News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. Holesky testnet shutdown begins this week, with operators deactivating nodes over ten days. Ethereum Foundation cites completion of Fusaka testing and technical evolution as reasons for closure. Validators should migrate to Hoodi, while developers move to Sepolia for application testing. The shift marks Ethereum’s new modular testnet era, ensuring faster, cleaner, and scalable testing environments.References 🚨 UPDATE: Ethereum Foundation announces Hol

A monologue from an ETH Maxi.

Prediction markets are becoming the focus of community discussions; however, beneath the immense spotlight, several major questions and concerns are gradually emerging.

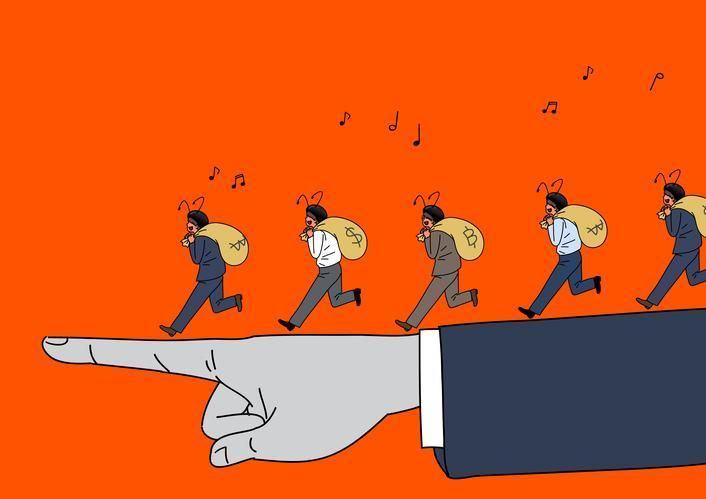

For exchanges and market makers, keeping retail investors trading continuously, engaging in repeated speculation, and retaining them long-term is far more profitable than "flushing out retail investors once a year."

Everyone should have their own mission, no matter how big or small, as long as it makes you happy.

A brutal "Squid Game".

USDe withstood the test during a record-breaking liquidation day in October, and remains safe unless multiple "black swan events" occur simultaneously.

- 08:02CryptoQuant: Bitcoin net flow indicator has recently shown a significant negative valueChainCatcher news, CryptoQuant published an analysis stating that the net bitcoin flow indicator on a certain exchange has recently shown a significant negative value, and the 30-day moving average (SMA30) data indicates that a large amount of bitcoin is flowing out of the exchange. Analysts pointed out that this phenomenon suggests investors are more inclined to hold rather than sell, which is usually consistent with the accumulation phase in the market cycle. Although daily data fluctuates greatly, the 30-day average trend clearly points to accumulation behavior, which may indicate increasing market confidence. Experts believe that the current trend may support a short-term bullish outlook for bitcoin.

- 08:02Data: Hyperliquid platform whales currently hold $5.585 billions, with a long-short ratio of 0.86According to ChainCatcher, citing Coinglass data, whales on the Hyperliquid platform currently hold positions totaling $5.585 billions, with long positions at $2.581 billions, accounting for 46.21% of the total, and short positions at $3.004 billions, accounting for 53.79%. The P&L for long positions is -$87.0026 millions, while the P&L for short positions is $106 millions. Among them, whale address 0x5b5d..60 is currently holding a 10x full position short on ETH at the price of $3,442.2, with an unrealized P&L of -$23.3747 millions.

- 07:50Cobo becomes a global partner of Google Agent Payment Protocol AP2On October 21, digital asset custody and wallet infrastructure provider Cobo announced that it has become a global partner of the Google AI Agent payment protocol AP2 (Agent Payments Protocol), and will work with global payment and technology partners to promote the application of A2A (Agent-to-Agent) in AI Agent payments. Cobo plans to launch a series of practical applications based on AP2 in the first quarter of 2026. AP2 (Agent Payments Protocol) is an open payment standard launched by Google for the "Agent Economy", and is an extension of the A2A communication protocol. It standardizes AI agent payment behavior through cryptographically signed authorization mandates, and supports multi-rail channels such as credit cards, bank transfers, and x402 stablecoins, enabling AI agents to securely and accountably complete transactions across merchants, applications, and payment networks within the scope of user authorization, while generating an auditable evidence chain.