Ripple Expands Its Presence in European Payments Market

Ripple connected Swiss banking group AMINA Bank AG to its licensed solution for cross-border payments.

Ripple, a provider of digital infrastructure for financial institutions, announced a partnership with Swiss crypto bank AMINA Bank. The collaboration is aimed at reducing difficulties in accessing traditional banking infrastructure for the bank’s clients working with digital assets.

As part of the partnership, companies within the AMINA Bank AG group will use Ripple Payments, a cross-border payments solution that combines the use of digital payment tokens with a global payout network. The initiative is expected to enable faster and cheaper processing of international transfers and to increase the reliability of settlements using stablecoins.

The AMINA Bank AG banking group includes its headquarters in Switzerland, a branch in the Abu Dhabi Global Market (ADGM) free economic zone, AMINA Limited in Hong Kong, and the European entity AMINA EU. The group holds:

- a banking license and a securities dealer license from the Swiss Financial Market Supervisory Authority (FINMA);

- authorization to provide advisory, brokerage, and custody services to professional clients from the Financial Services Regulatory Authority (FSRA) of ADGM;

- a license for asset management and securities operations from the Hong Kong Securities and Futures Commission (SFC);

a pan-European crypto-asset service provider (CASP) license under the MiCA regulation from the Austrian Financial Market Authority (FMA), obtained in November 2025.

Myles Harrison, Chief Product Officer at AMINA Bank, noted that traditional correspondent networks fail to adequately support cross-border stablecoin transactions, while clients are looking for solutions that work with both fiat and digital assets. According to him, the partnership with Ripple will significantly expand these capabilities for the banking group.

According to Cassie Craddock, Managing Director of Ripple UK & Europe, the partnership with AMINA Bank is designed to help local financial institutions integrate digital assets into their existing infrastructure. She also added that the initiative significantly strengthens Ripple’s strategic presence in Europe and expands the use cases for the RLUSD stablecoin in custody and trading services regulated under MiCA.

According to the press release, the Ripple Payments service covers more than 90% of daily foreign exchange market volume and processes payments totaling over $95 billion. Ripple continues to actively expand its global footprint, having obtained licenses or entered into strategic partnerships in Singapore, the United States, South Africa, Bahrain, Spain, Dubai, and many other countries.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

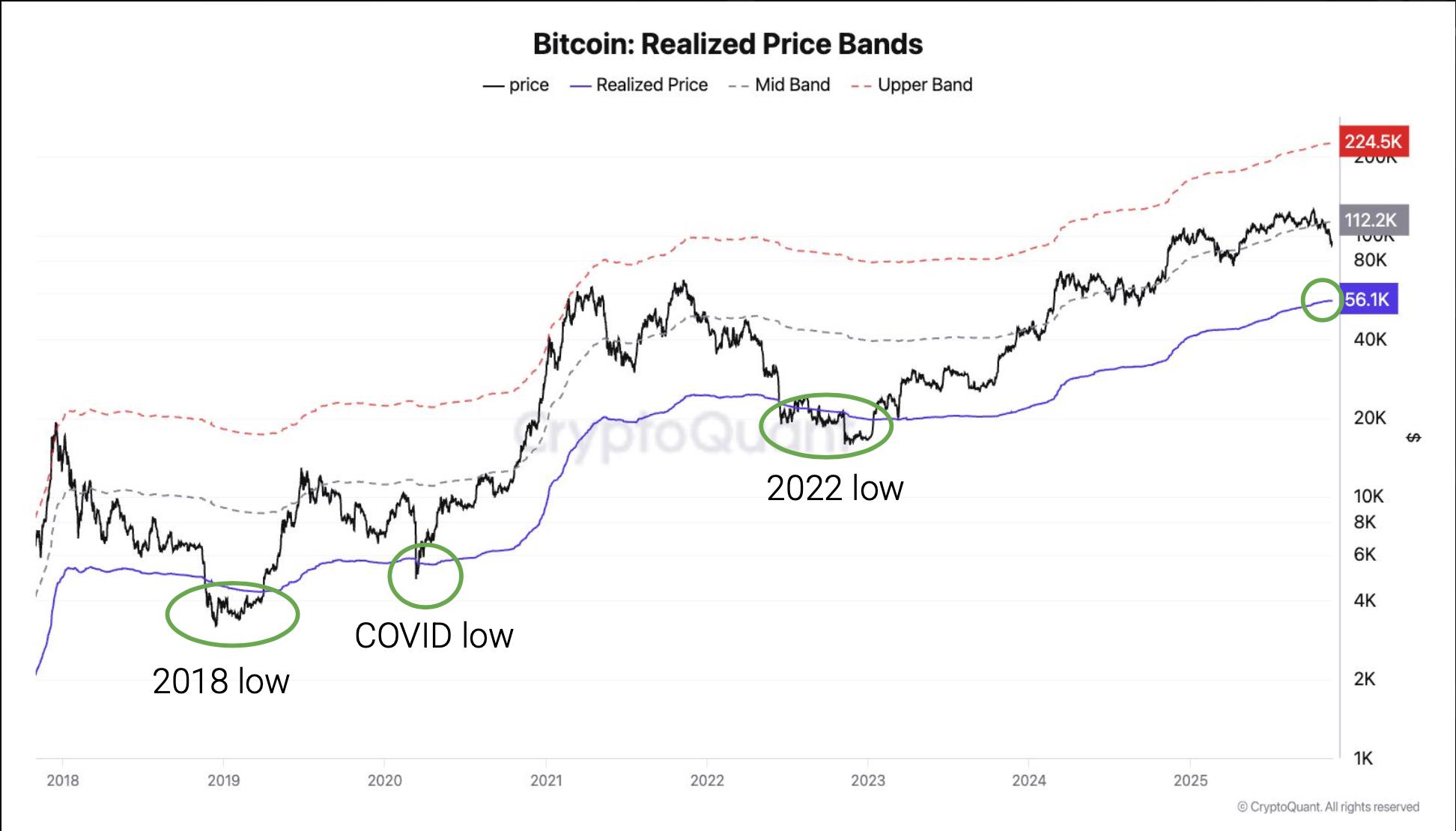

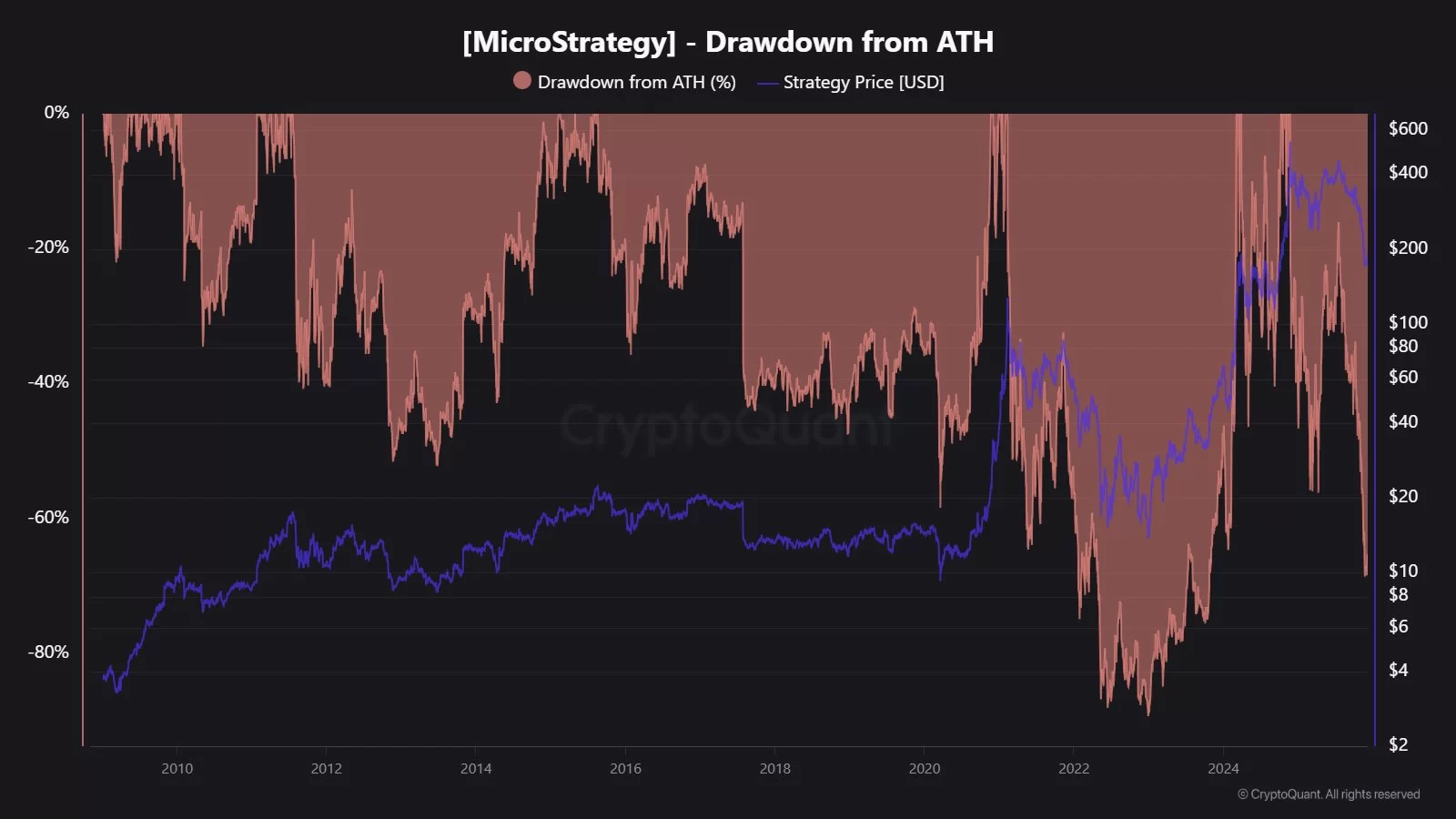

CryptoQuant says bear market has started, sees bitcoin downside risk to $70,000

Bitcoin Poised to Rise to $1.4 Million by 2035, Analysts Say—Or Much Higher

Cryptocurrencies Face Turbulent Times as Market Shifts Intensify

Crypto's Capitol Hill champion Sen. Lummis says she won't seek re-election