As everyone gears up for the holiday season, Bitcoin remains under pressure, closing below the crucial $88,000 support level. As of the time of writing, approximately two hours remained before the U.S. markets opened, and weakness in the futures markets was increasing. Today is expected to be relatively calm, with no significant data releases on the horizon.

Bitcoin Struggles Below Key Support Level as Markets Await Stability

Current Market Conditions

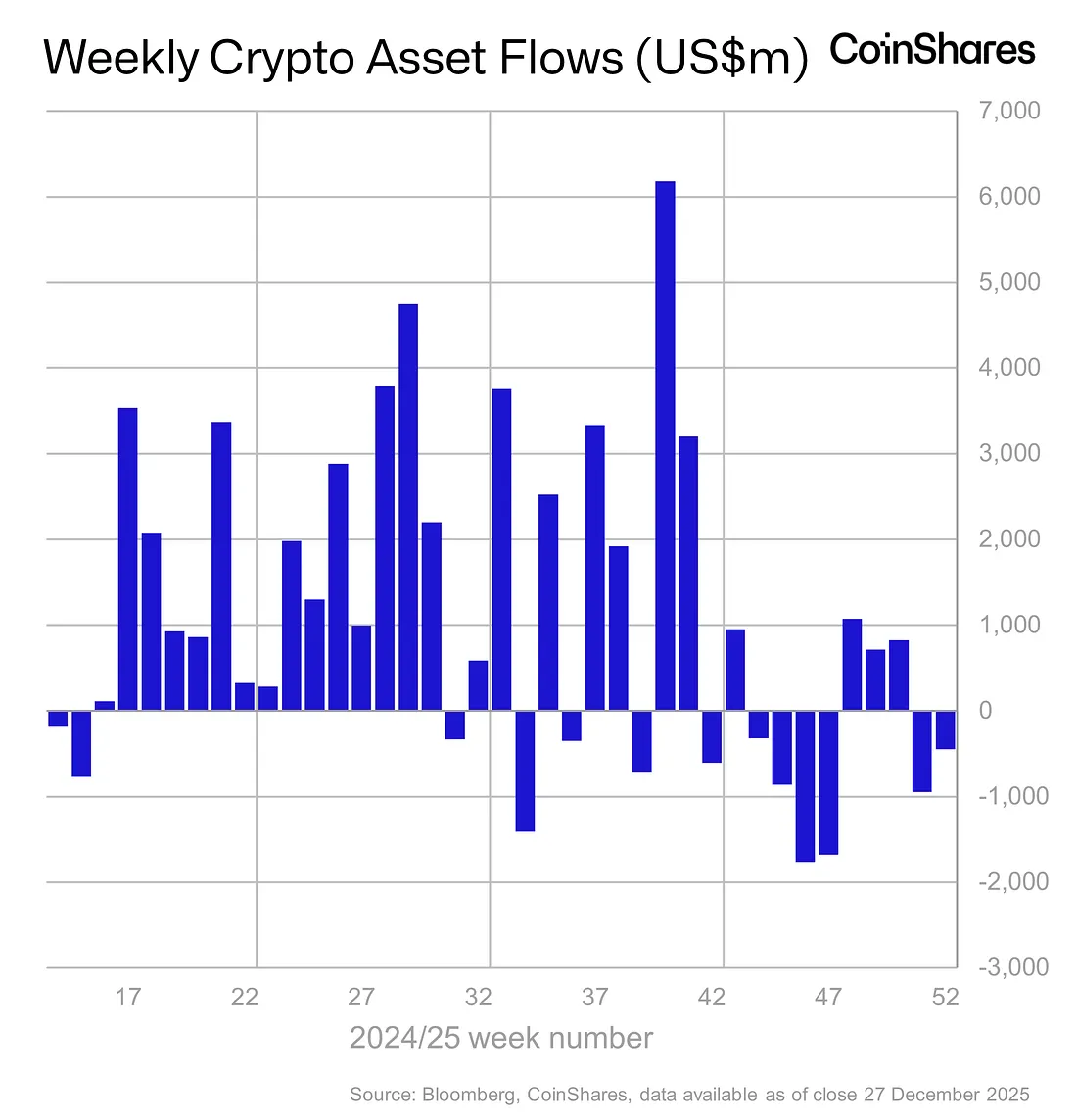

Approaching the end of 2025, investors have opted to reduce risks, with this trend particularly evident in the cryptocurrency market. Over the past two months, significant outflows, especially in altcoins, have been observed. Meanwhile, technology giants continue to influence U.S. stock indexes. Silver, after reaching a new record, is now undergoing a delayed correction, impacting other precious metals.

Futures for the S&P 500 remain in negative territory. In pre-market trading, Tesla and Nvidia have experienced losses of over 1%. While two of the top seven tech companies record losses, Nasdaq-100 futures continue to fall, down by 0.4%.

Peace negotiations between Ukraine and Russia have once again ended in failure. Despite recent face-to-face talks between Putin and Trump, negotiations remain stalled, pointing to ongoing regional tensions.

Due to supply issues and speculative trading, silver quickly reached $80 but has since plummeted over 5%, trading at $75. Gold fell by 1%, and copper trades at $13,000 per ton. Ongoing tension in Venezuela and U.S. bombings in Nigeria suggest that corrections in precious metals may be temporary. Silver stock levels approach record lows, indicating potential continued speculative moves next year.

China’s announcement to support economic growth in 2026 has helped stabilize oil prices slightly. Although oil prices have declined for over two years, the trend has not completely reversed, aiding efforts to combat inflation.

Cryptocurrency Market Update

In the last six business days, BTC ETFs have experienced steady net outflows. Friday’s outflows peaked at $275 million, the highest since December 16th. Ethereum ETFs also continued sales, with nearly $39 million in net outflows on Friday, bringing the spot price below $3,000. The total market value of cryptocurrencies remains below the psychological support level of $3 trillion.

Although BEAT has emerged as the top gainer among the 100 largest cryptocurrencies, most altcoins suffer losses. BEAT itself recorded a 35% weekly loss. The fear index stands at 30, with $86,000 being the key level to watch for BTC today. Should BTC close below this level, we may witness a new low extending to $80,500.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ubisoft Shuts Down Rainbow Six Siege Servers After Hackers Inject 2 Billion Credits Per Player

Tom Lee's Bitmine adds 44,463 ETH and starts staking as treasury tops 3.4% of supply

Digital Asset Funds See Mixed Flows Amid Ongoing Market Caution

Strategy Adds 1,229 BTC as Schiff Questions Funding Source