How Prediction Markets Could Create Crypto’s Next Billion Users

Prediction markets have been quite the story in 2025. From being a highly niche, unknown category previously, companies in the prediction market space are blowing up. They have now raised cash at bonanza billion dollar valuations to fuel their popularity and growth. The most well-known are Polymarket, which received a $2 billion investment from NYSE

Prediction markets have been quite the story in 2025. From being a highly niche, unknown category previously, companies in the prediction market space are blowing up. They have now raised cash at bonanza billion dollar valuations to fuel their popularity and growth.

The most well-known are Polymarket, which received a $2 billion investment from NYSE owner Intercontinental Exchange at a $9 billion valuation and Kalshi, which raised $300 million at a $5 billion valuation, both in October. And prediction market players such as Opinion, Limitless and Myriad have also raised or are seeing user growth.

With this predicting frenzy in mind, what happens next? Can these platforms, most of which are blockchain and crypto-based, help bring in a totally new set of users? Could they bring blockchain to the next billion, the fever dream every crypto native seeks?

The Path To Predicting

Although venues like Kalshi and Polmarket seem to have come out of nowhere in 2025 to the uninitiated, prediction markets actually aren’t new to the scene.

“They’ve been around in crypto for quite a while,” noted Shresth Agrawal, CEO of Pod, a layer 1 blockchain. “We had Gnosis and Augur, which were some of the early companies that tried it.”

Augur’s REP token has appreciated over 150% over the past year. Source:

CoinGecko

Augur’s REP token has appreciated over 150% over the past year. Source:

CoinGecko

In August 2015, Augur raised $5.5 million. In April 2017, Gnosis raised $12.5 million that sold out in ten minutes. Augur is still chugging along, with its v2 launch supporting the DAI stablecoin and its REP token ripping the past year. Gnosis pivoted away from predictions to its highly lucrative Safe multisig wallet, which scored $100 million in funding in 2022.

During the first Trump administration, in 2020, Kalshi was able to gain approval from the CTFC to be a Designated Contract Market to trade event contracts. And while Kalshi runs on a closed system instead of blockchain, this approval paved the way for onchain prediction markets.

Polymarket, founded in 2020, uses USDC on Polygon, and is really the first onchain prediction market to change the blockchain game.

“What we’re truly witnessing is the emergence of a new design space for financial and informational markets,” said Niraj Pant, an investor in Polymarket’s seed round.

Growing Market Access

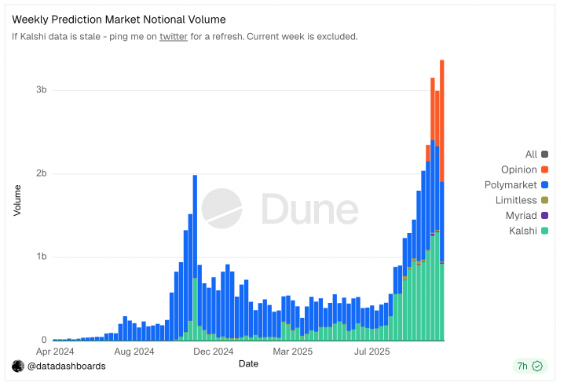

This emergence is being powered by a river of money entering into prediction market platforms. At the beginning of November, the total notional volume traded on prediction markets hit a record-high $3.3 billion according to data aggregator Dune Analytics. Kalshi had around $1 billion, Polymarket approximately $1 billion, and the just-launched BNB Chain-based Opinion led the way with $1.4 billion.

Notional volume across major prediction markets. Source:

Dune Analytics

Notional volume across major prediction markets. Source:

Dune Analytics

Pant, the Polymarket seed investor, sees this rising popularity as a sign of traders recognizing the brand-new financial markets these venues can unlock.

“There’s a greater market access story here,” he told BeInCrypto. Sportsbooks, for example, do offer some political betting options, but the menu is often quite limited to a book’s low appetite for risk.

In contrast, prediction markets intend to financialize events of all types. Previously, Pant says, “the average individual investor could not easily bet on whether the Fed will cut rates, whether a certain politician will win in a particular market, or even whether Tesla stock will go up or down, depending on where they live,” he added.

“Now they can.”

What’s Next

New categories in the prediction market space are continually developing. One of these gaining popularity are “mention markets” where bets are placed on what celebrities or other public figures say. Coinbase CEO Brian Armstrong recently read through a list of words in a market for him on his company’s earnings call; crypto social media voraciously ate it up.

Armstrong mentioned “bitcoin”, “ethereum”, “blockchain” “staking” and “web3”. Source:

X

Armstrong mentioned “bitcoin”, “ethereum”, “blockchain” “staking” and “web3”. Source:

X

The next frontier for prediction markets: Bringing in users to crypto who don’t know they are using crypto.

“I think what’s most powerful about Polymarket is that they don’t even carry obvious crypto branding,” said Vincent Manglietto, the founder of Pentagon Pizza Watch, a data tracker to help inform prediction market traders. The idea is that if Pentagon-area pizza joints get busy, it might mean some event might be cooking up as employees there are too busy to worry about food and just order pizza.

“Most users who are familiar or even engaging with them don’t realize there’s blockchain infrastructure under the hood,” Manglietto added regarding prediction markets. “Powering products that feel intuitive, entertaining, and culturally relevant is exactly how the next billion users come in.”

A Billion? Really?

The holy grail for crypto, at least among enthusiasts, is to get billions of users adopting blockchain. So an onchain prediction markets really bring in crypto’s next billion?

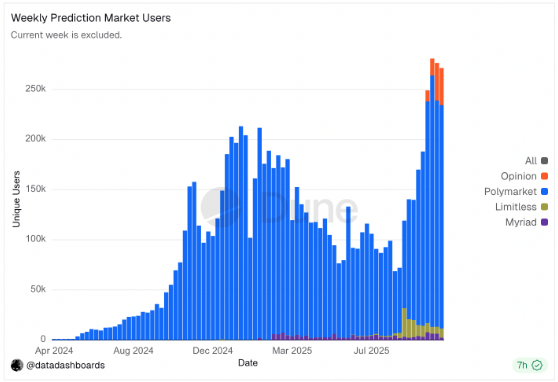

Weekly prediction market users since the data became available. Source:

Dune

Weekly prediction market users since the data became available. Source:

Dune

Right now, these blockchain-based prediction markets are only cultivating hundreds of thousands of users on a weekly basis – 274,000 the past week, according to Dune. It’s obviously still early – but it’s also clear that this market, and the number of venues, will grow.

This will likely grow due to the number of markets available, noted Pod’s Agrawal “Basically, any kind of information that exists on the internet, or could exist in the future, can become the basis for a market.” More markets to predict on could become akin to new tokens building fresh narratives that often bring users to blockchain.

And blockchain infrastructure is getting good enough that users may not even have to know crypto is being used on the back-end of these prediction markets as these venues grow. As Coinbase’s Brian Armstrong said in October: “In 10 years, many more people will use crypto, but they may not know they’re using crypto.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: SoftBank's PayPay Connects Japan's Conventional Finance with the Crypto Sector

Adherence to regulations and rapid transaction speeds are driving the widespread adoption of cryptocurrency in mainstream business.

- OwlTing Group's "Invisible Rails" strategy enables rapid deployment of compliant crypto gateways via global licensing across Asia and Latin America. - Opera's MiniPay expands Latin American reach by integrating USD₮ stablecoins with local payment systems like PIX and Mercado Pago. - Grayscale rebrands XRP Trust as GXRP ETF, reflecting growing institutional demand for regulated crypto exposure in global markets. - Industry analysis highlights blockchain's convergence with AI data infrastructure, emphasizi

DASH Experiences a Rapid 150% Jump in Value: Unpacking the Causes Behind the Price Fluctuation

- DASH surged 150% in Q3 2025 after listing on Aster DEX, a hybrid AMM-CEX platform boosting liquidity and attracting institutional interest. - Dash Platform 2.0 upgrades, enhanced privacy features, and SEC regulatory clarity positioned DASH as a stable alternative to volatile DeFi assets. - On-chain metrics showed 50% higher transaction volume and 35% more active addresses, though privacy tools like PrivateSend obscured organic growth verification. - Cybersecurity breaches and whale-driven volatility in l

Vitalik Buterin's Advances in Zero-Knowledge Technology: Driving Ethereum's Growth and Enhancing Investor Profits

- Vitalik Buterin advances Ethereum's ZK innovations, prioritizing scalability and efficiency through Layer 2 upgrades like ZKsync's 15,000 TPS Atlas upgrade. - ZK Stack bridges Ethereum's security with off-chain efficiency, driving 150% token price growth and a projected $90B ZK Layer 2 market by 2031. - Modexp precompile removal increases gas costs but optimizes ZK proofs, reflecting Buterin's focus on long-term sustainability over short-term savings. - Investors face high-reward opportunities as ZK-cent