News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1US Stocks Surge as Crypto Reserve Companies Find Growth Hack2Eightco Secures $250M for $WLD Treasury Launch3Bitcoin Inches up to $112K as Stocks Hit Record Highs

NFT Market Cools in Early September After Strong Summer Gains

Cointribune·2025/09/09 14:33

Is Hedera (HBAR) Poised for a Bullish Breakout? Key Fractal Pattern Saying Yes!

CoinsProbe·2025/09/09 14:33

Render (RENDER) To Rally Higher? Key Harmonic Fractal Formation Suggests So!

CoinsProbe·2025/09/09 14:33

Inflation Spikes, Fed Cuts Loom – What Happens to XRP Next?

Cryptoticker·2025/09/09 14:21

BTC Volatility Weekly Report (September 1 - September 8)

BTC Volatility Weekly Report (September 1 - September 8) Key Metrics (Hong Kong Time: 16:00 on September 1 to 16:00 on September 8) B...

SignalPlus·2025/09/09 14:14

From "flood irrigation" to a differentiated landscape, will the altcoin season repeat the glory of 2021?

The altcoin season of 2021 erupted under a unique macro environment and market structure, but now, the market environment has changed significantly.

Chaincatcher·2025/09/09 12:26

a16z In-Depth Analysis: How Do Decentralized Platforms Make Profits? Pricing and Charging Strategies for Blockchain Startups

a16z points out that a well-designed fee structure is not at odds with decentralization—in fact, it is key to creating a functional decentralized market.

Chaincatcher·2025/09/09 12:25

OpenSea unveils final phase of pre-TGE rewards, with $SEA allocation details due in October

Cryptobriefing·2025/09/09 10:54

Bitcoin Mining Difficulty Reaches New Record High

Theccpress·2025/09/09 10:27

Smart Investing vs Ideological Investing: Who Will Lead the Future Capital Markets?

The Bitcoin Treasury Company embodies a new paradigm of ideological investment, blending financial innovation with ideological alignment.

BlockBeats·2025/09/09 09:53

Flash

- 14:31PayPal says it will enable QR code payments with WeChat Pay as early as the fourth quarter of this year.Jinse Finance reported that at the 2025 PayPal China Cross-border E-commerce Conference held this afternoon in Shenzhen, Su Lei, Head of Sales for PayPal China, and Tony Yu, Senior Manager and Head of the China Technical Integration Partner Team at PayPal, stated in an interview with a Cailian Press reporter that as early as the fourth quarter of this year, PayPal World will enable QR code payment functionality with WeChat Pay (i.e., PayPal users will be able to make payments by scanning WeChat Pay QR codes), thereby achieving interoperability in the cross-border payment sector. When asked by the reporter whether there would be similar collaborations with other domestic Chinese payment companies besides WeChat Pay, the aforementioned representatives responded, "We have always maintained an open attitude when selecting partners."

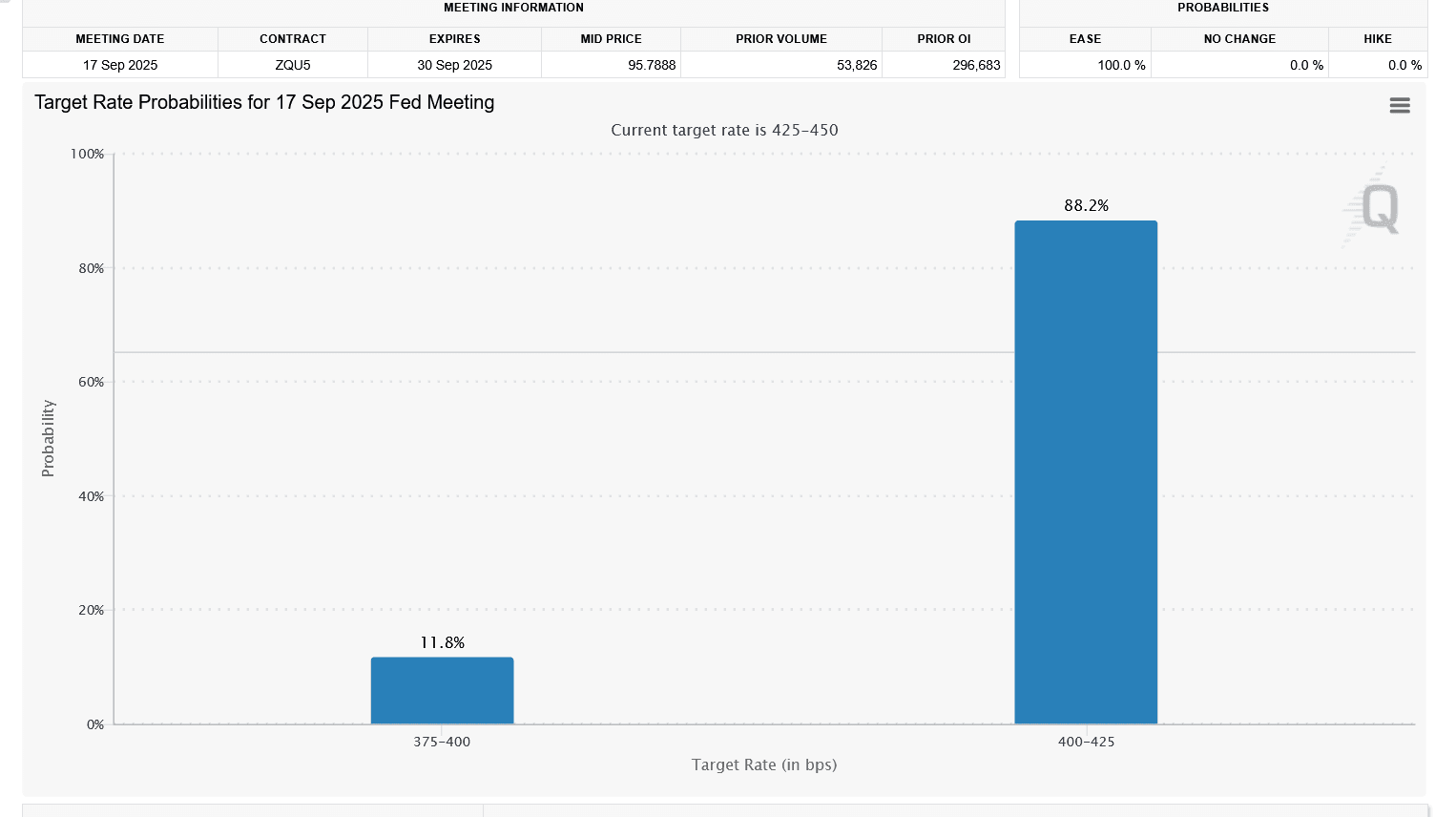

- 14:20U.S. employment data significantly revised downward: 911,000 fewer jobs added through MarchJinse Finance reported that the U.S. government stated on Tuesday that in the 12 months ending this March, the number of new jobs added to the U.S. economy may be 911,000 less than previously estimated. This indicates that signs of stagnation in job growth had already appeared before Trump implemented tough tariffs on imported goods. Economists had previously expected that the Bureau of Labor Statistics (BLS), under the U.S. Department of Labor, might revise down employment levels from April 2024 to March 2025 by 400,000 to 1 million jobs. Previously, employment levels from April 2023 to March 2024 had already been revised down by 598,000 jobs. This benchmark revision follows another announcement made last Friday—that job growth in August was nearly stagnant, and June saw the first decrease in jobs in four and a half years. In addition to being dragged down by uncertainty in trade policy, the labor market is also under pressure from the White House's tightening of immigration policies, which has weakened the supply of labor. At the same time, companies are turning to artificial intelligence tools and automation, which is also suppressing demand for labor. Economists believe that the downward revision of job growth data has little impact on monetary policy. The Federal Reserve is expected to resume interest rate cuts next Wednesday, after pausing its easing cycle in January due to uncertainty caused by tariffs.

- 14:18US non-farm payrolls revised down by 911,000, increasing pressure for interest rate cutsChainCatcher news, according to Golden Ten Data, based on the preliminary results of the annual benchmark revision released by the U.S. government on Tuesday, non-farm employment in the United States is expected to be revised down by 911,000 people in the 12 months ending this March, equivalent to an average monthly decrease of nearly 76,000 people. The final data will be released early next year. This adjustment indicates that the recent slowdown in the labor market may lay the foundation for the Federal Reserve to cut interest rates, and traders generally expect the Fed to announce a rate cut at its next meeting.