News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

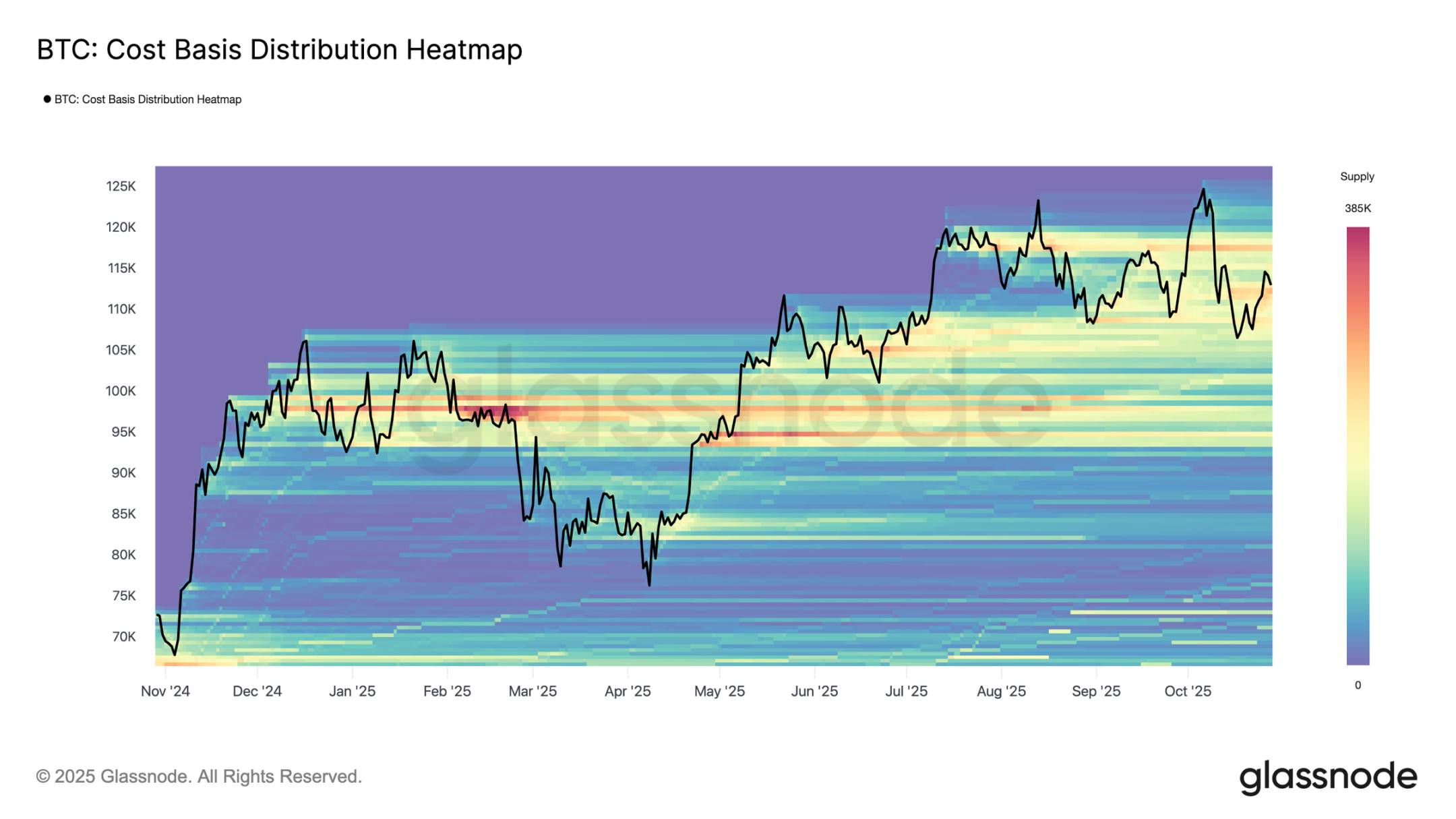

Bitcoin is showing clear signs of weakness, and market confidence is being put to the test.

JPMorgan tokenizes private equity fund on Kinexys platform, plans wider rollout in 2026.Kinexys: JPMorgan’s Digital InfrastructureA Sign of What’s to Come

Altcoin dominance is at historic oversold levels, hinting at a potential market reversal and opportunity for altcoin investors.What This Means for AltcoinsTime to Watch the Altcoin Space Closely

Explore how BlockDAG’s EVM compatibility, strong presale momentum, and developer migration make it the top presale crypto for 2025, alongside BFX, GGs, and MUTM.BlockDAG (BDAG): The EVM-Compatible Layer Built for Ethereum DevelopersBlockchainFX (BFX): A Unified Hub for Multi-Market TradingBased Eggman (GGs): Blending Meme Culture with Interactive UtilityMutuum Finance (MUTM): DeFi Infrastructure Built for StabilityConclusion

- 23:08Jump Crypto transferred $205 million worth of SOL to Galaxy Digital early this morning and received 2,455 BTCAccording to ChainCatcher, monitored by Lookonchain, Jump Crypto transferred 1,100,000 unlocked SOL (worth $205 million) to Galaxy Digital in the early hours today and received 2,455 BTC (worth $265 million) in exchange.

- 23:08Canary XRP spot ETF latest application removes delay amendment clause, expected to be listed soonChainCatcher news, according to crypto journalist Eleanor Terrett, Canary Capital has submitted an updated S-1 form for its XRP spot ETF, removing the "delaying amendment clause" that prevented automatic registration effectiveness, and has handed over control of the timing to the US SEC. Assuming Nasdaq approves the 8-A form application, Canary's XRP ETF will officially launch on November 13. Note: The reopening of the government may affect the schedule. If the application materials are complete and the US SEC is satisfied, the timeline may be moved up; if staff raise more comments, the timeline may be delayed. However, it is worth noting that the chairman of the US SEC himself also seems to support companies utilizing the automatic effectiveness mechanism. Although he did not directly comment on the launch of the ETF, Paul Atkins stated yesterday that he was pleased to see companies like MapLight use the 20-day statutory waiting period to go public during the government shutdown, and praised Bitwise and Canary for using the same legal mechanism this week to launch SOL, HBAR, and LTC ETFs.

- 22:56DYdX plans to enter the US market by the end of 2025 and will offer spot trading.Jinse Finance reported that DYdX President Eddie Zhang stated the company plans to enter the US market by the end of 2025 and, in addition to its existing perpetual contract trading, will launch cryptocurrency spot trading, including assets such as Solana. Zhang mentioned that the increasingly friendly US regulatory environment is an important reason driving this strategy. Recently, both the US SEC and CFTC have indicated they will consider including perpetual contracts in domestic trading.