Strategy (MSTR) CEO Says He’s Excited for 2026 Despite Bitcoin Market Downturn – Here’s Why

The CEO of the digital asset treasury company Strategy (MSTR) remains optimistic despite the firm’s massive losses after Bitcoin (BTC) plunged below $87,000.

Strategy invests heavily in BTC and is currently the world’s largest corporate holder of the crypto king.

The company’s shares dropped by 8.5% amid the dip in the crypto market.

In a new interview, Phong Le explains why he thinks Bitcoin will continue to bring in returns despite the current downturn.

“You have to take a step back with Bitcoin. It’s unique in that it’s a generational technology invention. It’s a macroeconomic innovation and it’s a capital markets breakthrough. That makes it a singular asset class. I don’t think people understand exactly what it means in the short term but they will figure it out over the long term.”

Le anticipates the coming year to be bullish for Bitcoin. He says the short term impacts of the benchmark cryptocurrency are just like those of other risk assets.

“Over the long term, if I look at 2026, I’m pretty excited. I think we’re going to see a more dovish Fed. I think we’re going to see more risk-on buying as we enter the midterm election period. I think bank adoption and state adoption is going to increase so I’m pretty excited about the long term.”

BTC is currently trading for

Featured Image: Shutterstock/Nikelser Kate/Quardia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Hovering In A Descending Range, But Alts Are Quietly Gaining Momentum

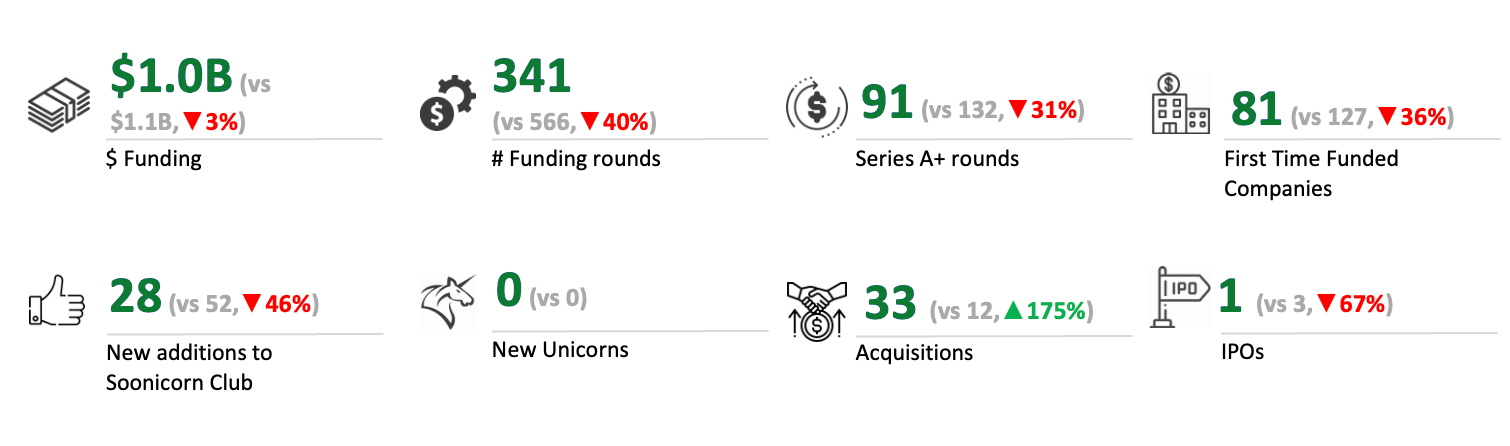

India startup funding hits $11B in 2025 as investors grow more selective

Trump Administration Brings Regulatory Clarity to U.S. Crypto Industry

Altcoins Flash Rare 2W Stoch RSI Buy Signal: 5 Coins Worth Trading as Historical Setups Point to 120% Upside