News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

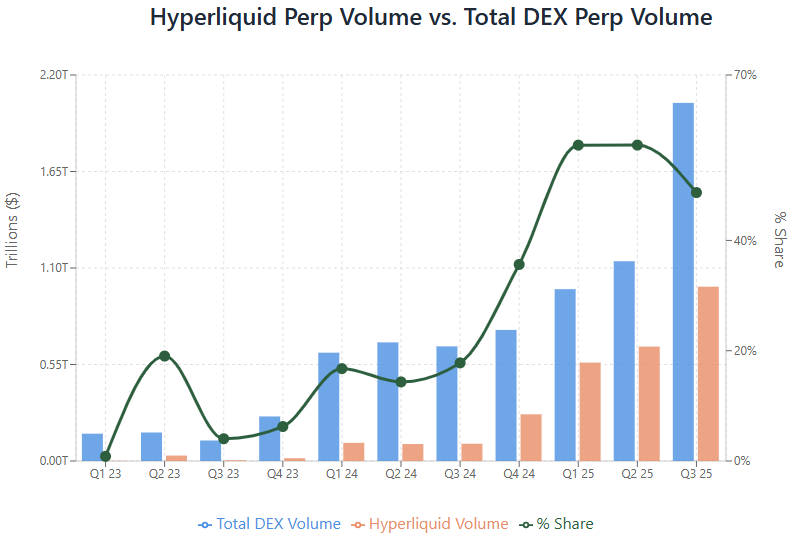

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.

The US and UK have jointly taken action against one of the largest investment fraud networks in history, seizing a record amount of funds.

On the surface, it is a DEX, but in reality, 40% of the initial supply will be used to fund public goods.

You can say it doesn't understand mining, but never say it doesn't understand gaming.

Where does the next opportunity lie?

- 07:34A newly created wallet deposited $9 million into HyperLiquid to open a 3x leveraged long position on Ethereum.According to Jinse Finance, Onchain Lens monitoring shows that a newly created wallet withdrew 10 million USDC from an exchange, deposited 9 million USD into the HyperLiquid platform, opened a 3x leveraged long position on Ethereum (ETH), and purchased 3 million USD worth of XPL tokens on the spot market through a time-weighted average price (TWAP) order.

- 07:34ZachXBT: Over 75% of Garden Finance's total transaction volume from April to July came from stolen fundsJinse Finance reported that ZachXBT posted on the X platform, saying, "I'm tired of on-chain technologies that mainly profit from illegal activities, where their teams charge fees but take no responsibility. If they can't establish mechanisms to prevent illegal activities, they should at least refund the fees. For example: From April to July 2025, over 75% of Garden Finance's total transaction volume came from stolen funds, and they profited hundreds of thousands of dollars from these fund flows (I stopped monitoring the flow of funds after July)."

- 07:33Analysis: The US government may have orchestrated the theft of LuBian mining pool; if true, it would make the US government the largest financial hacker in historyAccording to ChainCatcher, on-chain detective ZachXBT analyzed that documents released by the U.S. government show that wallet addresses listed among the $14 billion (127,000 BTC) seized had previously been named in the Milky Sad report about two years ago, which stated that their private keys were vulnerable. Now, the U.S. government claims to have custody of these wallet addresses. In response, Arkham analyst Emmett Gallic stated after research, "At present, it seems increasingly likely that the U.S. government was behind the theft from the LuBian mining pool. If true, the U.S. government would be the largest financial hacker in history." Although there is still no conclusive evidence to confirm this, Emmett Gallic believes that the future movements of the "LuBian hacker" addresses tagged on Arkham will be sufficient as a basis for judgment. Previous reports stated that LuBian, once among the world's top ten mining pools, suffered a major security incident in December 2020, with a total of 127,426 BTC stolen, making it the largest bitcoin theft in history. The 127,000 BTC seized by the U.S. government yesterday originated from these funds.

![[Bitpush Daily News Highlights] The US plans to confiscate 127,000 BTC, potentially increasing its bitcoin holdings to 324,000 BTC; Powell hints at possible rate cuts due to weak hiring and rising unemployment; Japan to introduce new regulations banning crypto insider trading; US Republicans propose a bill to codify Trump’s executive order allowing 401(k) investments in cryptocurrency and private equity.](https://img.bgstatic.com/multiLang/image/social/b0411719ec6c4657208c834dbbc069d31760470562725.png)