For months, investors engaged in high-leverage derivative transactions have become victims of high volatility in both directions. However, short position holders were lured by hopes of greater profits, while those with long positions, believing a bottom reversal had occurred, faced the greatest losses. What conditions must be adapted to in the cryptocurrency market?

Navigate Cryptocurrency Waves: Capturing Opportunities While Others Drift

Declining Bitcoin Demand

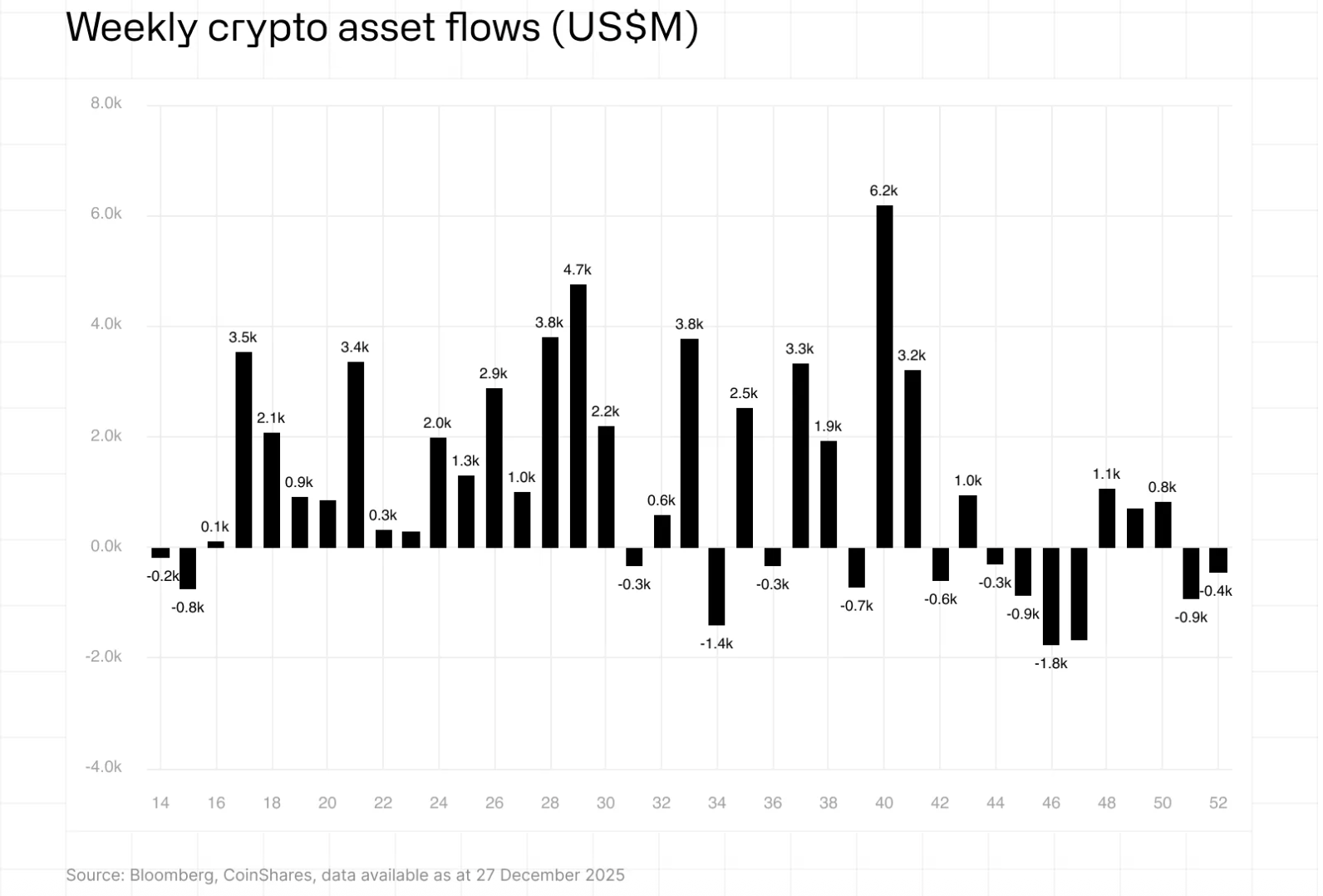

Interest in ETFs has waned, and there have been consistent net outflows for a long time. Annually, the closures are significantly lower than the total 2024 entries. Since October, visible demand for Bitcoin has been very weak, hitting a historic low at a negative level. The Capriole Investment demand metric showed a sharp decline in demand over the past two weeks, registering -3,491 BTC on Monday.

Such weakness hadn’t been observed since October 21st. Concerns about the year’s end and January significantly dampened interest. Although demand was declining, it remained positive until November 6th, maintaining some interest despite the downturn.

Cryptocurrency Strategy

In such conditions, following the crowd wisely might be the key to profit. For instance, the Coinbase Premium Index sharply declined over the past two weeks. While it was above zero on December 11, it has now dropped to negative values. The disinterest of U.S. retail investors stems from perceiving each rise as a selling opportunity. Investors who shadow them viewed every increase as a chance for short selling, profiting for months.

Concurrently, those hoping for a bounce and attempting to capitalize on an upturn from the bottom seemed to suffer continuously. In a recent evaluation, Mv_Crypto noted that the “Coinbase BTC Premium refuses to reverse. It’s still showing dark red bars, indicating that selling pressure in the U.S. hasn’t eased. Every rise is being sold off. Until this metric improves, caution is advised when approaching long positions. Don’t fight the wind.”

Under current conditions, leveraging the wind might mean opting for short-term positions. Short-term trades have become profitable for those aiming for modest gains and staying true to their strategies, particularly amidst a decline. While an uptrend will inevitably begin, capturing the absolute bottom or top is akin to throwing dice. If determined to position for an upswing, convincing movements are necessary.

The consistent positive trend in the Coinbase premium index, a definitive break of the 98,000-dollar resistance, confirmations of upward shifts in news, and volume increases can help capture price increases at an early stage, especially in altcoins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid Labs set for first HYPE token payout as 1.2 million tokens unstake

2025’s Crypto Winners: Here Are the Coins that Rallied the Most

2025 was the year AI got a vibe check

XRP funds up despite crypto ETPs posting $446 million in weekly outflows: CoinShares