News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Palantir's stock forms a bear flag pattern, signaling potential decline to $130–$135. - Analysts and traders debate technical signals, with conflicting bullish and bearish forecasts. - Mixed fundamentals and market sentiment highlight risks and opportunities for investors.

- The reflection effect in behavioral economics drives platinum's volatility, with investors shifting between risk-averse and risk-seeking behaviors during gains and losses. - 2020-2021 saw profit-taking amid gains, while 2022-2023 triggered speculative bets as platinum's gold-to-platinum ratio inverted and supply deficits widened. - A 2024 study highlights the gold-to-platinum ratio as a behavioral barometer, predicting market imbalances and bubble risks through investor sentiment shifts. - Strategic posi

- Solana's community approved the Alpenglow upgrade, replacing Proof-of-History with Votor-Rotor to boost speed and resilience. - The upgrade cuts block finality time to 150ms, matching traditional payment networks while maintaining security against adversarial validators. - A 1.6 SOL epoch fee and reduced transaction costs (<$0.0003) aim to attract DeFi and gaming apps, with SOL price rising to $208.24 post-approval. - The 10.6% validator support and institutional optimism highlight Solana's push for ente

- Bank of China (Hong Kong) plans to apply for a stablecoin issuer license under Hong Kong's new regulatory framework, with applications due by September 2025. - The framework requires HK$25 million minimum capital and 100% asset backing for fiat-pegged stablecoins, excluding CBDCs and bank deposits. - Hong Kong's strict rules aim to position the city as a global digital finance hub for cross-border RMB transactions while addressing fraud risks through licensing. - Market reactions include BitMart withdraw

- GHST surged 68.65% in 24 hours to $0.434, reversing a 5744.68% annual decline. - Analysts warn of a deeply bearish long-term outlook despite short-term volatility. - Retail/algorithmic traders drove the rally, but lack of institutional activity complicates sustainability. - Technical indicators highlight extreme volatility, with no clear baseline established for price stability.

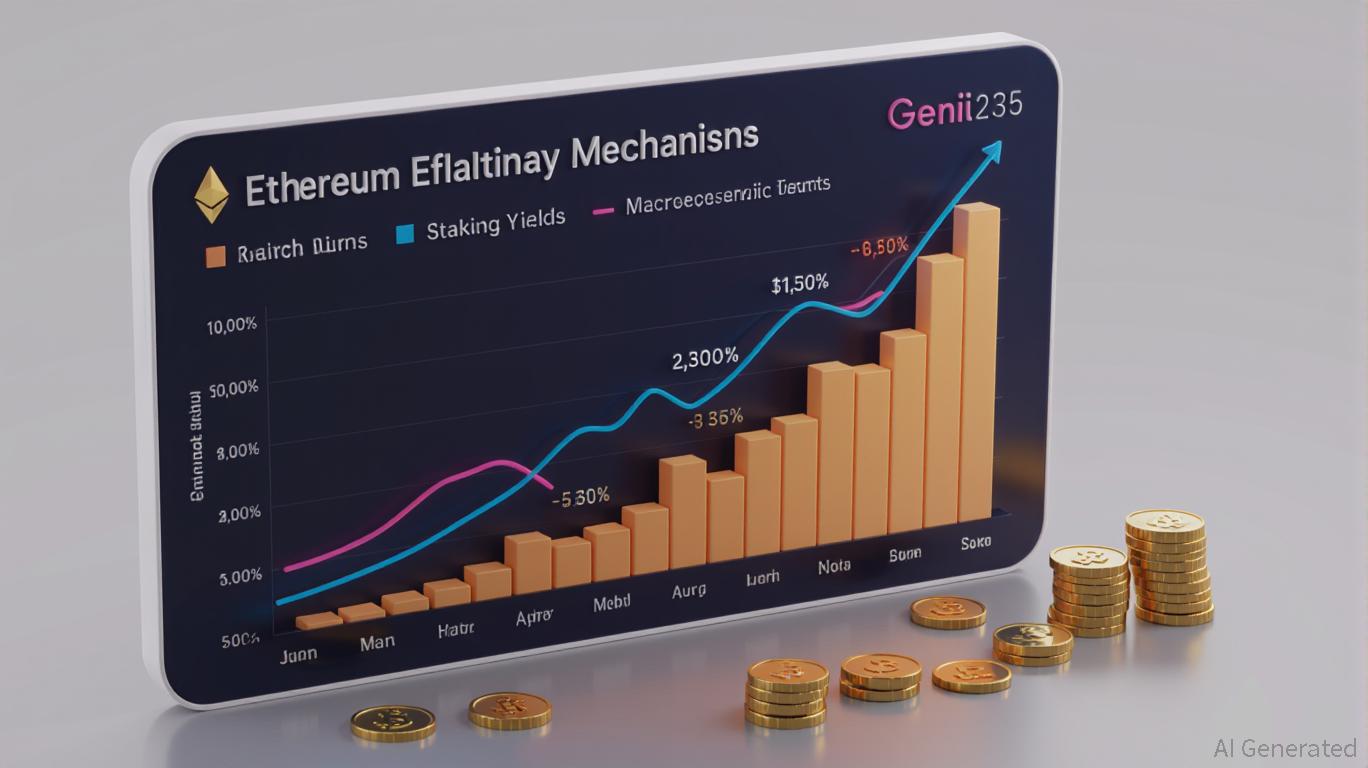

- Ethereum introduces BETH, a proof-of-burn token representing permanently destroyed ETH, enhancing transparency and value capture in its deflationary strategy. - BETH tokenizes burned ETH as a tradable asset, enabling scarcity tracking and new financial instruments like BETH-backed stablecoins or derivatives. - Institutional adoption and regulatory frameworks (e.g., U.S. GENIUS Act, EU MiCA) have normalized crypto assets, with Ethereum's supply contraction mechanisms (EIP-1559, staking) accelerating defla

- Mutuum Finance (MUTM) emerges as a high-yield altcoin with a 2500% projected upside, driven by its hybrid P2C/P2P lending model and deflationary tokenomics. - MUTM's $0.035 presale price contrasts with Ethereum's $4,400–$8,500 range and Arbitrum's $0.426 price, leveraging Ethereum's infrastructure while avoiding scalability bottlenecks. - A USD-pegged stablecoin and 95.0 CertiK audit score address DeFi's volatility and security risks, positioning MUTM to capture 70% of DeFi transactions by 2026. - While

- Ripple’s XRP and RLUSD redefine institutional-grade financial infrastructure in 2025, combining high-speed liquidity with USD-pegged compliance. - XRP’s ODL processed $1.3T in Q2 2025, cutting costs by 90% for institutions like Santander via sub-5-second settlements. - SEC’s 2025 commodity reclassification of XRP spurred $1.2B ETF inflows and $17M institutional allocations, targeting 14% SWIFT volume capture. - RLUSD’s $687M market cap and DeFi integration (e.g., Aave’s Horizon RWA Market) enable 24/7 in

- 01:27A smart money address closed $53 million in short positions on SOL and ETH and switched to going long on ETH.According to Jinse Finance, monitored by Lookonchain, a smart money address closed short positions in cryptocurrencies worth approximately $53.13 million within the past 3 hours, including $17.68 million in SOL and $35.45 million in ETH shorts, realizing a profit of about $1.06 million. Subsequently, the address switched to a long position, opening a long position of 6,590 ETH (approximately $28.9 million) with 20x leverage.

- 01:12On-chain video platform Everlyn has raised a total of $15 million in funding.Foresight News reported that the on-chain video platform Everlyn announced on Twitter that Sui blockchain development team Mysten Labs will join as a new investor in its $250 million valuation round. Other investors in this round include Baseline (Emirates), Selini Capital, NESA, Aethir Cloud, ionet, MH Ventures, as well as leadership from Kling AI, Google, Amazon, Meta, and others. In addition, Everlyn has raised a total of $15 million in funding to date.

- 01:12WLFI-related address transfers 10 WLFI cross-chain to BSC network via Chainlink CCIPForesight News reported that, according to monitoring by @ai_9684xtpa, a WLFI-related address transferred 10 WLFI cross-chain to the BSC network via Chainlink CCIP 45 minutes ago. This transaction is currently still in the "waiting for manual execution" status.