XRP News Today: Launch of XRP ETF Unable to Halt Price Drop Amid Strong Selling Pressure

- Bitcoin fell below $93,000, erasing 2025 gains amid a broader crypto selloff, with XRP dropping 7% despite a new ETF's debut. - XRPC ETF generated $58.6M in volume but failed to sustain momentum, highlighting fragile risk appetite amid macroeconomic uncertainty. - XRP's price collapse triggered $28M in liquidations and 342% trading volume spikes, with on-chain data showing 110.5M tokens moved during the selloff. - Technical indicators showed bearish signals for Bitcoin and Ethereum , while market partici

On Tuesday, Bitcoin dropped beneath $93,000, wiping out its gains for 2025 and intensifying a late-year downturn that has unsettled both institutional investors and traders

The

Technical signals for Bitcoin also suggested continued weakness. Although the Relative Strength Index (RSI) briefly rebounded to 34 on the daily chart, the Moving Average Convergence Divergence (MACD) indicator remained bearish, with its blue line staying below the red signal line

The debut of the XRP ETF underscored a contradiction in the crypto space: institutional demand for regulated investment vehicles exists alongside speculative selling. Despite XRPC’s strong opening, XRP’s price movement confirmed a structural breakdown, with sellers defending the $2.29–$2.30 support area and previous resistance at $2.36, $2.40, and $2.47 now serving as overhead resistance

Opinions remain split regarding the long-term prospects. While

As

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster News Today: Transparent Token Unlocks Fuel 9% Surge for Aster, $1.38 Target in Focus

- ASTER surged 9% to $3.27B market cap after team clarified tokenomics and Binance's CZ disclosed $2.5M holdings. - Misstated unlock schedules and a $10M trading competition fueled demand, with price stabilizing above $1.14. - Analysts highlight $1.38 target if $1.26 resistance holds, but warn of risks from stagnant fees and declining user growth.

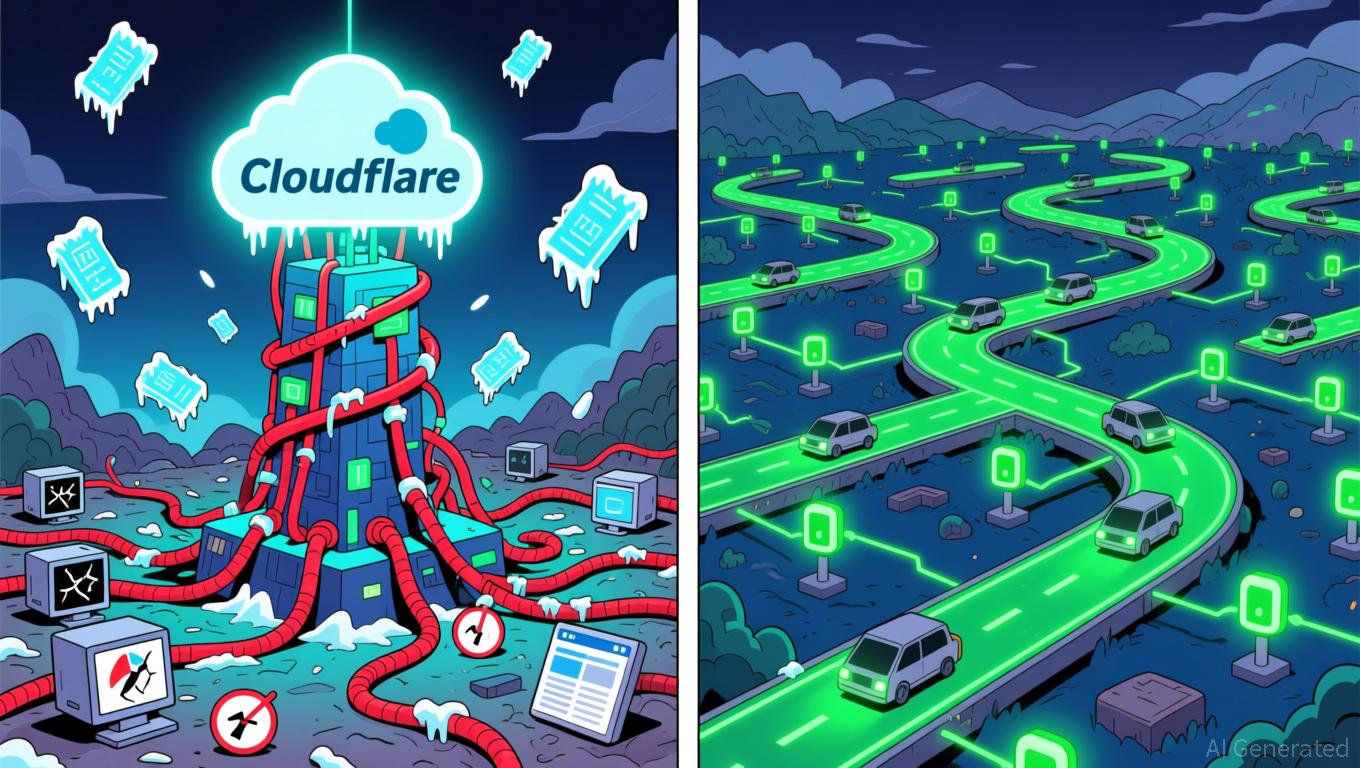

Bitcoin News Update: Recent Cloud Outages Highlight Systemic Risks, Fueling DePIN Adoption

- Cloudflare's 2025 global outage disrupted major websites and crypto platforms, exposing centralized infrastructure vulnerabilities and boosting DePIN interest. - The incident caused 500 errors and API failures, impacting services like ChatGPT, X, and crypto exchanges, while pushing Cloudflare's stock down 3.5%. - DePIN advocates argue decentralized infrastructure reduces single-point failures, with projects like Gaimin promoting distributed cloud models using global resources. - Blockchain's operational

Bitcoin Updates Today: Is Bitcoin's Decline a Temporary Correction or the Start of a Crash? Experts Disagree

- Bitcoin's recent sharp price swings, dipping below $90,000 before rebounding to $96,500, have intensified debates over bear market risks versus bull cycle consolidation. - MicroStrategy's CEO Michael Saylor denied Bitcoin sales, reaffirming accumulation strategies as institutional ETF redemptions hit $870M, signaling bear market concerns. - Technical analysts highlight critical $92,000–$95,000 support zones, with breakdown risks pushing prices toward $85,000–$90,000 amid deteriorating market sentiment. -

ICP Caffeine AI and Its Transformative Impact on the AI-Powered Investment Sector

- ICP Caffeine AI, a blockchain-AI platform by DFINITY, launched in 2025, boosted ICP token price by 56% and partnered with Microsoft and Google Cloud. - Its cost-efficient AI tools and chain-of-chains architecture enable real-time portfolio optimization and risk management for institutions. - Despite a 22.4% Q3 dApp activity drop, it achieved $237B TVL, but faces scalability and regulatory challenges from competitors and SEC scrutiny. - Analysts project growth if ICP sustains above $6.50, but institutions