Stable’s Infrastructure for On-Chain Stablecoin Payments Now Live

Stable announced the launch of the StableChain mainnet, built for stablecoin operations, and introduced the Stable Foundation along with the native token STABLE.

Stable officially activated StableChain, an L1 blockchain optimized for payments and financial transactions using stablecoins, primarily USDT. The Stable Foundation was established to oversee network development and protocol governance, and the utility token STABLE was unveiled.

The Stable Foundation will be responsible for expanding the StableChain ecosystem, supporting communities, distributing grants, driving educational initiatives, and contributing to protocol governance. The foundation is expected to play a key role in ensuring the network’s resilience and long-term growth.

STABLE is designed to secure the network and enable participation in protocol governance. Token holders will be able to vote on network development parameters and contribute to its decentralized security.

With the launch of the StableChain mainnet, the company aims to expand the use of stablecoins in payment infrastructure, enabling integration at both institutional and retail levels. According to Stable CEO Brian Mehler, the project is intended to become the foundation of a “real on-chain economy,” where fast and reliable digital payments are accessible to businesses and individual users alike.

In 2025, Stable raised $28 million in a seed round led by Bitfinex and Hack VC. The project’s advisors include Paolo Ardoino and several major crypto investors. The network already secured partnerships with PayPal, Anchorage Digital, and other financial institutions.

The launch follows a successful on-chain deposits campaign held before the mainnet release — over two phases, more than $2 billion was deposited to StableChain addresses by over 24,000 users. The scale of the deposits highlights strong demand for specialized stablecoin infrastructure.

StableChain was first announced in early July 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

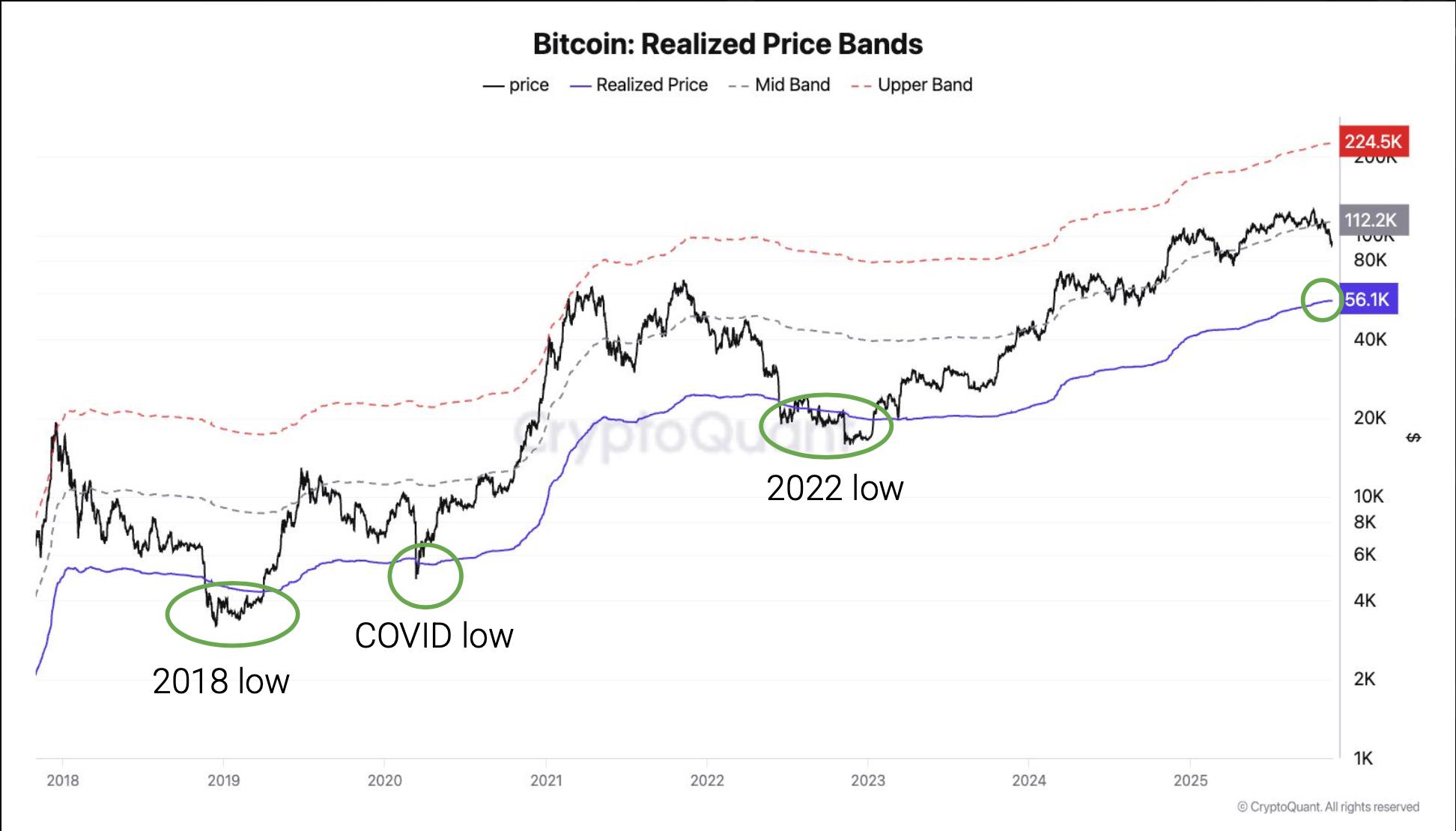

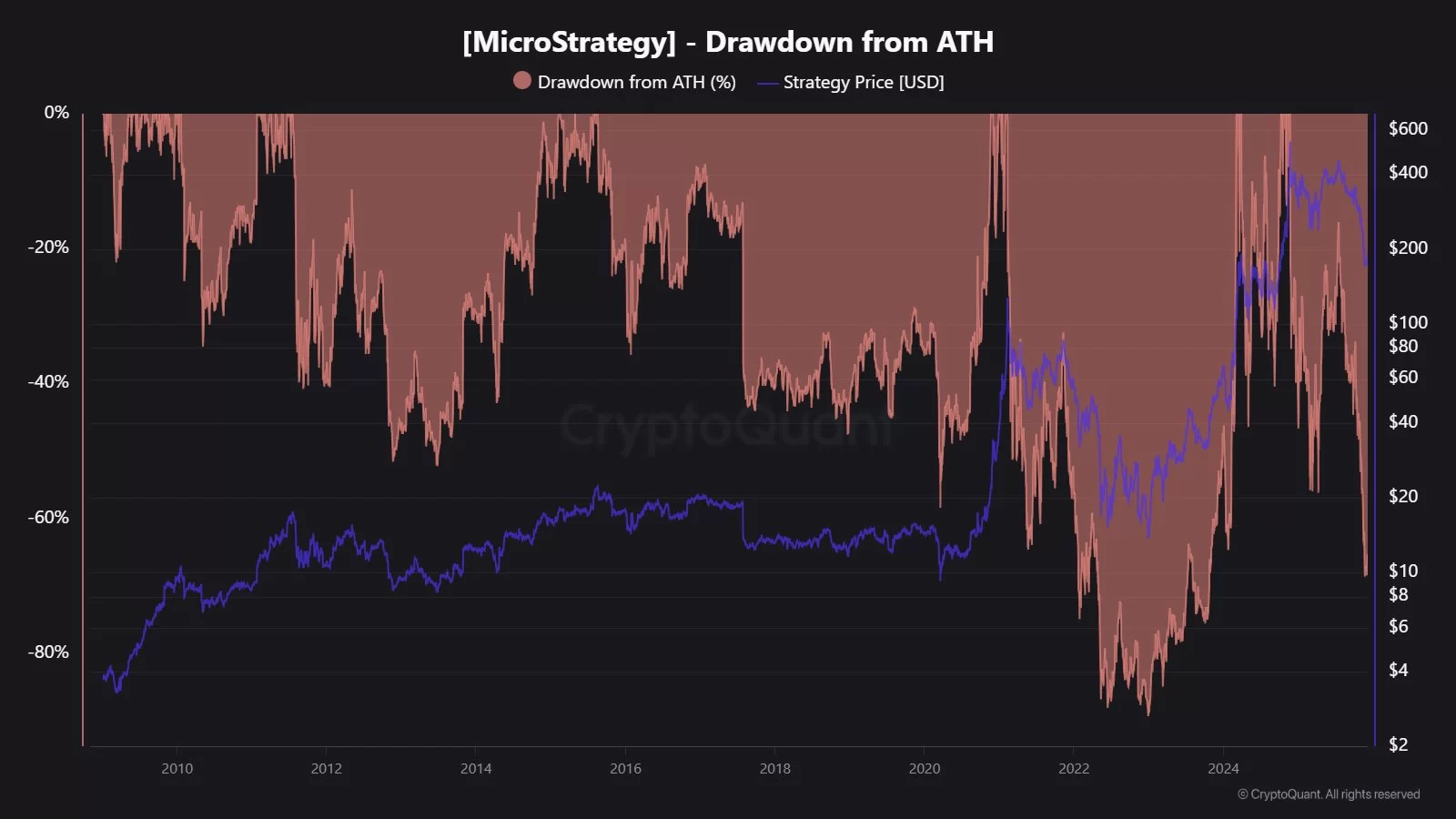

CryptoQuant says bear market has started, sees bitcoin downside risk to $70,000

Bitcoin Poised to Rise to $1.4 Million by 2035, Analysts Say—Or Much Higher

Cryptocurrencies Face Turbulent Times as Market Shifts Intensify

Crypto's Capitol Hill champion Sen. Lummis says she won't seek re-election