ALT5 Sigma Faces Auditor Controversy Amid Nasdaq Delisting Risk

Quick Breakdown

- ALT5 Sigma’s new audit firm cannot legally perform audit work because its firm license has expired.

- The auditor has a history of fines and missed regulatory deadlines.

- Delayed filings, board resignations, and governance gaps threaten the company’s Nasdaq listing.

A Trump-family-linked crypto firm, ALT5 Sigma, is facing fresh scrutiny after an investigation found that its newly appointed auditor lacks an active license, further compounding concerns about delayed financial reporting and governance lapses.

Auditor switch raises regulatory red flags

Nasdaq-listed ALT5 Sigma, which has ties to World Liberty Financial, a crypto venture backed by the Trump family, recently changed auditors after failing to file its quarterly financial results on time.

Trump-Linked Crypto Firm ALT5 Sigma Faces Auditor Scandal

A Nasdaq-listed firm backed by Trump’s World Liberty Financial has switched to an auditor with an expired license since August, who has a history of regulatory fines and violations.#TrumpCrypto #ALT5Sigma #CryptoScandal pic.twitter.com/681VJB4I3L

— AIW_Visuals (@AIW_Visuals) December 29, 2025

The new auditor, Victor Mokuolu CPA PLLC, is a little-known Texas-based accounting firm that is currently operating without an active firm license, according to state filings cited by the Financial Times. The firm’s license reportedly expired in August and remained inactive as of December 26, barring it from issuing audit opinions under Texas regulations.

While the firm’s founder, Victor Mokuolu, renewed his personal CPA license on August 31, the company’s registration has not yet been reinstated. ALT5 Sigma confirmed that no audits or financial reviews will be issued until the firm’s license is reactivated, adding that the auditor is undergoing a peer review expected to conclude by the end of January.

History of compliance issues

Regulatory concerns surrounding the audit firm extend beyond the expired license. The firm has previously failed peer review inspections and has been penalized by multiple regulators.

In 2023, the Public Company Accounting Oversight Board fined the firm for failing to notify regulators about six public company audits within the required deadlines. Additional penalties were imposed by the Texas State Board of Accountancy in 2024 over similar lapses, according to the report.

The company’s financial reporting under strain

ALT5 Sigma, which has pivoted from appliance recycling to biotech and later fintech, has struggled with transparency since

The company has yet to file its quarterly results for the period ended September, putting it at risk of delisting from Nasdaq. Its shares have

Further complicating matters, board member David Danziger has resigned, leaving the company out of compliance with Nasdaq rules requiring an audit committee with adequate staffing and sufficient accounting expertise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tom Lee's Bitmine adds 44,463 ETH and starts staking as treasury tops 3.4% of supply

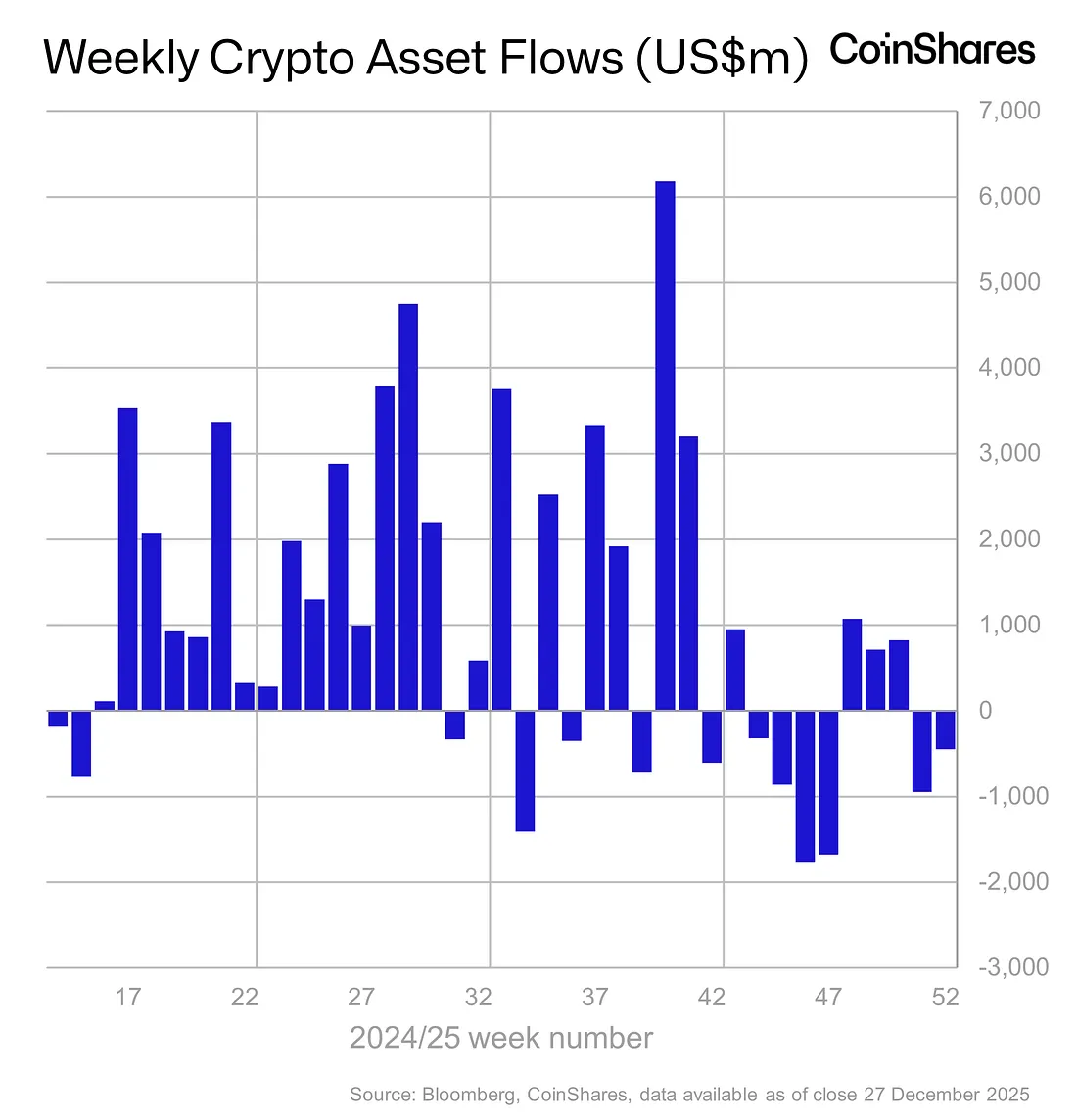

Digital Asset Funds See Mixed Flows Amid Ongoing Market Caution

Strategy Adds 1,229 BTC as Schiff Questions Funding Source

Cango Secures $10.5M Equity Investment as Bitcoin Mining and AI Strategy Expands