News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

How the Trump family is reshaping prediction markets and the boundaries of information.

The MegaMafia 2.0 Accelerator Program focuses on incubating innovative crypto consumer products aimed at mainstream users.

Investing in the new stablecoin sector requires finding a balance among technological innovation, regulatory compliance, and market demand.

Whale Accumulation, Animoca Brands' Entry, and Bullish Technical Indicators Fuel AERO's 7% Surge

Revolutionizing Cross-Border Payments: How Ripple's Partnership Aims to Bypass Traditional Banking in Infrastructure-Limited Regions

The Federal Reserve announced a 25 basis point rate cut and halted quantitative tightening (QT), but the market experienced short-term panic due to Powell's hawkish comments regarding uncertainty over a rate cut in December. Bitcoin and Ethereum prices declined. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

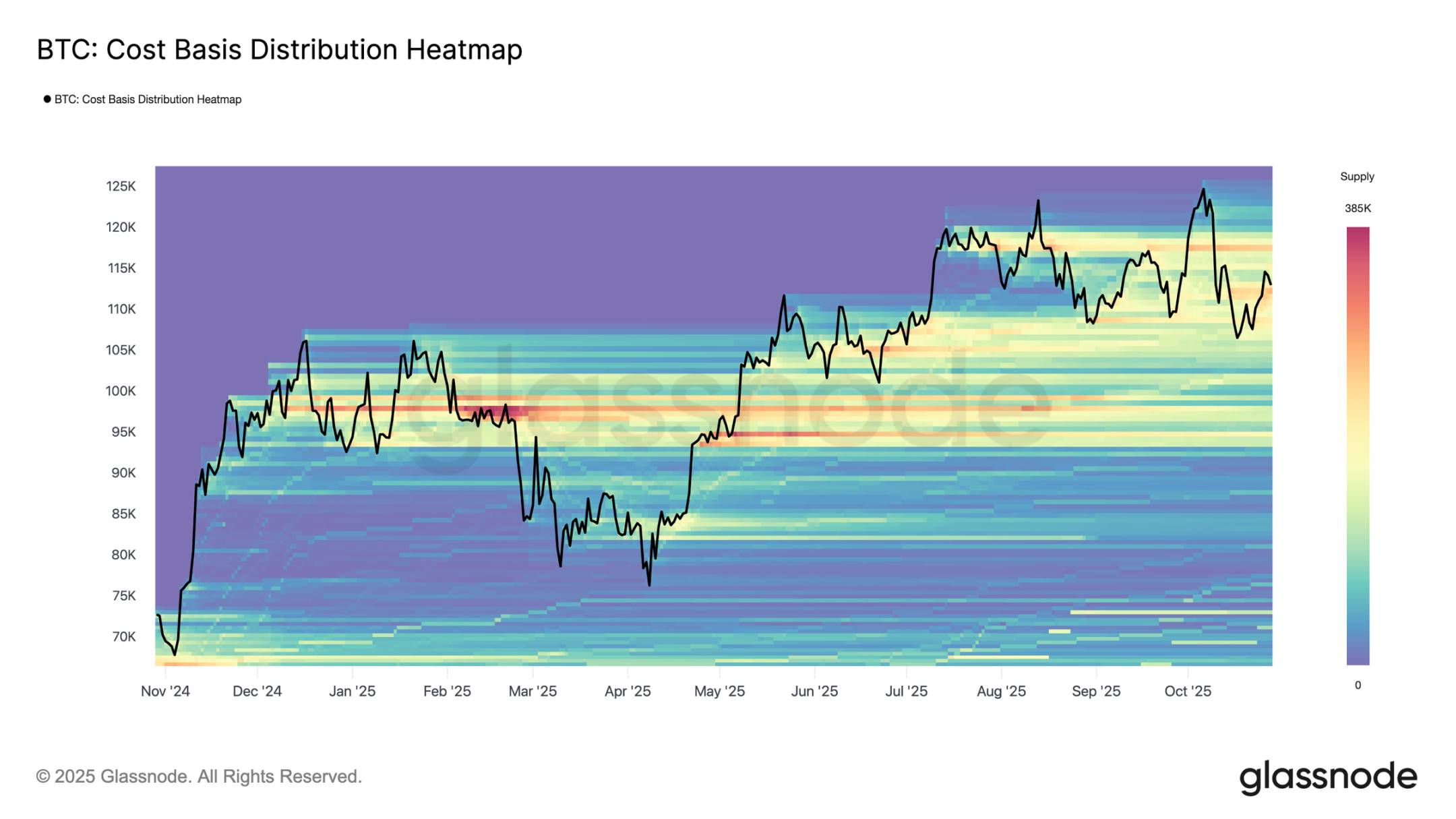

Bitcoin is showing clear signs of weakness, and market confidence is being put to the test.

- 03:53Brevis partners with KaitoAI to introduce privacy-preserving on-chain verification for the InfoFi ecosystemBlockBeats News, on October 31, the intelligent verifiable computation platform Brevis announced a new partnership with KaitoAI to introduce privacy-preserving on-chain verification features to the InfoFi ecosystem. Starting today, any activity on the Kaito platform can utilize Brevis's zero-knowledge proof technology to verify users' on-chain identities without exposing their wallet addresses. The first implemented application is the Brevis Yapper leaderboard. This move addresses a fundamental limitation of InfoFi: previously, activities could only track social data, and whenever on-chain behavior needed to be verified, users were required to publicly connect their wallets, resulting in privacy leaks. Now, users can anonymously prove they are "long-term holders" or "active DeFi users" without exposing their entire asset portfolio.

- 03:53"Machi" adds approximately $14,000 in margin, significantly lower than beforeBlockBeats News, October 31, according to monitoring by Lookonchain, "Machi Big Brother" Jeffrey Huang, after experiencing several partial liquidations, has just deposited 13,937 USDC into Hyperliquid and may continue to go long on ETH and HYPE. Previously, each of his deposits was in the hundreds of thousands of US dollars.

- 03:53A certain whale sold off 1,531 ETH at a loss, incurring a $617,000 loss in two weeks.BlockBeats News, October 31, according to on-chain analyst Ai Aunt (@ai_9684xtpa), a swing whale who has repeatedly bought high and sold low in ETH, dumped 1,531 ETH (about $5.65 million) 7 hours ago, with an average selling price of $3,691 and an average entry price of $4,094. After holding for two weeks, the whale incurred a loss of $617,000.