Trump's pressure works! India's five major refineries suspend orders for Russian oil

Due to Western sanctions and US-India trade negotiations, India significantly reduced its purchases of Russian crude oil in December, with its five major core refineries placing no orders.

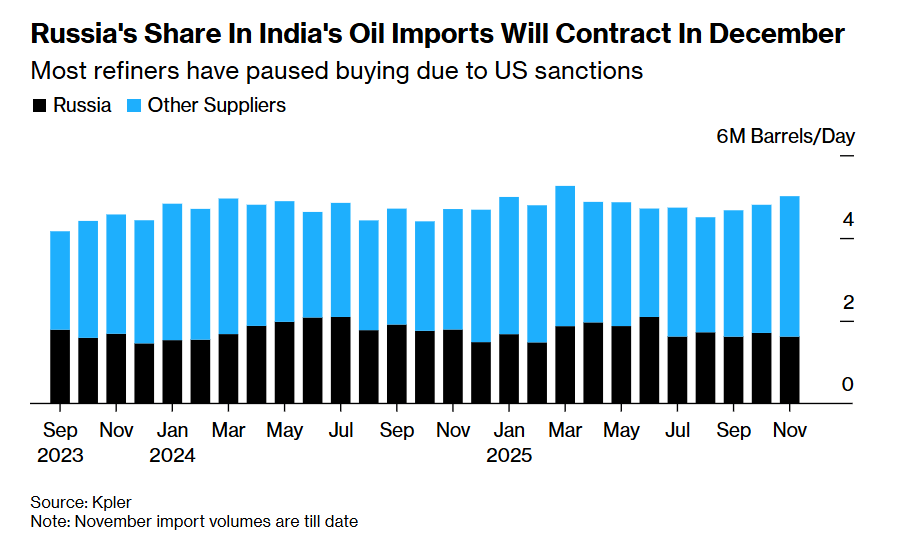

India has reduced its purchases of Russian crude oil arriving in December, indicating that Western sanctions and US-India trade negotiations are having a significant impact on its procurement patterns.

According to sources familiar with the matter, India's five core refiners have not placed any Russian crude oil orders for next month. Typically, crude oil transactions for the following month must be completed by the 10th of the current month.

As the world's third-largest oil importer, India's change in procurement comes after Trump doubled tariffs on all Indian imports to 50% in August and imposed sanctions last month on two major Russian oil producers—Rosneft PJSC and Lukoil PJSC. In recent years, India has heavily relied on discounted Russian crude, drawing criticism from the US for allegedly funding Russia's military actions in Ukraine.

Data from Kpler shows that this year, Reliance Industries Ltd., Bharat Petroleum Corp. Ltd., Hindustan Petroleum Corp. Ltd., Mangalore Refinery and Petrochemicals Ltd., and HPCL-Mittal Energy Ltd.—these five major refiners—accounted for two-thirds of India's Russian crude oil imports.

Russia's share in India's oil imports will shrink in December

Russia's share in India's oil imports will shrink in December Sources said that their cautious approach is partly due to trade negotiations between New Delhi and Washington. Trump stated on Monday that the two countries are "very close" to reaching an agreement. India has pledged to increase purchases of US crude oil under the negotiation framework.

Only two refiners—Indian Oil Corp. and Nayara Energy Ltd.—have purchased some Russian crude for December. Indian Oil Corp. buys from non-sanctioned sellers, while Nayara Energy, partly owned by Rosneft PJSC, continues to rely solely on Russian crude.

According to sources, in the spot market, traders have been selling Russian crude from non-sanctioned suppliers at a discount of $3 to $4 per barrel. However, they noted that Indian buyers remain hesitant, as they must go through lengthy and complex due diligence processes to ensure that no sanctioned entities are involved in the supply chain.

This year, 36% of India's crude oil imports have come from Russia, but the upcoming global oil supply surplus will make it much easier for India to seek alternative sources. Indian Oil Corp. has sought to purchase up to 24 million barrels of American crude for delivery between January and March; Hindustan Petroleum Corp. recently purchased 4 million barrels of US and Middle Eastern crude, scheduled to arrive in January.

Refiners have also contacted traditional suppliers in the Persian Gulf to make up for the shortfall in Russian crude. According to sources, during an industry conference held in Abu Dhabi last week, executives from India's state-owned refineries met with executives from Saudi Aramco and Abu Dhabi National Oil Co., and secured supply assurances.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What would happen to bitcoin if the entire world lost internet access for a day?

Even if World War III breaks out, bitcoin will not disappear.

How to view Monad's market-making arrangements? These core messages are also hidden in the 18-page sales document

Can only 0.16% of market-making funds provide support to the bottom?

The Essence of Bitcoin and AI

Liberalism gives vitality to Bitcoin; democratization gives it scale. The network effect is the invisible bridge connecting the two, and also proves that freedom grows through participation.

Masayoshi Son takes action! SoftBank sells all its Nvidia shares, cashing out $5.8 billions to shift towards other AI investments

SoftBank Group has completely sold its Nvidia holdings, cashing out $5.8 billions. Founder Masayoshi Son is shifting the strategic focus, allocating more resources to the artificial intelligence and chip-related sectors.