Bitcoin Looks More Bullish Than Ethereum as $4 Billion Options Expire Today

Over $3.9 billion in Bitcoin and Ethereum options contracts will expire today at 8:00 UTC on Deribit, with traders maintaining a bullish stance despite sharp price declines earlier in the week. The major expiry event on Deribit will feature a call-heavy positioning for both assets, signaling cautious optimism amid volatile market conditions. Bitcoin Options Show

Over $3.9 billion in Bitcoin and Ethereum options contracts will expire today at 8:00 UTC on Deribit, with traders maintaining a bullish stance despite sharp price declines earlier in the week.

The major expiry event on Deribit will feature a call-heavy positioning for both assets, signaling cautious optimism amid volatile market conditions.

Bitcoin Options Show Strong Call Bias Despite Price Weakness

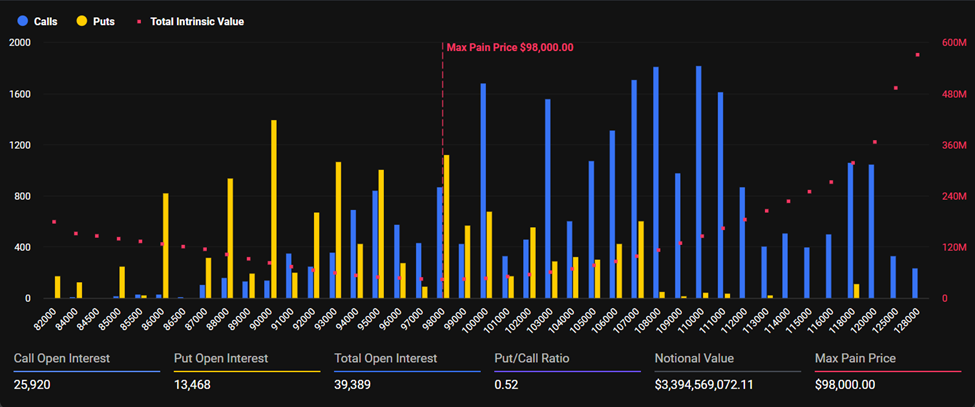

Bitcoin traded at $86,195 as of this writing, reflecting a 7.02% decline over 24 hours. Meanwhile, as the options near expiry, 39,389 BTC contracts (total open interest) worth $3.39 billion in notional value will expire, with open interest heavily skewed toward calls.

Bitcoin Expiring Options. Source:

Deribit

Bitcoin Expiring Options. Source:

Deribit

According to Deribit data, calls reached 25,920 contracts, while puts stood at 13,468, yielding a put-call ratio of 0.52. This ratio indicates that traders held nearly twice as many call (purchase) options as puts (sells) before expiry, reflecting expectations of upside potential despite the recent selloff.

The max pain price for Bitcoin was $98,000, about 14% above the current trading level. Max pain marks the strike price at which most options become worthless, thereby maximizing the loss for holders.

The pronounced gap indicates that many call holders could see significant losses at expiry, directly proportional to how much the price draws toward this $98,000 strike price.

Bitcoin reached a record high of $126,080 on October 6, 2025, before entering a correction. The drop aligns with broader market headwinds. Previously, the Fear and Greed Index soared to an extreme greed value of 93 in late 2024.

Ethereum Traders Maintain Focus on Mid-to-Upper Strike Calls

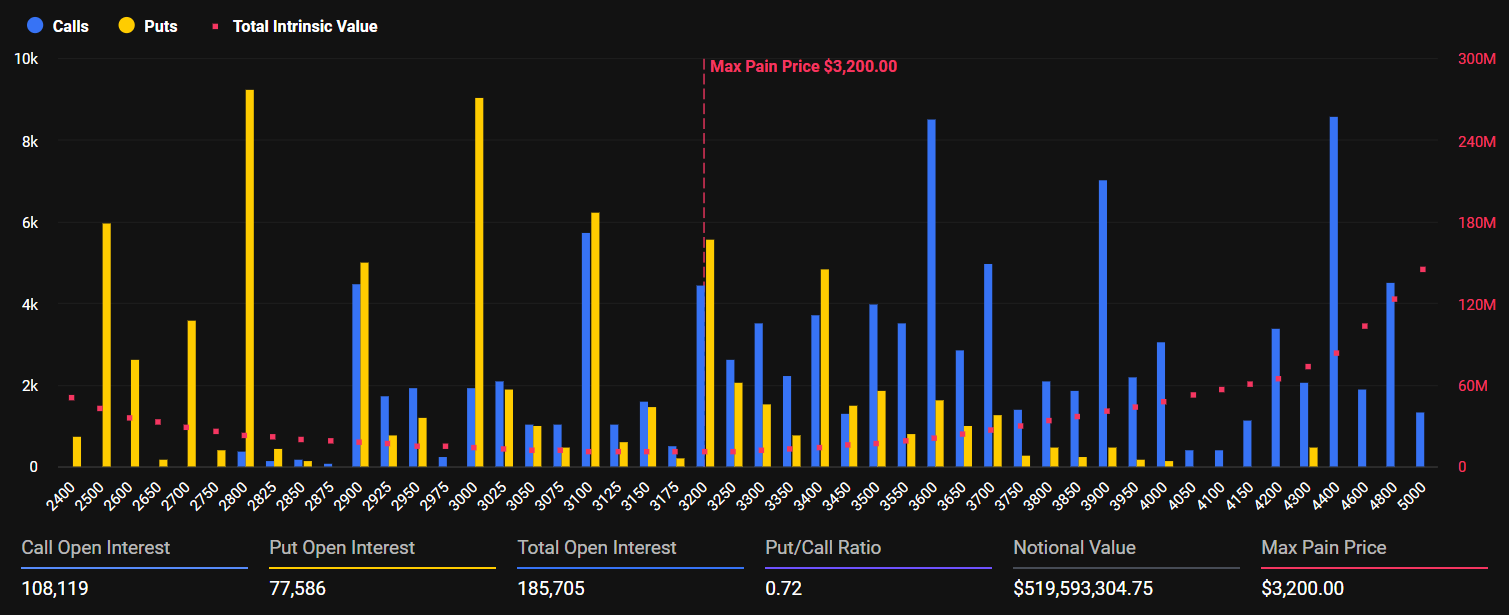

Ethereum experienced similar pressure, trading at $2,822 after a 6.98% decline over 24 hours. The expiry covered 185,730 ETH contracts valued at $524 million notional, with 108,166 calls and 77,564 puts.

Ethereum Expiring Options. Source:

Deribit

Ethereum Expiring Options. Source:

Deribit

The put-call ratio for Ethereum was 0.72, showing less bullishness than Bitcoin, yet a preference for calls persisted.

Based on the Ethereum expiring options chart above, trading focused on December 2025 expiry at 2,900 and 3,100 strikes, suggesting hopes for a rebound to those levels.

Ethereum’s max pain was at $3,200, roughly 13% above its current price, mirroring Bitcoin’s profile. Many options thus could expire out of the money. Still, persistent call exposure suggests that traders are holding onto a bullish outlook.

Market Signals Show Cautious Optimism Amid Volatility

The derivatives market structure reveals nuanced investor sentiment as today’s options expiry approaches. Although prices for both assets dropped sharply earlier, traders maintained considerable call exposure rather than increasing protection with puts or fully closing their positions.

“Flows lean toward calls across the upper strikes while downside hedging remains light… Positioning is not signaling a major risk-off move, but traders remain cautious after this week’s sharp drop,” wrote analysts at Deribit.

Light downside hedging suggests many traders view this dip as a regular correction rather than the start of a lasting bear market. Still, the presence of caution shows that volatility could persist.

For Ethereum, Deribit observed that traders leaving call exposure open through expiry indicates confidence endures. This differs from typical risk-off scenarios, where participants quickly hedge or exit bullish trades when prices fall before expiry.

The combination of strong call positioning, high open interest, and light downside protection may result in pronounced market moves. If prices recover toward max pain levels, short-dated call buyers could find relief.

Should markets drop further, additional selling pressure could arise as bullish bets face higher losses. Upcoming sessions will show whether this cautious optimism is sustainable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: SoftBank's PayPay Connects Japan's Conventional Finance with the Crypto Sector

Adherence to regulations and rapid transaction speeds are driving the widespread adoption of cryptocurrency in mainstream business.

- OwlTing Group's "Invisible Rails" strategy enables rapid deployment of compliant crypto gateways via global licensing across Asia and Latin America. - Opera's MiniPay expands Latin American reach by integrating USD₮ stablecoins with local payment systems like PIX and Mercado Pago. - Grayscale rebrands XRP Trust as GXRP ETF, reflecting growing institutional demand for regulated crypto exposure in global markets. - Industry analysis highlights blockchain's convergence with AI data infrastructure, emphasizi

DASH Experiences a Rapid 150% Jump in Value: Unpacking the Causes Behind the Price Fluctuation

- DASH surged 150% in Q3 2025 after listing on Aster DEX, a hybrid AMM-CEX platform boosting liquidity and attracting institutional interest. - Dash Platform 2.0 upgrades, enhanced privacy features, and SEC regulatory clarity positioned DASH as a stable alternative to volatile DeFi assets. - On-chain metrics showed 50% higher transaction volume and 35% more active addresses, though privacy tools like PrivateSend obscured organic growth verification. - Cybersecurity breaches and whale-driven volatility in l

Vitalik Buterin's Advances in Zero-Knowledge Technology: Driving Ethereum's Growth and Enhancing Investor Profits

- Vitalik Buterin advances Ethereum's ZK innovations, prioritizing scalability and efficiency through Layer 2 upgrades like ZKsync's 15,000 TPS Atlas upgrade. - ZK Stack bridges Ethereum's security with off-chain efficiency, driving 150% token price growth and a projected $90B ZK Layer 2 market by 2031. - Modexp precompile removal increases gas costs but optimizes ZK proofs, reflecting Buterin's focus on long-term sustainability over short-term savings. - Investors face high-reward opportunities as ZK-cent