Bitcoin Whiplash: $94K Liquidation Squeeze Shocks Traders

Bitcoin startled leveraged traders when the price dropped to a low of $94,000 a few minutes and billions of dollars in long positions were liquidated. The resulting abrupt turnaround wiped out the over leveraged shorts and produced a two sided wipe out that is the ideal example of how dangerous the current market conditions are.

Cryptocurrency analyst Satoshi Staker, who went by the alias StackerSatoshi, pointed to the action on X (once Twitter) and said, Longs have just been squeezed on that pull to $94,000, and now late shorts are being squeezed to the long side.

This theatrical operation was done on thin weekend liquidity, but now every eye is on the opening of the US futures market at 2: 30 PM ET, which frequently turns out to be the trigger of volatility to the extreme.

Liquidation Heatmap Displays the Battlefield

The heatmap of Coinglass liquidation shows just huge liquidation clusters at the point of approximately 94K, and traders are overexposed in each way. These liquidation areas are liquidity magnets, they are violated and the price runs away and positions are rudely closed.

Why This Happens:

- Highly leveraged traders make wild speculation on the short term.

- After price drops under important levels, wave after wave of forced closures ensues.

- Short sellers frequently are squeezed by the rebound that the drop will persist.

This tug-of-war has the retail traders destroyed, unless they have a comprehensive grasp of the dynamics of liquidation and do not follow the momentum. The abrupt decline is part of a larger correction of 25% of recent elevations however, sentiment has gone in every direction. The Fear and Greed Index fell to 9/100, one of the most fearful levels since the end of 2022. Amazingly, this fear is more than in the course of 32 percent-33 percent corrections in the previous two market cycles.

What’s Behind the Fear?

Overleveraged speculation, Macroeconomic uncertainty, Expectation of control measures and institutional flows. However, analysts caution that crypto markets tend to be at the bottom when the mood is extreme fear is not necessarily a time to sell. As the US futures market opens late this afternoon, crypto traders prepare to be hit. The volatility can be increased by the institutional activity in the futures hours, particularly when the funding rates are positive and open interest is high. The increased rates of higher funding indicate that long positions are still predominating, and the probability of short squeeze once price grinds higher is more likely to occur, particularly where liquidity is still low.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dash Coin Value Climbs 4.86% Amid Strategic Growth and Positive Analyst Revisions

- DASH surged 4.86% in 24 hours, driven by strategic expansions and upgraded analyst sentiment. - Partnerships with Coco Robotics and Old Navy expanded delivery services and diversified revenue streams. - Q3 2025 results showed 49.2% gross margin and 0.34 debt/equity ratio, supporting bullish analyst price targets up to $260. - Technical analysis identified $208 breakout and $200 support levels, aligning with positive backtest results showing 28% average gains post-earnings.

Internet Computer (ICP) Experiences a Surge: What Factors Are Fueling the Latest Uptrend?

- Internet Computer (ICP) surged in late 2025 due to blockchain infrastructure upgrades and rising DeFi adoption. - Key innovations like Fission, Protium, and Chain Fusion enhanced scalability, interoperability, and cross-chain integration with Bitcoin , Ethereum , and Solana . - AI-powered Caffeine platform boosted TVL by 22.5% and drove 1.2M active wallets, supported by partnerships with Microsoft and Google Cloud. - Despite record $1.14B trading volume, ICP faces challenges in closing its TVL gap with E

Bitcoin Updates Today: Cardone Blends Real Estate and Bitcoin in a Strategic Move to Navigate Market Fluctuations

- Cardone Capital increased Bitcoin holdings to 888 coins while acquiring a $235M Florida multifamily property. - The hybrid strategy combines real estate stability with crypto growth, reinvesting $10M annual property income into Bitcoin. - Grant Cardone emphasized using real estate profits to hedge volatility, with 935 new Bitcoin purchases funded by cash flows. - Institutional Bitcoin adoption grows as Harvard allocates $443M to crypto ETFs, mirroring Cardone's diversified approach. - The model contrasts

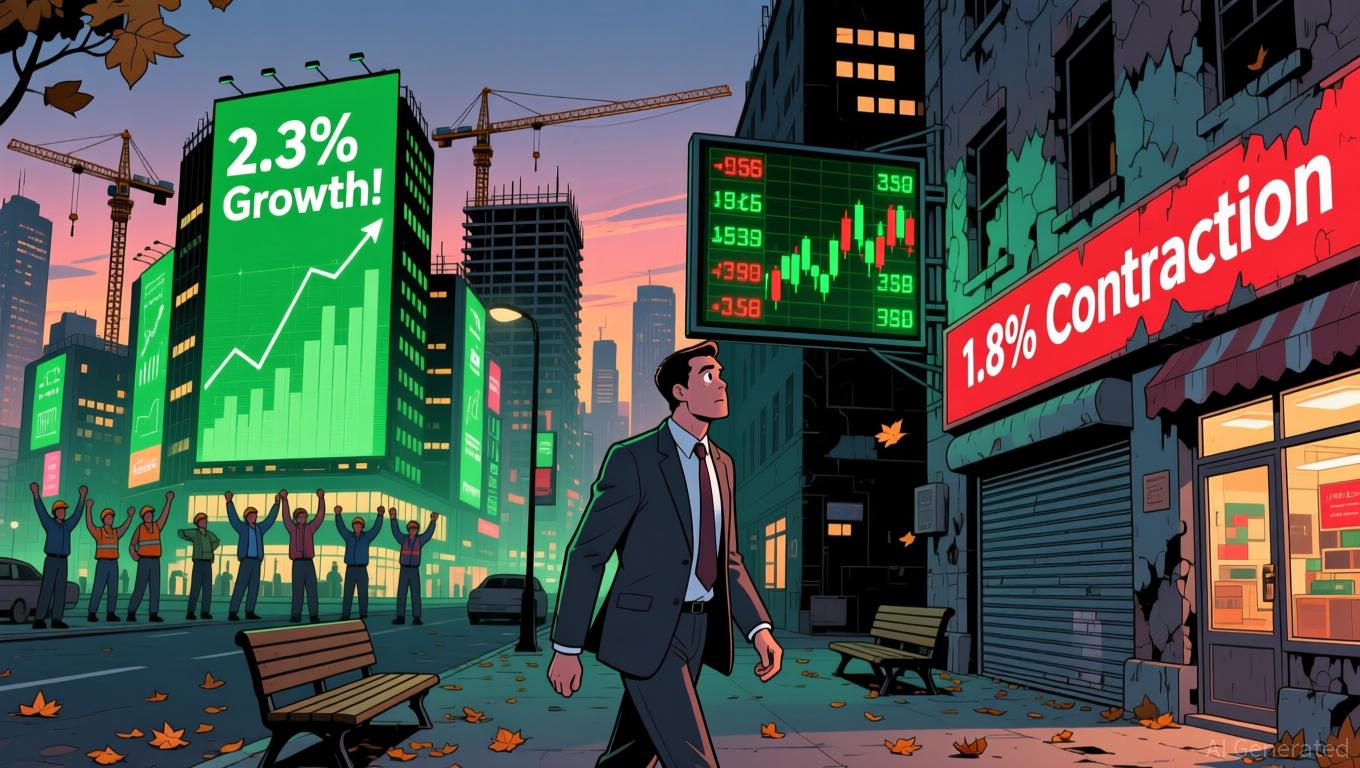

Global trade barriers and increasing expenses lead to Japan's initial economic downturn after six consecutive quarters of growth

- Japan's Q3 2025 economy contracted 1.8% annually, first decline in six quarters, driven by 0.4% GDP drop and weak private consumption amid global trade tensions and domestic cost pressures. - Nexon Co. defied downturn with ¥118.7B revenue and 61% growth in MapleStory, showcasing digital innovation's resilience despite broader economic headwinds. - BOJ faces balancing act as growth wanes, with U.S. tariffs and rising energy/food costs constraining domestic demand while capital spending remains supported b