Where Does Ethereum Whale Accumulation Stand As Price Dips Below $3,000?

Ethereum is facing renewed bearish pressure as its price continues to fall, driven in part by a halt in whale accumulation. The slowdown in buying from major holders has weakened market support at a time when broader conditions are already unfavorable. If long-term holders begin selling, the decline could intensify. Ethereum Holders Seem To Be

Ethereum is facing renewed bearish pressure as its price continues to fall, driven in part by a halt in whale accumulation.

The slowdown in buying from major holders has weakened market support at a time when broader conditions are already unfavorable. If long-term holders begin selling, the decline could intensify.

Ethereum Holders Seem To Be On The Edge

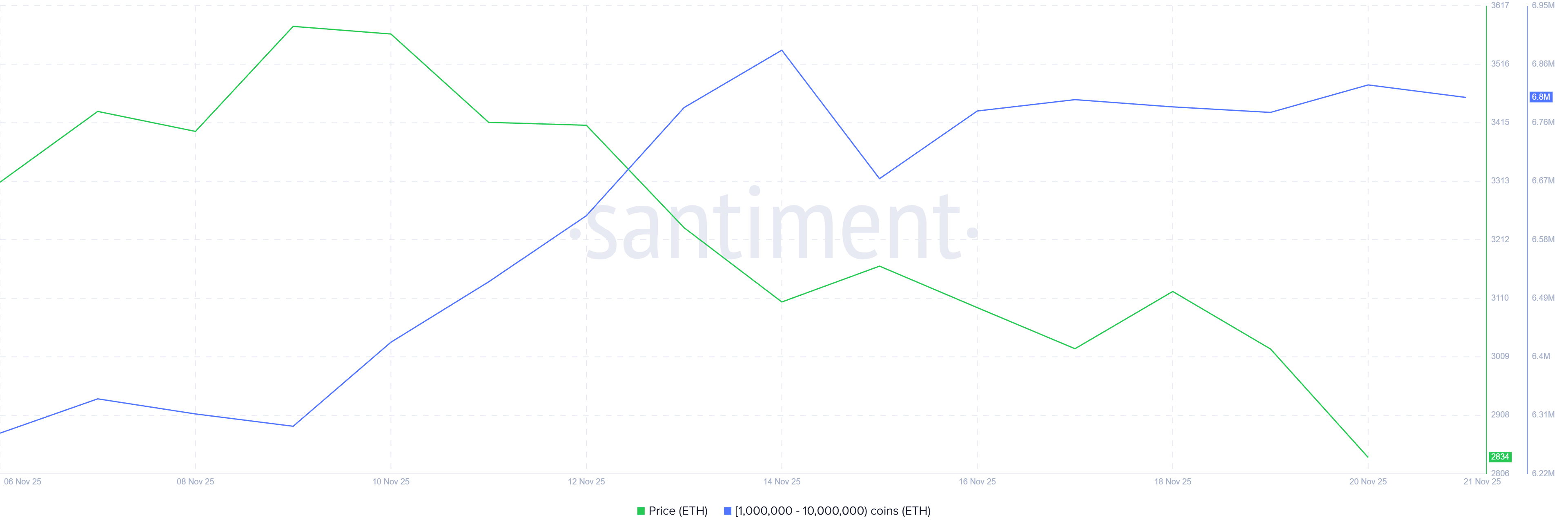

Whales appear to be losing confidence in Ethereum’s near-term recovery. Addresses holding between 1 million and 10 million ETH were accumulating aggressively at the start of the month. That trend has now paused as ETH continues to drop, signaling hesitation among the network’s most influential participants.

This shift suggests reduced conviction in the asset’s ability to rebound quickly. Whale accumulation is often a key driver of upside momentum, and the absence of sustained buying creates additional vulnerability. Without renewed support from these large holders, Ethereum may struggle to stabilize.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum Whale Holdings. Source:

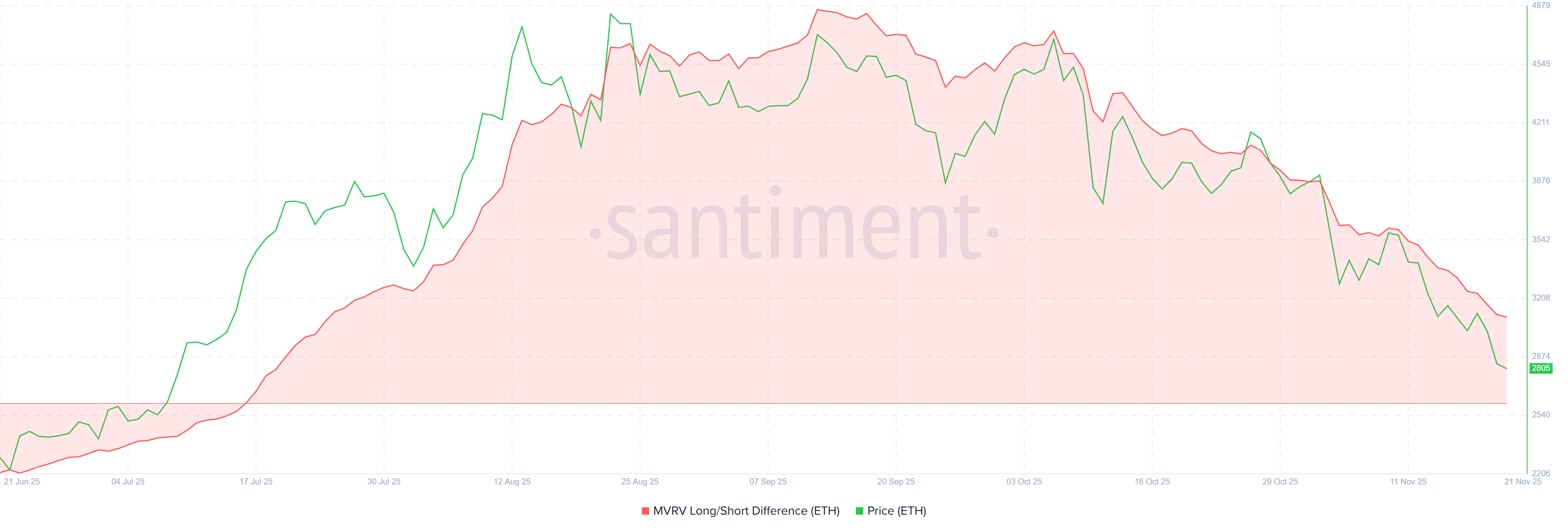

Macro indicators are reinforcing this caution. The MVRV Long/Short Difference has fallen to a four-month low, highlighting growing strain among both long-term and short-term holders. The metric shows whether long-term holders are in profit relative to short-term holders, and positive values typically reflect strong LTH confidence.

Ethereum Whale Holdings. Source:

Macro indicators are reinforcing this caution. The MVRV Long/Short Difference has fallen to a four-month low, highlighting growing strain among both long-term and short-term holders. The metric shows whether long-term holders are in profit relative to short-term holders, and positive values typically reflect strong LTH confidence.

However, the indicator’s decline indicates that long-term holders are losing profitability. If this trend deepens, it could trigger selling from long-term investors seeking to protect remaining gains. Such selling pressure would weigh heavily on Ethereum and accelerate its current downtrend.

Ethereum MVRV Long/Short Difference. Source:

Ethereum MVRV Long/Short Difference. Source:

ETH Price Could Continue Its Decline

Ethereum’s price has dropped 7.4% in the past 24 hours, pressured by bearish macro conditions and weakening investor confidence. These factors point to a continuation of the downtrend unless sentiment shifts significantly.

ETH has fallen below $3,000 for the first time in more than four months and currently trades at $2,801. With the loss of $2,814 support, the next downside target sits at $2,681. A break below this level could send the price toward $2,606, signaling deeper weakness.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

If market conditions improve and long-term holders avoid selling, Ethereum could mount a recovery. A rebound toward $3,000 would be the first sign of strength. Breaking above that barrier could push ETH to $3,131 or higher. This would invalidate the bearish outlook and restore confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: SoftBank's PayPay Connects Japan's Conventional Finance with the Crypto Sector

Adherence to regulations and rapid transaction speeds are driving the widespread adoption of cryptocurrency in mainstream business.

- OwlTing Group's "Invisible Rails" strategy enables rapid deployment of compliant crypto gateways via global licensing across Asia and Latin America. - Opera's MiniPay expands Latin American reach by integrating USD₮ stablecoins with local payment systems like PIX and Mercado Pago. - Grayscale rebrands XRP Trust as GXRP ETF, reflecting growing institutional demand for regulated crypto exposure in global markets. - Industry analysis highlights blockchain's convergence with AI data infrastructure, emphasizi

DASH Experiences a Rapid 150% Jump in Value: Unpacking the Causes Behind the Price Fluctuation

- DASH surged 150% in Q3 2025 after listing on Aster DEX, a hybrid AMM-CEX platform boosting liquidity and attracting institutional interest. - Dash Platform 2.0 upgrades, enhanced privacy features, and SEC regulatory clarity positioned DASH as a stable alternative to volatile DeFi assets. - On-chain metrics showed 50% higher transaction volume and 35% more active addresses, though privacy tools like PrivateSend obscured organic growth verification. - Cybersecurity breaches and whale-driven volatility in l

Vitalik Buterin's Advances in Zero-Knowledge Technology: Driving Ethereum's Growth and Enhancing Investor Profits

- Vitalik Buterin advances Ethereum's ZK innovations, prioritizing scalability and efficiency through Layer 2 upgrades like ZKsync's 15,000 TPS Atlas upgrade. - ZK Stack bridges Ethereum's security with off-chain efficiency, driving 150% token price growth and a projected $90B ZK Layer 2 market by 2031. - Modexp precompile removal increases gas costs but optimizes ZK proofs, reflecting Buterin's focus on long-term sustainability over short-term savings. - Investors face high-reward opportunities as ZK-cent