News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Federal Reserve Payments Conference May Accelerate RWA Tokenization as Ethereum Remains Dominant Onchain2Satoshi-era Bitcoin Wallet Appears Active After Decade as $328M Flows Into Spot Bitcoin ETFs3Ether whales have added 14% more coins since April price lows

Asia Bitcoin Summit: Eric Trump on Crypto and Freedom

coinfomania·2025/09/04 20:15

Trump-backed American Bitcoin Surges 60% in Nasdaq Debut

coinfomania·2025/09/04 20:15

Smarter Web Company Signs New 21M Share Subscription Agreement

coinfomania·2025/09/04 20:15

SEC Reviews Quantum Proof Plan For Bitcoin And Ethereum

coinfomania·2025/09/04 20:15

XRP Ledger’s Carbon Footprint Matches One Flight

Coinlive·2025/09/04 19:55

Ripple’s XRP Reaches Crucial Support Amid Price Uncertainty

Coinlive·2025/09/04 19:55

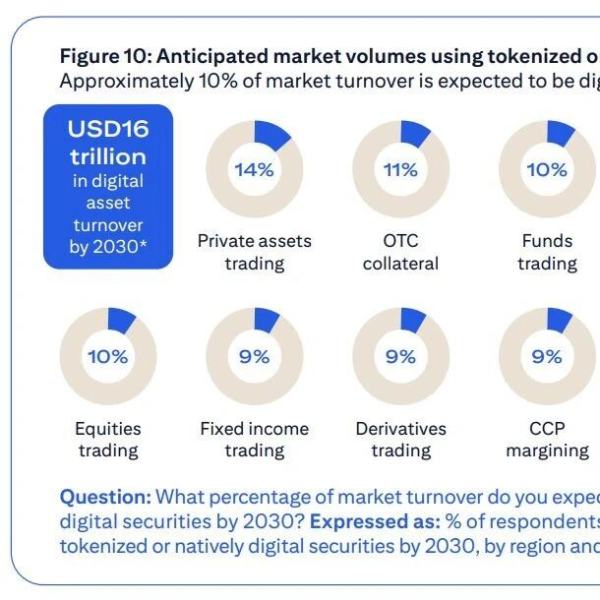

Citi survey: Cryptocurrency expected to account for one-tenth of the post-trade market by 2030

According to Citibank's latest "Securities Services Evolution Report," a survey of 537 global financial executives shows that by 2030, approximately 10% of global post-trade market volume is expected to be processed through digital assets such as stablecoins and tokenized securities.

Techub News·2025/09/04 19:46

Texas Instruments: Signs of Slowdown After Tariff-Driven Surge in Demand

新浪财经·2025/09/04 19:14

Complacent tech investors face a reality check

新浪财经·2025/09/04 19:14

Flash

- 21:13Plural raises $7.13 million in seed funding led by ParadigmJinse Finance reported that energy asset management platform Plural has announced the completion of an oversubscribed $7.13 million seed round led by Paradigm, with participation from Maven11, Volt Capital, and Neoclassic Capital, bringing the company's total funding close to $10 million. Plural is committed to bringing high-yield energy assets such as distributed photovoltaics, battery storage, and data centers on-chain through tokenization and smart contracts, enabling institutional investors to efficiently participate in this sector that is traditionally difficult to finance.

- 20:33Bank of America: Serious Internal Disagreements May Emerge at the Fed's September MeetingJinse Finance reported that Bank of America expects significant internal divisions in the Federal Reserve's interest rate decision in September. Dovish members such as Waller, Bowman, Daly, and Milan, who is likely to be confirmed as a board nominee, may push for further rate cuts, while hawkish members such as Harker, Bostic, Musalem, and Schmid emphasize inflation risks. Even if there is a 25 basis point rate cut at the September meeting, there may still be dissenting votes in both directions within the committee.

- 20:08All three major U.S. stock indexes closed higher.Jinse Finance reported that all three major U.S. stock indexes closed higher, with the Dow Jones Industrial Average up 0.77%, the S&P 500 up 0.83%, and the Nasdaq Composite up 0.98%. Chip stocks strengthened, with Western Digital rising over 5% and Micron Technology up more than 4%. Major tech stocks also performed strongly, with Amazon rising over 4%, marking its largest increase since May.