BlackRock Bitcoin ETF Sees $135.4M Outflow This Month

BlackRock, one of the world’s largest asset managers, has seen its clients sell $135.4 million in its Bitcoin ETF. This is the highest outflow the fund has recorded this month. The sale highlights ongoing shifts in how investors are approaching Bitcoin and crypto-related products.

What This BlackRock Bitcoin ETF Sale Means

A Bitcoin ETF allows people to invest in Bitcoin without owning it directly. BlackRock’s ETF has attracted a lot of attention because of the company’s size and reputation. When clients sell shares, it can reflect caution, profit-taking, or changes in investment strategies.

This recent $135.4 million outflow is notable. It shows that even institutional investors are careful when investing in cryptocurrency. Analysts say such moves are normal in a volatile market like crypto. Some investors may be reallocating money into other assets or locking in gains.

Why Investors Are Selling

Volatility in the crypto market is a major reason for selling. Bitcoin’s price can rise and fall quickly. Some investors may feel it is the right time to secure profits. Others may be responding to economic news, interest rate changes, or regulatory updates that affect crypto markets.

Even with the outflow, BlackRock’s ETF still holds large amounts of assets. The firm’s strong reputation and risk management help maintain confidence among its investors. This shows that selling does not always mean panic; sometimes it is just normal portfolio adjustments.

Impact on the Crypto Market

Large movements in Bitcoin ETFs can influence market sentiment. Traders often watch ETF flows to gauge investor mood. While an ETF does not hold Bitcoin in the same way as a crypto wallet, buying or selling shares can affect perception in the market.

Some market watchers may see the $135.4 million sale as a sign of caution. Others see it as routine behavior as investors balance their portfolios. Either way, BlackRock’s Bitcoin ETF remains a key barometer of institutional interest in crypto.

What’s Next for Bitcoin ETF Investors

Investors and analysts will be paying attention to future ETF activity. Continued volatility or news affecting cryptocurrencies could trigger more inflows or outflows. Despite the sale, Bitcoin remains a popular and high-profile digital asset worldwide.

The $135.4 million outflow reminds everyone that investing in crypto is active and ongoing. Investors adjust their strategies regularly. At the same time, ETFs like BlackRock’s show that professional investors are taking a measured approach to digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin's Support for ZKsync and Its Influence on Layer 2 Scaling Technologies

- Vitalik Buterin's endorsement of ZKsync in November 2025 boosted its profile as a key Ethereum scaling solution with 15,000+ TPS and near-zero fees. - Institutional partnerships with Deutsche Bank and Sony , plus a 37.5M $ZK staking pilot, strengthened ZKsync's enterprise adoption and tokenomics. - The $0.74 token price surge and $15B capital inflow highlight market confidence in ZK-based infrastructure as Ethereum's primary scaling path. - Upcoming Fusaka upgrade (30,000 TPS) aims to challenge Arbitrum'

CyberCharge and SocialGrowAI Unite to Accelerate Web3 User Growth and Engagement

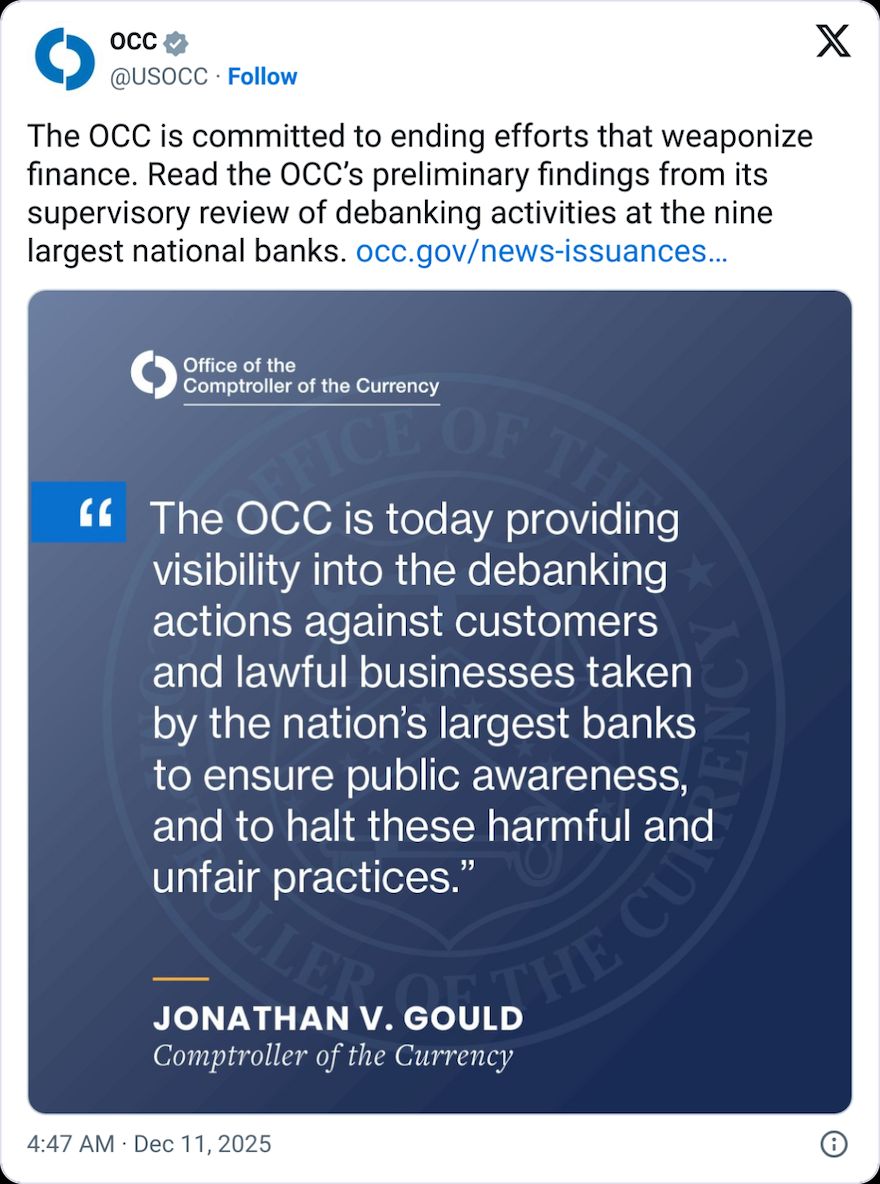

Crypto among sectors ‘debanked’ by 9 major banks: US regulator

Bitcoin Reverses From Channel Resistance as Whale Shorting Intensifies