Bitcoin Updates Today: Institutional Bitcoin Buzz vs. Arbitrage Facts: Hayes Reveals the Strategy

- Arthur Hayes challenges institutional Bitcoin bullishness, arguing major players exploit arbitrage strategies rather than hold long-term conviction. - Harvard University's $442.8M IBIT stake and 15% Q3 surge in BlackRock's ETF holders highlight growing institutional adoption. - Hayes reveals "basis trade" tactics where large holders buy IBIT shares while shorting Bitcoin futures to capture yield differentials. - ETF flows show $2.3B November outflows and Wisconsin's $300M IBIT liquidation, reflecting vol

The narrative of institutional enthusiasm for Bitcoin is being questioned, as BitMEX co-founder Arthur Hayes disputes the idea that influential firms like

Harvard University’s latest disclosure to the U.S. Securities and Exchange Commission showed

Yet, Hayes maintains that this apparent institutional interest is misleading. He points out that major players—hedge funds, bank trading desks, and BlackRock itself—are engaging in a “basis trade,” simultaneously purchasing IBIT shares and shorting Bitcoin futures to profit from yield differences

Recent figures back up this trend.

Hayes’ recent moves stand in contrast to his outspoken support for privacy-oriented

The ongoing debate between institutional involvement and arbitrage strategies highlights Bitcoin’s shifting place in the financial world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

El Salvador Buys Bitcoin Dip, Expands Reserves Amid IMF Pressure

Aster News Today: Transparent Token Unlocks Fuel 9% Surge for Aster, $1.38 Target in Focus

- ASTER surged 9% to $3.27B market cap after team clarified tokenomics and Binance's CZ disclosed $2.5M holdings. - Misstated unlock schedules and a $10M trading competition fueled demand, with price stabilizing above $1.14. - Analysts highlight $1.38 target if $1.26 resistance holds, but warn of risks from stagnant fees and declining user growth.

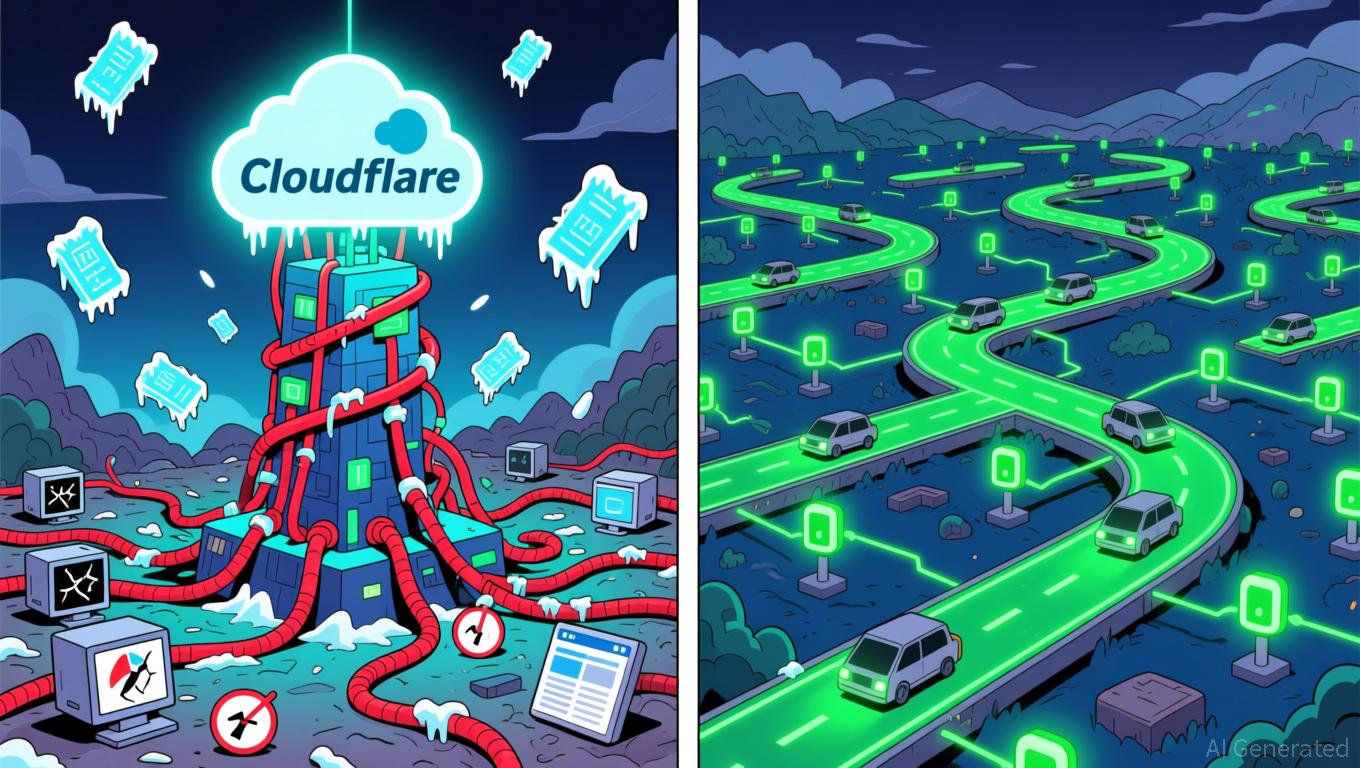

Bitcoin News Update: Recent Cloud Outages Highlight Systemic Risks, Fueling DePIN Adoption

- Cloudflare's 2025 global outage disrupted major websites and crypto platforms, exposing centralized infrastructure vulnerabilities and boosting DePIN interest. - The incident caused 500 errors and API failures, impacting services like ChatGPT, X, and crypto exchanges, while pushing Cloudflare's stock down 3.5%. - DePIN advocates argue decentralized infrastructure reduces single-point failures, with projects like Gaimin promoting distributed cloud models using global resources. - Blockchain's operational

Bitcoin Updates Today: Is Bitcoin's Decline a Temporary Correction or the Start of a Crash? Experts Disagree

- Bitcoin's recent sharp price swings, dipping below $90,000 before rebounding to $96,500, have intensified debates over bear market risks versus bull cycle consolidation. - MicroStrategy's CEO Michael Saylor denied Bitcoin sales, reaffirming accumulation strategies as institutional ETF redemptions hit $870M, signaling bear market concerns. - Technical analysts highlight critical $92,000–$95,000 support zones, with breakdown risks pushing prices toward $85,000–$90,000 amid deteriorating market sentiment. -