BitMine Faces Over $4 Billion in Unrealized Loss as Digital Asset Treasury Model Faces Scrutiny

BitMine Immersion Technologies, the world’s largest corporate Ethereum (ETH) holder, is now facing over $4 billion in unrealized losses on its ETH holdings. The firm’s drawdown reflects wider turmoil for digital asset treasury (DAT) companies, prompting new questions about the sustainability of this business model. BitMine’s Mounting Losses Create ‘Hotel California’ Scenario In a recent

BitMine Immersion Technologies, the world’s largest corporate Ethereum (ETH) holder, is now facing over $4 billion in unrealized losses on its ETH holdings.

The firm’s drawdown reflects wider turmoil for digital asset treasury (DAT) companies, prompting new questions about the sustainability of this business model.

BitMine’s Mounting Losses Create ‘Hotel California’ Scenario

In a recent disclosure released earlier this week, BitMine revealed that it held nearly 3.6 million ETH, equivalent to approximately 2.97% of Ethereum’s supply. The company is steadily approaching its long-stated goal of accumulating 5% of all ETH.

However, its treasury is increasingly feeling the strain from the asset’s sharp price decline. Ethereum has dropped 27.4% over the past month, now trading below $3,000. Concurrently, BitMine’s balance sheet has reflected that drop.

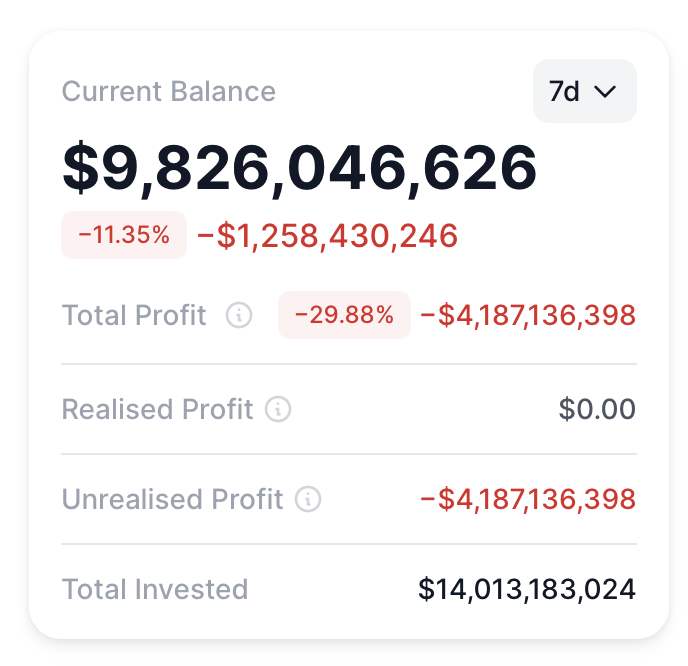

The latest figures show that the firm’s ETH stack is now worth just under $10 billion, placing BitMine’s unrealized losses at around $4.18 billion.

BitMine Unrealized Losses. Source:

BitMine Unrealized Losses. Source:

According to BitmineTracker data, the company’s basic market-to-net-asset-value (mNAV) ratio stands at 0.73, while its diluted mNAV is 0.88. Research firm 10x Research highlighted the implications in a recent post on X (formerly Twitter).

The post emphasized that shifts in NAV tend to reward long-term shareholders when the metric rises, but can amplify losses when it declines — a pattern that many investors in digital-asset vehicles still overlook.

“Treasury companies will face a hard reality: attracting new retail investors becomes nearly impossible when existing shareholders are sitting on billions in losses. When the premium inevitably shrinks to zero, as it is doing now, investors find themselves trapped in the structure, unable to get out without significant damage, a true Hotel California scenario,” 10x Research wrote.

The strain is equally visible in the company’s stock performance. Google Finance data shows that BMNR’s monthly dip is nearly twice that of ETH, with the share price dropping 49.8% over the same period.

This divergence is not unique to BMNR. Several Bitcoin-oriented treasuries have displayed the same pattern, registering declines that exceed BTC’s own downturn.

BitMine (BMNR) Stock Performance. Source:

BitMine (BMNR) Stock Performance. Source:

Meanwhile, BitMine is not alone in these challenges. Sharplink Gaming, the second-largest corporate holder of ETH, faces over half a billion dollars in unrealized losses. It owns 859,853 ETH valued at $2.4 billion at current market prices. The firm’s stock, SBET, is down 35.15% over the past month.

Despite this, on-chain data reveals BitMine is still actively buying ETH. Earlier this month, the firm bought 110,288 ETH. OnchainLens also reported a recent purchase of 17,242 ETH, valued at $49.07 million, from FalconX and BitGo.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: SoftBank's PayPay Connects Japan's Conventional Finance with the Crypto Sector

Adherence to regulations and rapid transaction speeds are driving the widespread adoption of cryptocurrency in mainstream business.

- OwlTing Group's "Invisible Rails" strategy enables rapid deployment of compliant crypto gateways via global licensing across Asia and Latin America. - Opera's MiniPay expands Latin American reach by integrating USD₮ stablecoins with local payment systems like PIX and Mercado Pago. - Grayscale rebrands XRP Trust as GXRP ETF, reflecting growing institutional demand for regulated crypto exposure in global markets. - Industry analysis highlights blockchain's convergence with AI data infrastructure, emphasizi

DASH Experiences a Rapid 150% Jump in Value: Unpacking the Causes Behind the Price Fluctuation

- DASH surged 150% in Q3 2025 after listing on Aster DEX, a hybrid AMM-CEX platform boosting liquidity and attracting institutional interest. - Dash Platform 2.0 upgrades, enhanced privacy features, and SEC regulatory clarity positioned DASH as a stable alternative to volatile DeFi assets. - On-chain metrics showed 50% higher transaction volume and 35% more active addresses, though privacy tools like PrivateSend obscured organic growth verification. - Cybersecurity breaches and whale-driven volatility in l

Vitalik Buterin's Advances in Zero-Knowledge Technology: Driving Ethereum's Growth and Enhancing Investor Profits

- Vitalik Buterin advances Ethereum's ZK innovations, prioritizing scalability and efficiency through Layer 2 upgrades like ZKsync's 15,000 TPS Atlas upgrade. - ZK Stack bridges Ethereum's security with off-chain efficiency, driving 150% token price growth and a projected $90B ZK Layer 2 market by 2031. - Modexp precompile removal increases gas costs but optimizes ZK proofs, reflecting Buterin's focus on long-term sustainability over short-term savings. - Investors face high-reward opportunities as ZK-cent