News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 11)|Trump Announces 100% Tariffs on China, Triggering Market Turmoil; Crypto Industry Liquidations Exceed $19.1 Billion in 24 Hours, Setting New Record.2Bitcoin slump may rebound up to 21% in 7 days if history repeats: Economist3US–China Tariff Fears Hit Bitcoin Treasury Stocks

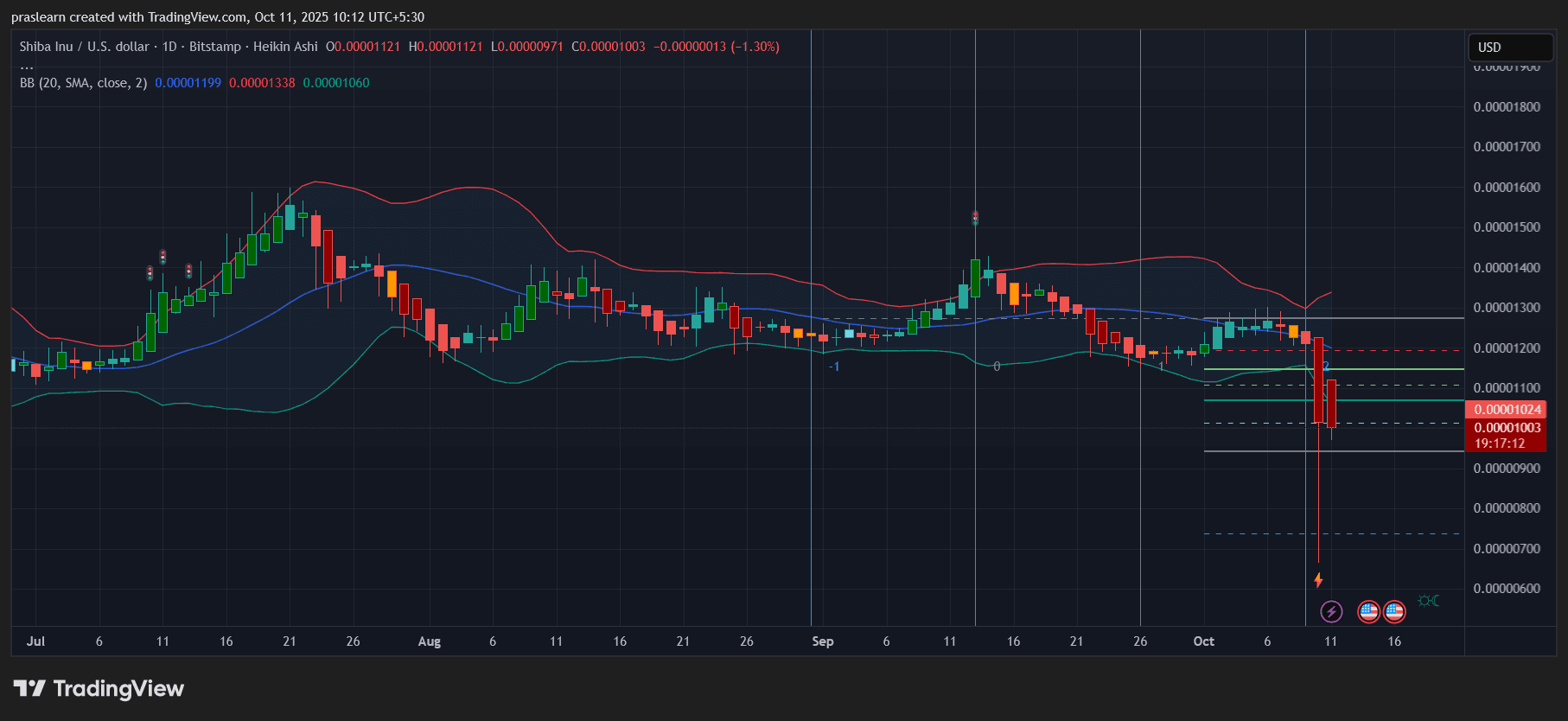

Will SHIB Price Crash to 0 After Trump’s 100% Tariff Threat?

Cryptoticker·2025/10/11 11:39

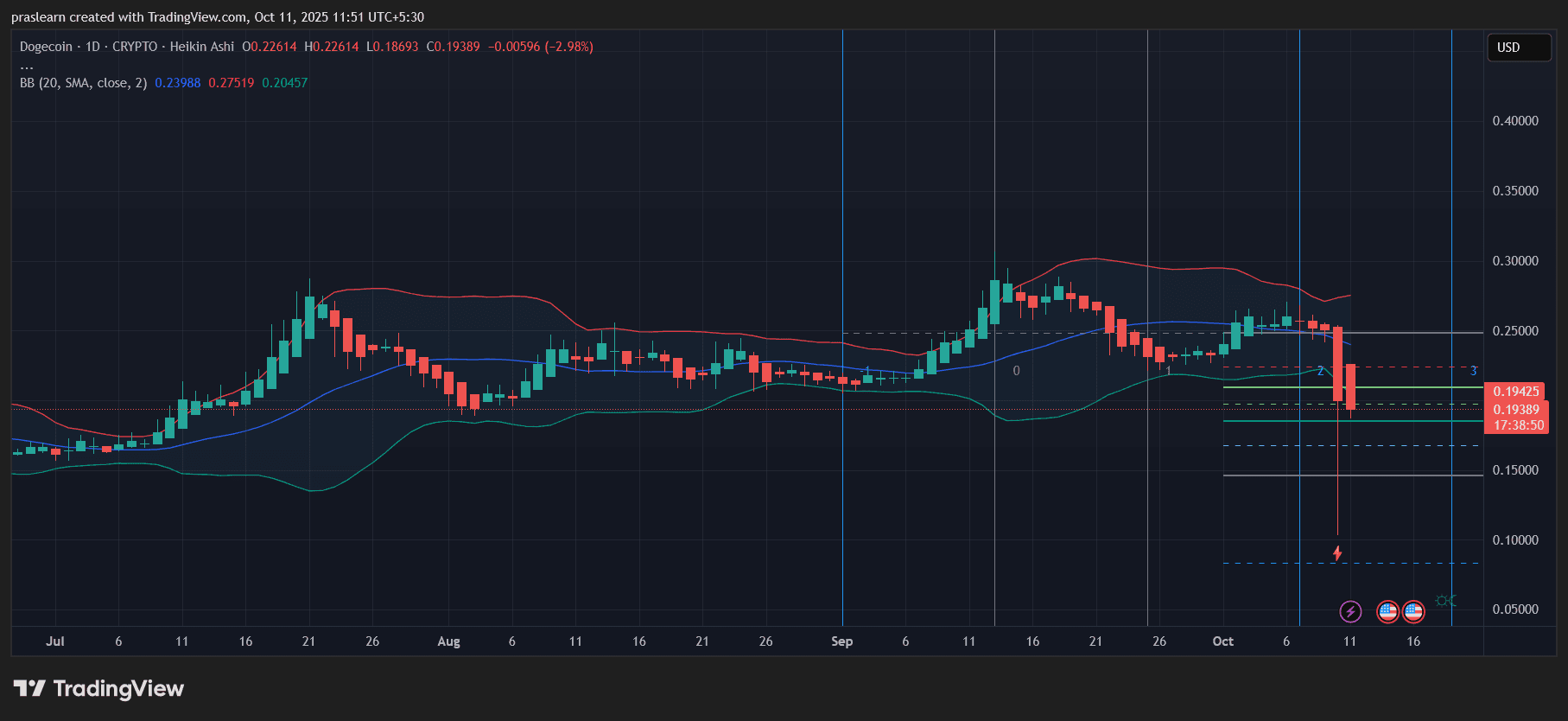

Trump’s 100% Tariffs: Is This the End for Dogecoin?

Cryptoticker·2025/10/11 11:39

BTC, ETH, XRP, SOL Face Slow Bottoming Process After $16B Liquidation Shock

Cointime·2025/10/11 11:36

Russia Acknowledges Crypto’s Popularity With Its Citizens as Central Bank Weighs Bank Involvement

Cointime·2025/10/11 11:36

Collection of Opinions: Tariffs, Whales, or Market Makers—Who Is the Culprit Behind Today’s Crypto Market Crash?

Although the market generally believes that Trump's tariff remarks have disturbed sentiment in the crypto market, the sudden plunge in altcoins was far greater than expected. What exactly triggered this unexpected collective drop in altcoins?

Chaincatcher·2025/10/11 10:46

Black Swan Spreads Its Wings: "10·11" Becomes the Most Terrifying "Liquidation Day" in Crypto History

Over 1.63 million people were liquidated in the market, and market sentiment shifted overnight from greed to fear.

ForesightNews 速递·2025/10/11 09:52

US-China Tariff War: Can the Crypto Market Survive a New Trade War?

Tariffs have reignited the US-China trade war, causing trillions in stock market value to evaporate and shaking global markets.

Cryptoticker·2025/10/11 09:51

Is this the real reason behind the $20 billion liquidation in the crypto market?

律动BlockBeats·2025/10/11 09:50

Flash

- 11:53Securitize is in merger talks with Cantor's SPAC for a public listing, with an expected valuation exceeding $1 billion.BlockBeats News, October 11, according to Bloomberg, the RWA tokenization platform Securitize, backed by BlackRock, is in talks with a special purpose acquisition company (SPAC) initiated by Cantor Fitzgerald LP regarding a potential public listing. Sources familiar with the matter revealed that the merger deal between Securitize and Cantor Equity Partners II Inc. would value the company at over $1 billion. However, negotiations are still ongoing, and Securitize may also choose to remain private.

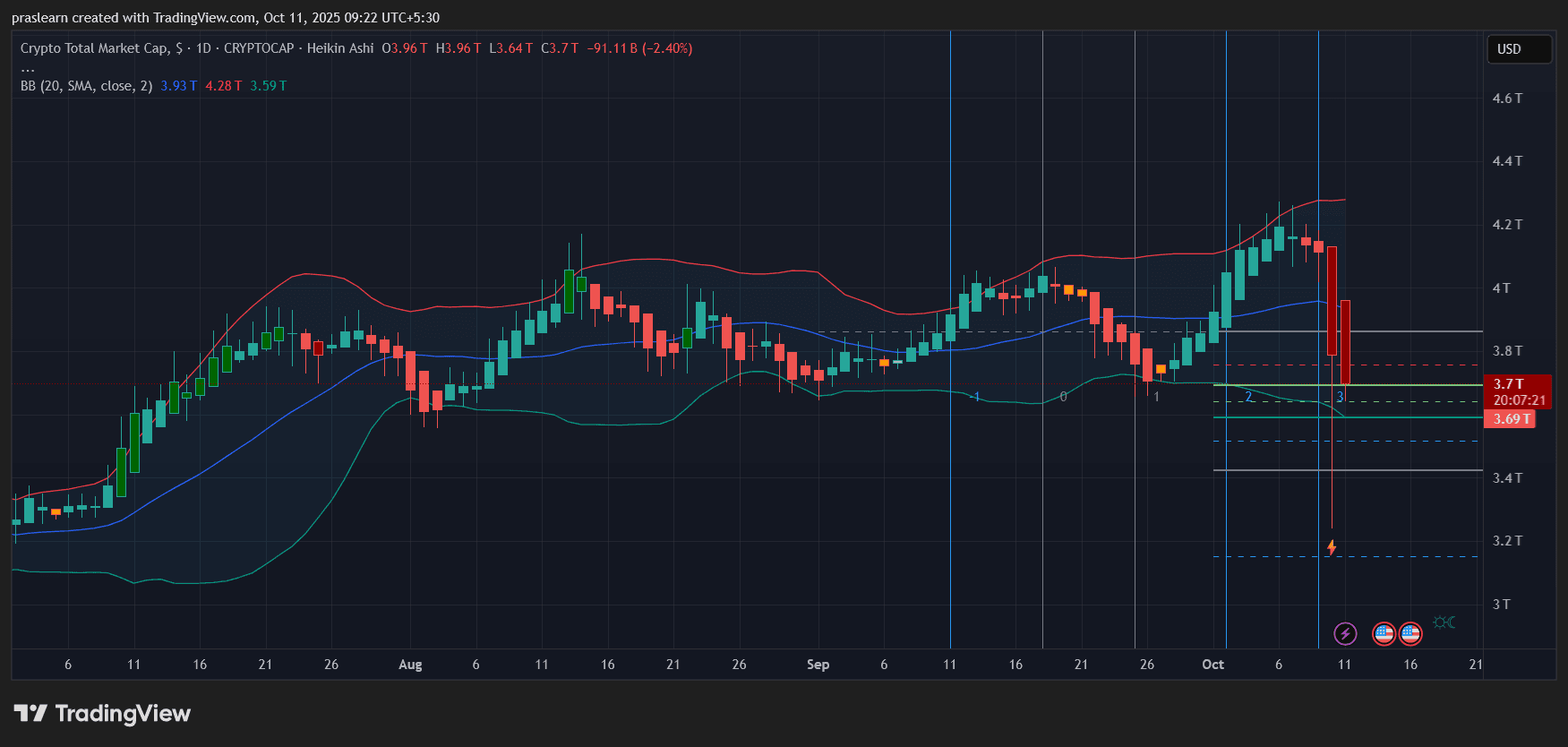

- 11:53Analysis: Today's flash crash resembles the late bull market crash of 2021; traders should activate stop-losses and control position sizesBlockBeats News, October 11 — Crypto analyst @ali_charts released a market analysis stating that today we witnessed the largest liquidation event in the history of cryptocurrencies, which can only be described as a total flash crash. Approximately $19.3 billions worth of positions were liquidated in a single day, affecting around 1.66 million traders. Many assets experienced sharp intraday declines followed by partial rebounds, but the scale of this sell-off has raised serious questions about where the market stands within the broader cycle. By digging into historical data, the most recent similar event occurred at the tail end of the 2021 bull market, shortly after bitcoin reached its peak of $69,200. The December 2021 flash crash wiped out more than 24% of market capitalization in a single daily candle, an event that later proved to be the beginning of the subsequent bear market. Today, bitcoin's daily candle shows a maximum drop of about 17%, which is strikingly similar in scale and context to the 2021 bull market crash. The similarities between the two—local market highs, a wave of excessively leveraged long positions, and cascading liquidations—are hard for traders to ignore. While this rebound may be seen as a buying opportunity, caution is essential. Such large-scale liquidations often signal a structural shift in the market rather than a temporary dip. This event may represent a market top, potentially followed by a deeper pullback. If currently holding long trading positions, strict risk management is necessary, and traders should ensure stop-loss orders are activated and position sizes are controlled.

- 11:53Bitcoin dominance returns above 60%, while altcoin market cap drops nearly 15% in the past four daysBlockBeats News, October 11, according to market data, Bitcoin dominance (BTC.D) has returned above 60%, rising 2.34% in a single day. The total cryptocurrency market capitalization is now reported at $3.848 trillions, with a 24-hour decline of 9.1%. The total market capitalization excluding Bitcoin (TOTAL 2) has dropped from this week's high of $1.73 trillions to $1.48 trillions, a nearly 15% decrease over the past four days. Market opinion generally believes that a significant rebound in Bitcoin dominance means the altcoin season is nearing its end.