Key Market Information Discrepancy on November 7th - A Must-Read! | Alpha Morning Report

1. Top News: Stablecoin USDe Market Cap Drops Below $9 Billion, Decreasing by Around 45% in the Past Month 2. Token Unlocking: $ACE, $GFAL

Featured News

1. Stablecoin USDe Market Cap Falls Below $9 Billion, Down About 45% in a Month

2. Storage Sector Tokens Soar, FIL Surges Over 51.34%

3. Cryptocurrency Market Sees General Decline, Bitcoin Falls Below $101,000, US Stock Crypto-Related Stocks Significantly Affected

4. Nasdaq Extends Losses to 2%, NVIDIA Falls 3.43%

5. "Binance Life" Sees Large Buy-Ins Yesterday, Average Entry Price Around $0.17

Articles & Threads

1. "DeFi’s Potential $80 Billion Minefield, Only $1 Billion Exploded So Far"

The fund manager, a figure once trusted and later demystified in the stock market and enshrined with countless retail investors' wealth dreams. At first, everyone was chasing after fund managers who graduated from prestigious schools and had impressive resumes, believing that funds were a lower-risk, more professional alternative to direct stock trading. However, when the market plummeted, investors realized that the so-called "professionalism" couldn’t withstand systemic risks. Even worse, holding management fees and performance incentives, gains were seen as personal skills while losses translated to investors' money. Now, when the role of "fund manager" arrives on-chain with a new moniker "Curator" (an external curator), the situation becomes even more perilous.

2. "Intensifying Market Volatility, Why Bitcoin Still Aims to Reach $200,000 in Q4?"

This article was first published on October 27, 2025. On November 6, Tiger Research published again, stating that amidst increased market volatility, they are maintaining their $200,000 price target. This article elaborates on the specific reasons.

Market Data

Daily Market Overall Funding Heatmap (as reflected by the Funding Rate) and Token Unlocks

Data Sources: Coinglass, TokenUnlocks

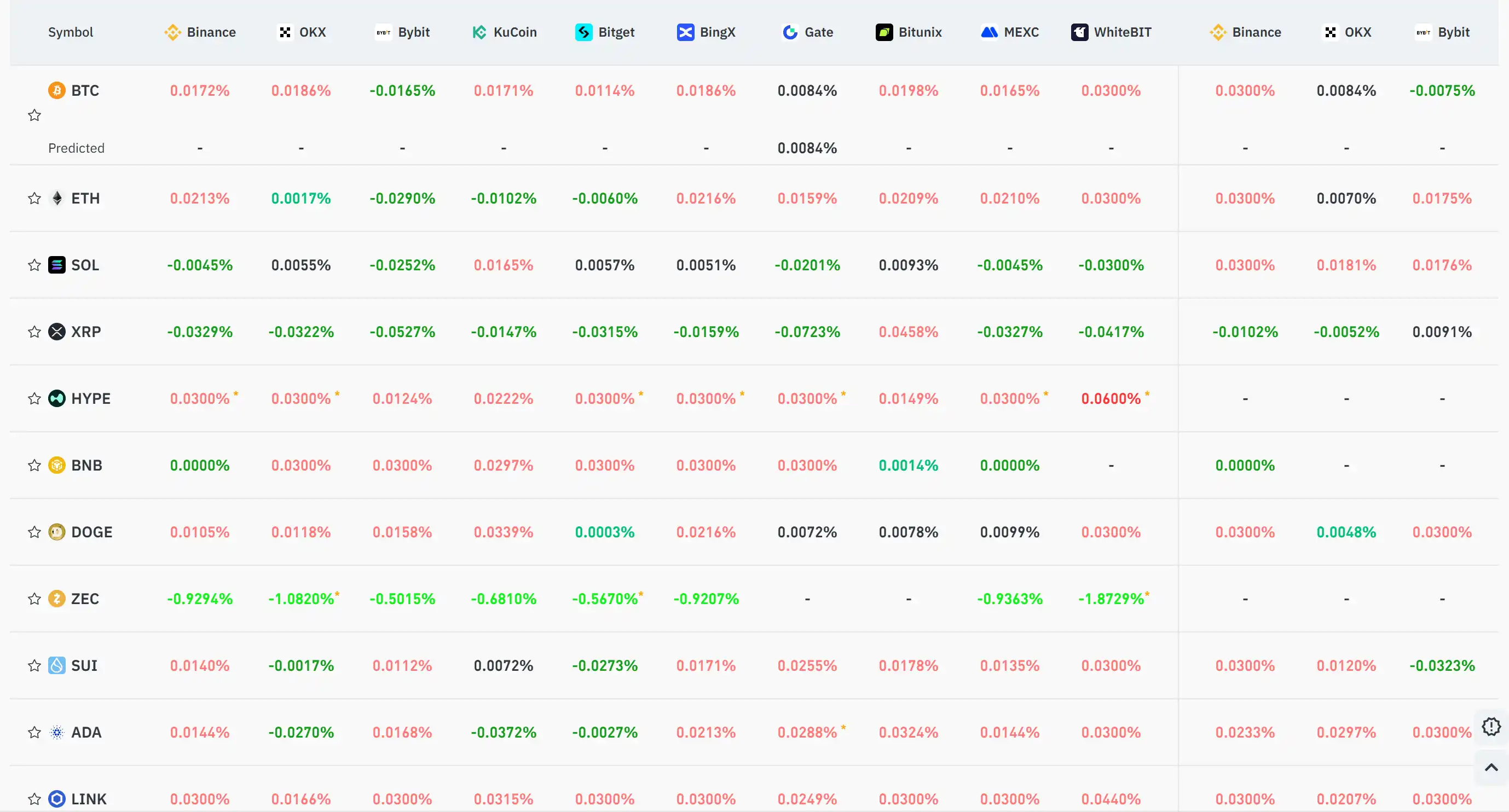

Funding Rate

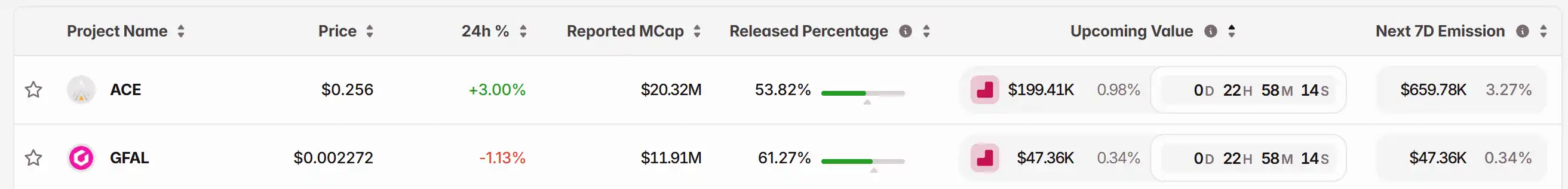

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi’s Fragile Foundation Falls Apart: $116 Million Breach Triggers Widespread Breakdown

- DeFi faces systemic collapse after Balancer's $116.6M exploit via boosted pool vulnerabilities, draining liquidity across Ethereum and Base. - Cascading failures hit Stream Finance ($93M loss) and Elixir's deUSD stablecoin, triggering liquidity freezes and 45% stablecoin value drops. - RedStone's Credora and Mutuum Finance aim to rebuild trust with risk ratings and non-custodial lending, but TVL remains low in Cardano's DeFi. - Analysts warn of persistent governance flaws and cross-protocol risks, as Bit

Cardano News Today: Vulnerabilities in DeFi Smart Contracts Reveal Underlying Systemic Risks

- Balancer's third major exploit in 2025 drained $116M via a smart contract vulnerability, exposing DeFi's fragility. - Elixir's deUSD stablecoin collapsed after Stream Finance's $93M loss, echoing past DeFi crises. - Cardano's $271M TVL lags peers due to governance issues, despite high staking activity, as founder Charles Hoskinson pushes Bitcoin integration. - Industry calls for stronger audits and governance as DeFi's TVL rebounds but remains vulnerable to systemic risks. - BAL and ADA tokens trade belo

XRP News Update: XRP ETFs Near Approval as Institutional Interest Accelerates

- XRP's 21,000 new wallets and $2.40 price level highlight renewed investor interest amid pending U.S. ETF approvals. - Canary Capital and Franklin Templeton's ETF filings could trigger automatic approval by November 2025, offering institutional access to XRP . - Ripple's $2.4B XRP liquidity release and expanded institutional services aim to stabilize markets and boost adoption. - Analysts predict short-term volatility between $2.26-$2.70 but long-term optimism as XRP ETFs mirror Bitcoin/Ethereum's institu