom Lee, has modeled its strategy after Michael Saylor’s bitcoin treasury approach, acquiring 3.4 million Ethereum at an average price of $3,909. Now, Bitmine’s funds are fully deployed and the company is under increasing pressure.

10x wrote in its report: “For months, Bitmine has dominated market narratives and capital flows. Now, with all its funds deployed and over $1.3 billions in unrealized losses, it has no more capital left to use.”

The report notes that retail investors who bought Bitmine shares at a premium to net asset value (NAV) have suffered even heavier losses, and the market’s willingness to “catch a falling knife” is limited.

Lee did not immediately respond to a request for comment, and Bitmine representatives also did not respond promptly.

Bitmine’s bet is far from a simple balance sheet trade. Behind the company’s accumulation is a grander vision: that digital assets can shift from speculative tools to corporate financial infrastructure, thereby cementing Ethereum’s place in mainstream finance. Supporters believe that by including Ethereum in the asset base of publicly listed companies, corporations will help build a new decentralized economy—one where code replaces contracts and tokens serve as assets.

This logic fueled the summer rally. Ethereum’s price once approached $5,000, and in July and August alone, Ethereum ETFs attracted over $9 billions in inflows. But since the crypto market crash on October 10, the situation has reversed: according to data compiled by Coinglass and Bloomberg, Ethereum ETFs have seen $850 millions in outflows since then, and open interest in Ethereum futures has dropped by $16 billions.

Lee had previously predicted that Ethereum would reach $16,000 by the end of this year.

Bitmine’s net asset value (mNAV) premium drops

According to Artemis data, Bitmine’s market capitalization to net asset value multiple has plummeted from 5.6 in July to 1.2, with its share price down 70% from its peak. Similar to previous bitcoin-related companies, Bitmine’s share price is now much closer to the value of its underlying holdings, as the market reassesses the previously lofty valuations of crypto balance sheets.

Last week, another publicly listed Ethereum treasury company, ETHZilla, sold $40 millions worth of Ethereum holdings to buy back shares, aiming to bring its adjusted net asset value (mNAV) ratio back to normal levels. In a press release at the time, the company stated: “ETHZilla plans to use the proceeds from the remaining Ethereum sales for further share buybacks, and intends to continue selling Ethereum to repurchase shares until the discount to net asset value returns to normal.”

Despite the price decline, Ethereum’s long-term fundamentals appear to remain strong: the value it processes on-chain still exceeds all rival smart contract networks, and its staking mechanism gives the token both yield and deflationary attributes. However, as competitors like Solana gain momentum, ETF flows reverse, and retail interest wanes, the narrative that “corporations can stabilize crypto prices” is gradually failing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why does bitcoin only rise when the US government reopens?

Is the US government shutdown the main culprit behind the global financial market downturn?

Crypto "No Man's Land": Cycle Signals Have Emerged, But Most People Remain Unaware

If the crypto market of 2019 taught us anything, it's that boredom is often the prelude to a breakout.

Don't panic, the real main theme of the market is still liquidity.

Such pullbacks are not uncommon in a bull market; their purpose is to test your conviction.

Arthur Hayes Dissects Debt, Buybacks, and Money Printing: The Ultimate Cycle of Dollar Liquidity

If the Federal Reserve's balance sheet expands, it will be positive for US dollar liquidity, ultimately driving up the prices of bitcoin and other cryptocurrencies.