Is Web3 gaming dead? How can compliance revive true asset ownership?

Web3 games have long promised players “true ownership” of in-game assets. Players are told they can permanently control their items, tokens, and NFTs. But when a game shuts down, that ownership disappears as well. The issue doesn’t lie with shady teams behind these games, but rather with the law.

Once a game allows players to exchange real money for in-game assets, it’s no longer just entertainment. In the eyes of regulators, it becomes a financial service. Magnus Söderberg, CEO of Triolith Games, a company specializing in Web3 gaming compliance, says this fundamentally changes the rules of the game.

Debunking the Myth of Ownership

The mass shutdown of Web3 games in 2025 exposed the fragility of the “Play-to-Earn (P2E)” model and the illusion of digital ownership in blockchain gaming.

Sponsorship

According to DappRadar, in Q2 of 2025, at least 8% of active Web3 games shuttered, due to a 93% plunge in venture capital funding and deepening market saturation.

Web3 gaming was once heralded as the future of the gaming industry, with many outstanding Web3 titles emerging, such as… Tatsumeeko, Nyan Heroes, Blast Royale, and NBA star Stephen Curry’s Loud League going dark. Even Ember Sword, a large-scale MMORPG that raised over $200 million, abruptly shut down, wiping out the real-world value of its tokens and NFTs overnight.

Nyan Heroes’ NYAN token plummeted about 40% in a single day, with its market cap dropping 99% from its peak, highlighting a harsh reality: the promise of digital ownership is largely an illusion. Players holding tokens or NFTs found that their “assets” only exist as long as the game is live.

But behind these closures lies a bigger issue—regulatory barriers that few studios are willing to cross.

The Regulatory Trap

If a blockchain game truly puts assets on-chain, allowing players to mint NFTs, trade tokens, and freely withdraw, it ceases to be just a game and becomes a regulated financial platform—with compliance costs that are extremely high.

When Web3 gaming platforms offer fiat exchange, custodial services, or token-gated transactions, regulators classify them as financial service providers or Crypto Asset Service Providers (CASP).

This status triggers strict Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, including identity verification, transaction monitoring, secure asset custody, and consumer protection audit obligations.

In Europe, such platforms fall under MiCA rules; in the US, they are subject to the Financial Crimes Enforcement Network (FinCEN)’s Money Services Business (MSB) framework and state-level money transmitter licenses. Meeting these standards can cost millions of dollars, even before any participant goes live.

“Currently, compliance in the Web3 gaming sector is indeed poor. Few studios take compliance seriously, and this will come back to haunt them,” said Magnus Söderberg, CEO of Triolith Games.

Söderberg added that small studios are hit the hardest, as most cannot afford legal teams or the millions required for global, comprehensive launches. Once regulators begin enforcement, “We didn’t know” is not a valid excuse.

However, the consequences of non-compliant Web3 game operations extend far beyond the studios. Developers may face fines or delistings, but it’s the players who bear the brunt of trust-shattering outcomes such as failed tokenomics, internal allocations, and sudden sell-offs.

Söderberg believes that “stricter regulation may ultimately curb such behavior.”

The High Cost of Compliance

Building a fully compliant Web3 gaming platform is not only complex, but also extremely costly.

With MiCA licensing in Europe, approvals from multiple US states, and regulatory clearance in Asia and the Middle East, a global operator could easily spend $10–15 million just to obtain legal standing—long before any game development or player login.

For smaller Web3 studios, becoming a cross-jurisdictional financial operator is a daunting challenge. Many studios opt for the easier path: skipping CASP licensing and relying on Web3’s intrinsic features instead.

But Söderberg warns that the absence of regulation comes at a price.

“Small studios are hit the hardest, as most cannot afford legal teams or the millions required for a global rollout. Once regulators start enforcing, ‘We didn’t know’ isn’t a defense.”

For developers, the risks may mainly be fines or delistings, but for players, it’s worse: unregulated projects still use flawed tokenomic models, internal allocations, and dumping, all of which undermine trust. Söderberg thinks increased regulation could eventually curb such behavior.

The Road Ahead: Compliance-as-a-Service

But can the rigor of regulation be reconciled with the creativity of gaming? Some experts believe it’s possible. Licensed infrastructure may be the solution.

Instead of handling all financial operations like a bank, studios can outsource legal burdens to third-party compliance service providers.

“This means we handle the KYC/AML layer, asset custody, and even tokenomics setup—so developers don’t have to operate like a bank or exchange,” Söderberg explained.

According to him, compliance infrastructure providers ensure loot box systems aren’t lotteries, tokens pass legal reviews, and player wallets comply with reporting rules.

“This way, teams can focus on building great games instead of drowning in paperwork,” he said.

He explained that this system embeds compliance at the smart contract level, automatically verifying wallets, transaction limits, and regional restrictions before any on-chain operation occurs.

The goal is for players to be unaware of regulatory checks while developers comply with legal standards in real time, effectively baking compliance into game design instead of treating it as an afterthought.

“For players, it’s seamless—the gameplay remains smooth and fun. For developers, it means every on-chain action is legally checked in real time. This is compliance by design, not as a patchwork fix.”

Why This Matters

The collapse of Web3 gaming shows that without regulation, true digital ownership cannot be realized. As studios struggle with compliance costs and the line between gaming and finance continues to blur, only those able to adapt will survive the next wave of Web3.

Check out DailyCoin’s crypto gaming news coverage:

Keep Calm and Mine Crypto: A Match Made in Heaven?

Building Your Crypto Gaming Portfolio: A Gamer’s Guide

People Also Ask:

In theory, Web3 games promise to give players full control over their in-game assets via blockchain technology—which means items, tokens, or NFTs should completely belong to the player, not the developer. However, in practice, once a game shuts down or servers go offline, ownership often vanishes.

Most in-game assets depend on centralized servers or smart contracts controlled by developers. When a game ends or a contract fails, these NFTs or tokens lose their function and value, breaking the illusion of ownership.

Once a game allows players to exchange in-game assets for real money, it’s no longer just entertainment. Regulators classify it as a financial service, triggering compliance requirements such as KYC, AML, and licensing under regulations like the EU’s MiCA or the US’s FinCEN rules.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Bitcoin traders stay cautious despite global liquidity boom

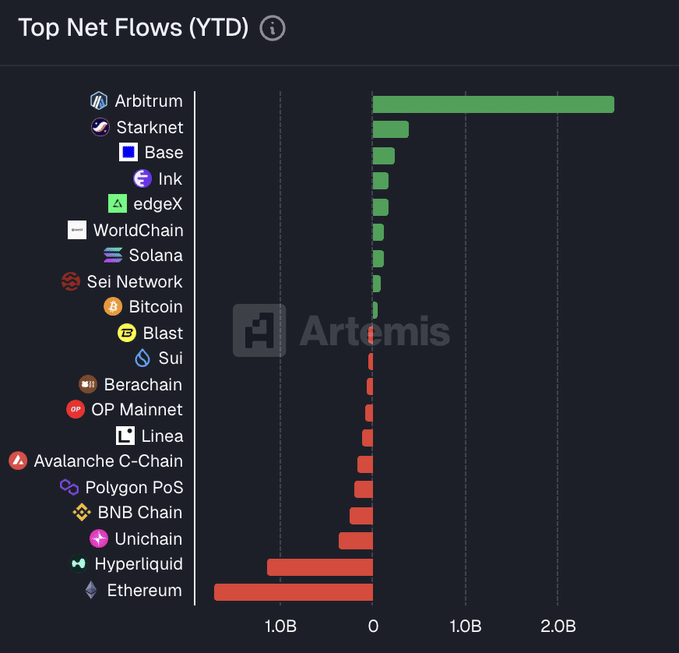

Arbitrum leads 2025 inflows, but ARB hesitates – What comes next in 2026?