CITES and Instant DNA Technology Aim to Uncover Covert Shark Trade and Prevent Species Disappearance

- CITES CoP20 in Uzbekistan proposes historic protections for 12 shark/ray species via Appendix I listings and stricter Appendix II monitoring. - Genetic testing reveals illegal shark trade volumes exceed official records by 10-70x, with Hong Kong as a key trafficking hub despite zero-export claims. - Portable DNA tools now enable real-time identification of 38 CITES-listed species, aiding enforcement in Indonesia, Ecuador, and other source countries. - Experts stress CITES is critical to prevent extinctio

At the 20th Conference of the Parties to the Convention on International Trade in Endangered Species (CITES CoP20), held in Samarkand, Uzbekistan, government representatives are at a crucial crossroads to prevent the disappearance of whale sharks, manta rays, and other highly threatened marine animals. Currently, more than 37% of shark and ray species are at risk of extinction, with pelagic shark numbers having dropped by over 70% in the past five decades and

The measures being discussed at CoP20—with backing from over 50 nations—would provide the most extensive protections for sharks and rays ever seen under CITES. These proposals include moving the oceanic whitetip shark, all manta and devil rays, and whale sharks to Appendix I, effectively banning international commercial trade. Zero export quotas are suggested for wedgefish and giant guitarfish, while species such as gulper sharks and smoothhound sharks would be added to Appendix II, requiring tighter oversight

The need for immediate action is highlighted by a recent Science Advances study, which discovered that fins from species listed under CITES, such as oceanic whitetip and hammerhead sharks, are found in markets at rates 10 to 70 times higher than what is officially reported. For instance, 81% of countries exporting shark fins claimed no exports of threatened species, even though DNA evidence traced the fins back to their waters. Hong Kong continues to be a major trade center, with many source countries failing to report the quantities uncovered by genetic testing.

To address this, marine biologist Diego Cardeñosa from Florida International University has created a portable DNA testing device that can instantly identify protected shark and ray species. The tool, tested on 55 species—including 38 listed by CITES—can detect unknown species and provide immediate proof for authorities. Cardeñosa points out that without fast identification methods, illegal shipments often go unnoticed, weakening global conservation efforts. The technology, which can also be used for turtles and mammals, is now being used in countries such as Indonesia and Ecuador to help stop trafficking.

Luke Warwick, who leads the Wildlife Conservation Society's (WCS) shark and ray initiative, emphasized that "CITES remains the most powerful international mechanism to ensure that wildlife trade does not push species to extinction." Dr. Susan Lieberman of WCS further noted that the proposed listings "align CITES with other international commitments and clearly demonstrate the global intent to safeguard these species before it is too late"

The outcomes of CoP20 may decide the fate of these vital species. As top predators and key ecosystem engineers, sharks and rays are essential for maintaining marine biodiversity and the stability of fisheries.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO rises by 0.21% even after a 5.32% decline over the week, reflecting ongoing market fluctuations

- ALGO rose 0.21% to $0.1439 on Nov 24, 2025, but fell 5.32% weekly and 56.92% annually amid market volatility. - Persistent selling pressure and lack of project/regulatory catalysts highlight structural valuation declines since peak levels. - Analysts project continued downward pressure unless major developments like regulatory updates or institutional adoption emerge. - Investors advised to remain cautious as short-term gains fail to offset 18.77% monthly losses and broader bearish market conditions.

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

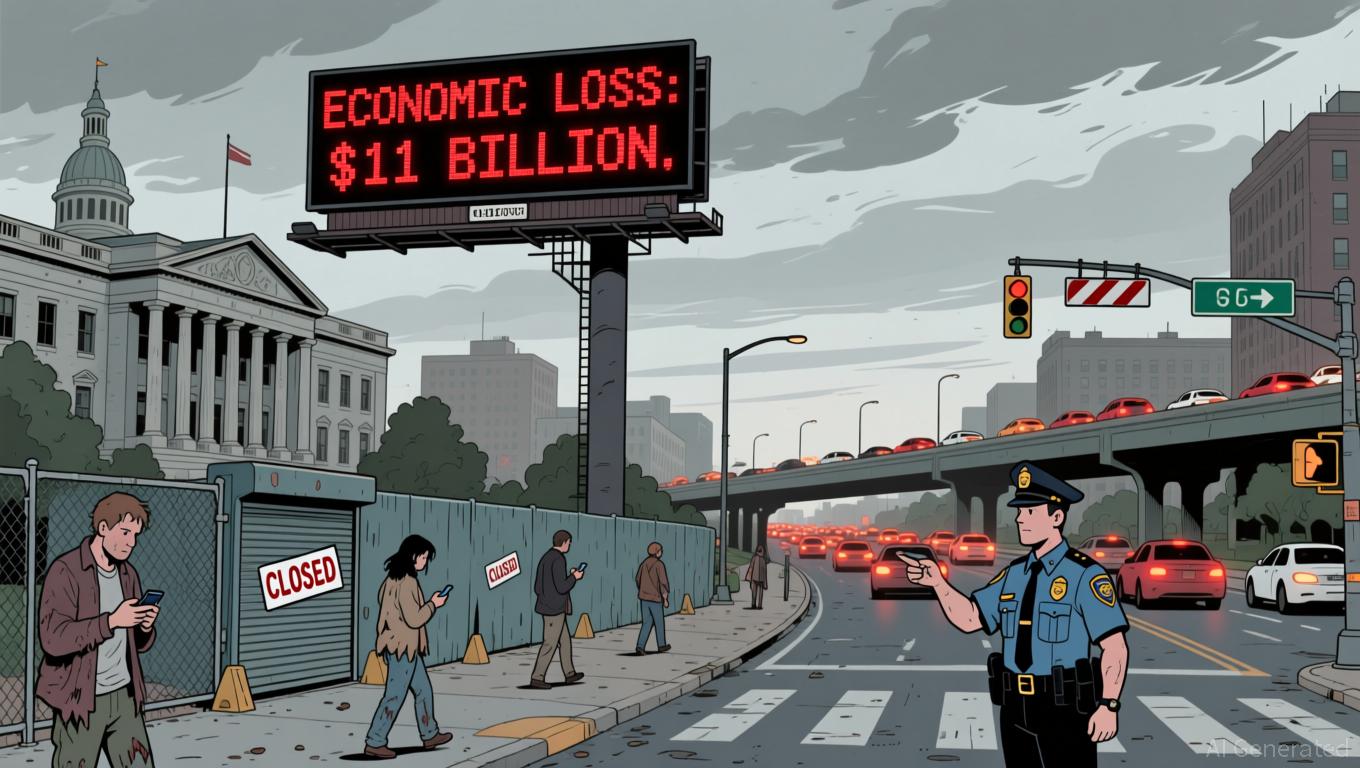

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest