News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

An increasing number of traditional judicial authorities are beginning to adopt on-chain tracking and cryptographic decryption technologies, making it increasingly unrealistic for criminals to use crypto technology to evade legal sanctions.

Is my on-chain wallet still my wallet?

For Ethereum, ZK is not just a technological upgrade but a structural overhaul. It transforms Ethereum from redundant validation to efficient consensus, and from performance bottlenecks to verifiable computation. This could be the key ticket for Ethereum to enter the next cycle.

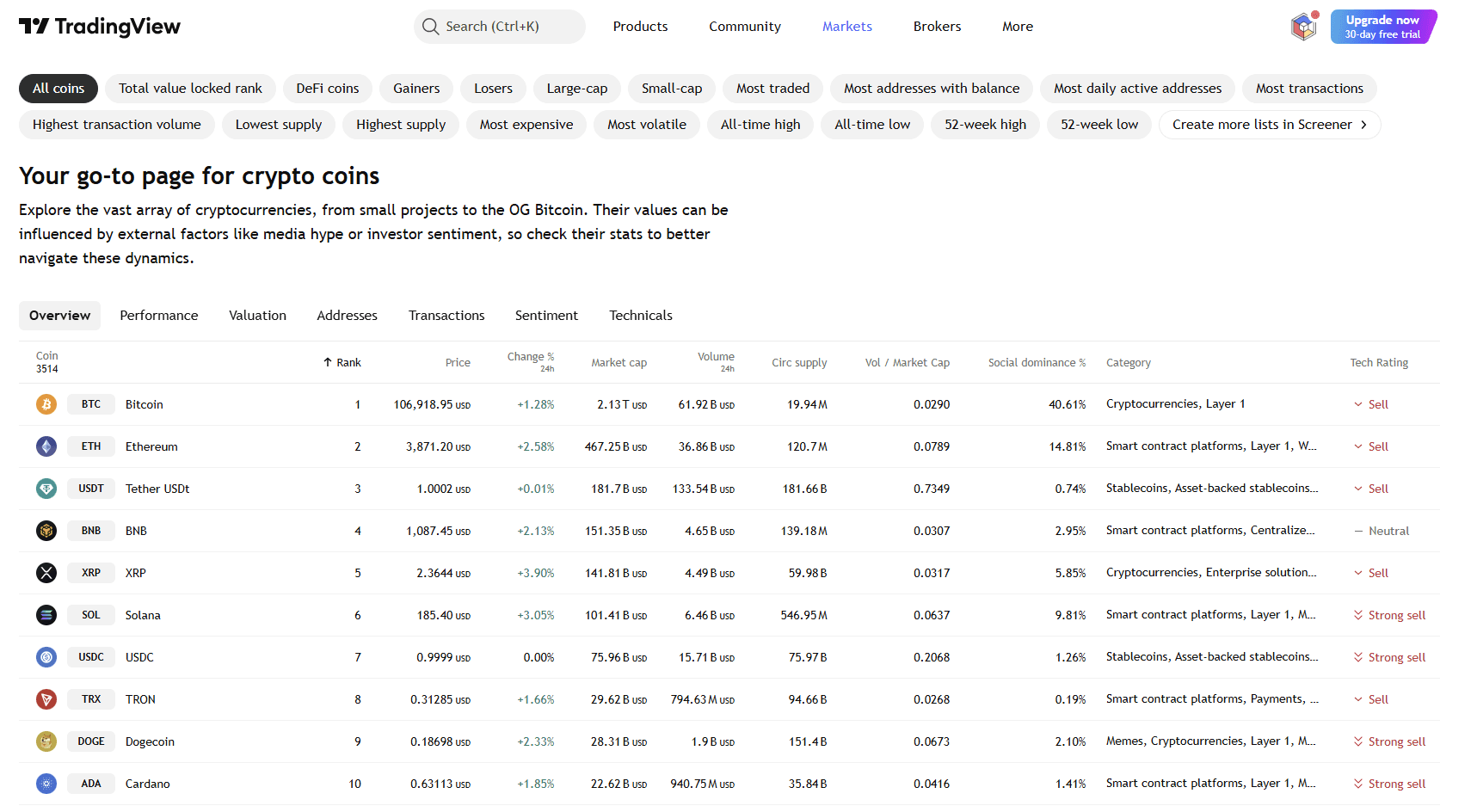

Despite ETF outflows reaching $598 million, bitcoin remains above $107,000, and ethereum is up by 2%. Experts are divided on the market’s strong performance amid wallet security warnings.

Even Tom Lee has stated that the crypto treasury bubble may have already burst.

- 20:02US SEC Chairman: The United States is ten years behind in the crypto sector; establishing a regulatory framework to attract innovation is the "top priority"BlockBeats News, October 18, according to Cointelegraph, at an event held in Washington, D.C., U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins stated that the United States has fallen behind by ten years in the crypto sector, and addressing this issue is a top priority for regulators. Atkins said he believes the United States is "probably about 10 years behind" in the field of cryptocurrency. He said, "Crypto is our top priority." Atkins pointed out that the SEC aims to "establish a robust framework to bring back those who may have already left the United States." The agency hopes this framework will allow innovation to flourish.

- 20:02Analyst: Bitcoin trend reversal requires simultaneous growth in price and open interest, or significant capital inflowsBlockBeats News, October 18, CryptoQuant analyst Axel Adler Jr stated in a post that after a large-scale leverage wipeout, the market is still in a correction phase; the risk of cascading liquidations has dropped below peak levels. A short-term rebound is possible, but for a sustainable reversal to occur, either prices and open interest need to grow in sync, or there must be a significant inflow of spot funds.

- 20:01Bloomberg: Crypto mining companies riding the AI boom are gradually abandoning BitcoinBlockBeats News, October 18, according to Bloomberg, the stocks of large computing companies that support the operation of bitcoin have once again outperformed bitcoin itself, as more and more companies shift to a hybrid model centered on artificial intelligence and high-performance computing. These companies were initially referred to as "mining companies," drawing an analogy between the process of creating bitcoin and the extraction of traditional precious metals such as gold. However, they have long been affected by fluctuations in the price of bitcoin. Two years ago, the industry benefited from the early stages of the AI boom, but in the following year, as mining profits declined and competition intensified, their stock prices fell again.