Bitcoin Records Largest-Ever $23.6B Options Expiry, Max Pain at $96,000 Signals Upside

COINOTAG News, December 24, reports that Friday’s session will see roughly $23.6 billion in Bitcoin options expiring, the largest options expiry in BTC history. Market participants expect intense hedging activity that could influence BTC liquidity and short-term delta moves, as open interest compresses into the expiry window. The development highlights rising institutional engagement and a heightened sensitivity to macro cues in the crypto options market.

Analysts point to an upside skew in the options structure, with risk premium priced toward calls. The published data identify a maximum pain point near $96,000, a level that, if reached, could align with a constructive Bitcoin price outlook over the near term. Traders should monitor delta hedging flows and short-term volatility signals as the expiry unfolds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Memecoin Dominance Hits All-Time Lows: 5 High-Risk Coins That Could Lead the Next Speculative Rebound

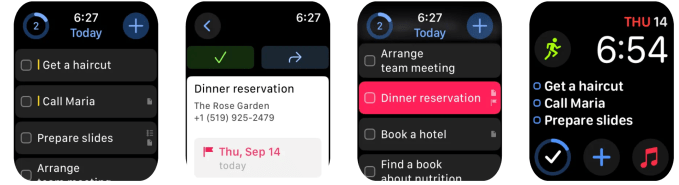

Best Apple Watch apps for boosting your productivity

What Does XRP Really Do? Expert Explains What It Is Built For

Bitcoin Hovering In A Descending Range, But Alts Are Quietly Gaining Momentum