News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

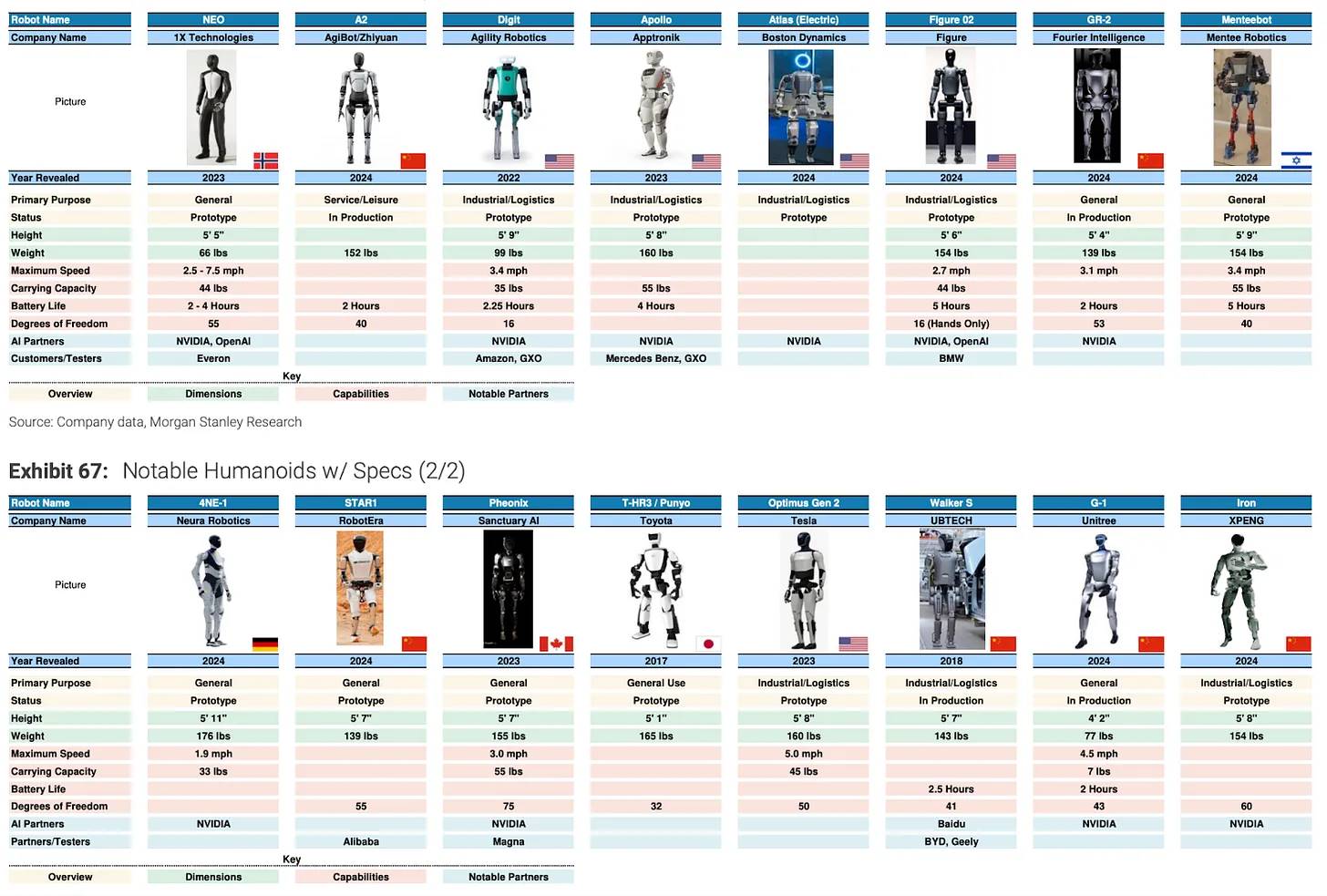

Embodied intelligence x Web3: Structurally driven solutions create investable opportunities.

The goal of transforming traditional finance with Ethereum does not necessarily have to be achieved through DeFi.

Tether and Circle have minted $12 billion in stablecoins over the past month; Figma holds $90.8 million in spot bitcoin ETFs; Russia plans to lower the entry threshold for crypto trading; Ethereum ICO participants have staked 150,000 ETH; REX-Osprey may launch a DOGE spot ETF. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

U.S. non-farm payroll data for August fell far short of expectations, with the unemployment rate hitting a new high. Market expectations for a Federal Reserve rate cut in September have risen significantly, causing sharp volatility in the cryptocurrency market. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Sei once surpassed Solana in active users. By leveraging EVM compatibility and a high-performance architecture, Sei is propelling itself onto a new growth trajectory and becoming a focal point in the industry narrative.

- 01:07Weak non-farm data intensifies expectations for a Fed rate cut in SeptemberChainCatcher news, according to Golden Ten Data, after the downward revision of the US non-farm payroll data for July, the newly added non-farm payroll data for August once again fell significantly short of expectations. The JOLTS and ADP employment data released earlier this week also showed weakness, and overseas markets expect the BLS to make a substantial downward revision to the benchmark non-farm data, which has basically established the expectation of a Federal Reserve rate cut in September. After the data was released, the yield on the 2-year US Treasury fell by about 11 basis points, the US dollar index weakened, and the pressure from a cooling economic fundamental led to an adjustment in US stocks.

- 01:07WLFI: Blacklisting 272 addresses is to protect users' asset security; we never proactively seek to ban any accounts.On September 6, the official social media account of the Trump family crypto project, World LibertyFi, posted that their team has noticed the community's concerns regarding the recent wallet blacklist. The primary principle is transparency, meaning WLFI only intervenes to protect users and never interferes with normal activities. In the past few days, a total of 272 wallets have been blacklisted, which accounts for only a very small portion of the total holders. This action is purely a temporary measure taken to prevent harm during the investigation and to assist affected users. Among these 272 addresses: · 215 (about 79.0%) are related to phishing attacks—the team proactively intervened to prevent hackers from transferring funds and is working with legitimate owners to secure/transfer assets. · 50 (about 18.4%) were reported stolen by owners through support channels, and the team implemented blacklist protection upon request. The WLFI team never proactively seeks to ban any accounts and only takes action when malicious or high-risk activities that may harm community members are detected. User safety is above all else. The team will never ban accounts for normal market participation.

- 00:47WLFI: 272 wallets have been blacklisted, and the freeze is to prevent user lossesChainCatcher reported that WLFI stated on the X platform that it is aware of the community's concerns regarding the recent wallet blacklist. WLFI emphasized that it will never suppress normal activities. In the past few days, 272 wallets have been blacklisted. This accounts for only a small portion of the total number of holders. The move is purely to prevent user losses, and investigations are underway to assist affected users. The breakdown of these 272 wallets is as follows: 215 cases (about 79%) are related to phishing attacks: the team has intervened to prevent hackers from stealing funds and is working with legitimate owners to protect/transfer assets. 50 cases (about 18.4%) involved owners reporting violations; at their request, these addresses were blacklisted to help protect/recover funds. 5 cases (about 1.8%) were marked as high-risk exposure (security risks are under review). 1 case (about 0.4%) is suspected of misappropriating funds from other holders; a comprehensive internal review is underway. WLFI stated that it will not block normal trading activities. When alerts of malicious or high-risk activities that may endanger community members are received, immediate action will be taken. The follow-up measures are as follows: continue to work with legitimate owners to verify control and ensure fund security. After the review is completed, clear results for each category will be announced. Any broader actions affecting holders will be publicly disclosed. .