Bitcoin to Bottom Around October 2026 at $37,500, Based on 1064/364-Day Cycle Pattern

COINOTAG News, December 24 — In a Bitcoin cycle analysis by analyst @alicharts, the behavior across major phases shows a historically consistent rhythm of duration and depth. The data indicate an average 1,064 days from a market trough to the next peak, followed by roughly 364 days from peak to the next low, a cadence informing the crypto market outlook and risk models.

Applying the framework to the present cycle, the analyst suggests Bitcoin may be navigating a 364-day adjustment window, rather than a swift reversal. In this scenario, a potential bottom could emerge around October 2026 with an implied price near $37,500, contingent on sustained macro conditions and on-chain signals aligning with historical patterns.

Readers should view this as a pattern-based scenario rather than a guaranteed outcome. The takeaway for investors is to monitor corroborating signals from on-chain metrics, liquidity flows, and macro data, maintaining disciplined risk controls while awaiting confirmation if the cadence persists.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Memecoin Dominance Hits All-Time Lows: 5 High-Risk Coins That Could Lead the Next Speculative Rebound

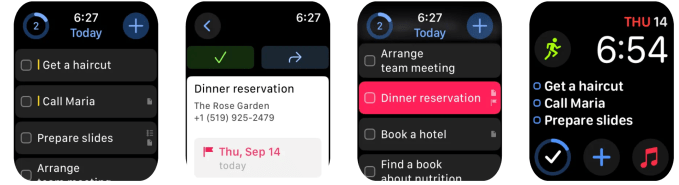

Best Apple Watch apps for boosting your productivity

What Does XRP Really Do? Expert Explains What It Is Built For

Bitcoin Hovering In A Descending Range, But Alts Are Quietly Gaining Momentum