News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 13)|Portal to Bitcoin mainnet launch and $50M funding; BTC and ETH rebound in short term, over $8.5B liquidated in 24 hours; 2XRP Targets $5.25 After Holding Strong Near the $1.5 Assembly Zone3Clues of the "End of the Bull Market": The "Bull's Tail" Is the Fattest and Everyone Is Bullish

ETH Market Unveiled: Multiple Logics Behind the Volatility

AICoin·2025/10/13 05:47

The Biggest Liquidation Day in Crypto History: Lessons from the 10·11 Crash

Survival is everything.

深潮·2025/10/13 05:47

Trader Says | Why Did This Epic Market Crash Happen, and When Is the Right Time to Buy the Dip?

律动BlockBeats·2025/10/13 05:46

Leverage Liquidation and Major Shakeout: How Do KOLs View the Crypto Market Situation?

AICoin·2025/10/13 05:45

Mars Morning News | Bitcoin rebounds and surpasses $115,000, Trump may become the largest Bitcoin investor in the US

1kx co-founder deposited 2 million USDC into Hyperliquid and opened a 10x leveraged long position on ENA; Trump may indirectly hold 870 million USD worth of bitcoin through TMTG; the probability of a Federal Reserve rate cut in October has reached 97.8%; spot gold hit a record high; the total cryptocurrency market cap has recovered to 4 trillion USD. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

MarsBit·2025/10/13 05:44

An Overview of 12 Projects Scheduled for TGE in October

The TGE boom is expected to continue into Q4.

Chaincatcher·2025/10/13 05:44

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net inflow of $2.71 billion; US Ethereum spot ETFs saw a net inflow of $488 million

DTCC has listed the Bitwise Avalanche ETF with the ticker BAVA.

Chaincatcher·2025/10/13 05:24

Critical Moment for the Market! Gold Surpasses $4,060, Global Assets Rebound

AICoin·2025/10/13 04:59

Crypto ETFs enter an acceleration phase, what’s next for the market?

Bitpush·2025/10/13 04:57

Flash

- 05:45Tether CEO: CBDCs may evolve into government surveillance toolsJinse Finance reported that Tether CEO Paolo Ardoino recently stated that central bank digital currencies (CBDCs) could turn "money" into a tool for government surveillance. At the TOKEN2049 conference held in Singapore, Ardoino pointed out that while governments view CBDCs as an advanced financial innovation, in reality, they may be used to control consumers rather than achieve so-called "financial inclusion." CBDCs are digital forms of a country's fiat currency issued and controlled by the central bank. Unlike decentralized cryptocurrencies such as bitcoin, CBDCs are fully centralized, and transaction records can be comprehensively tracked. Ardoino also mentioned that when he first heard about blockchain and bitcoin, his impression was "it felt like inventing nuclear weapons—a powerful technology that could bring disaster if misused." He warned that CBDCs could grant government agencies complete oversight over digital currency transfers.

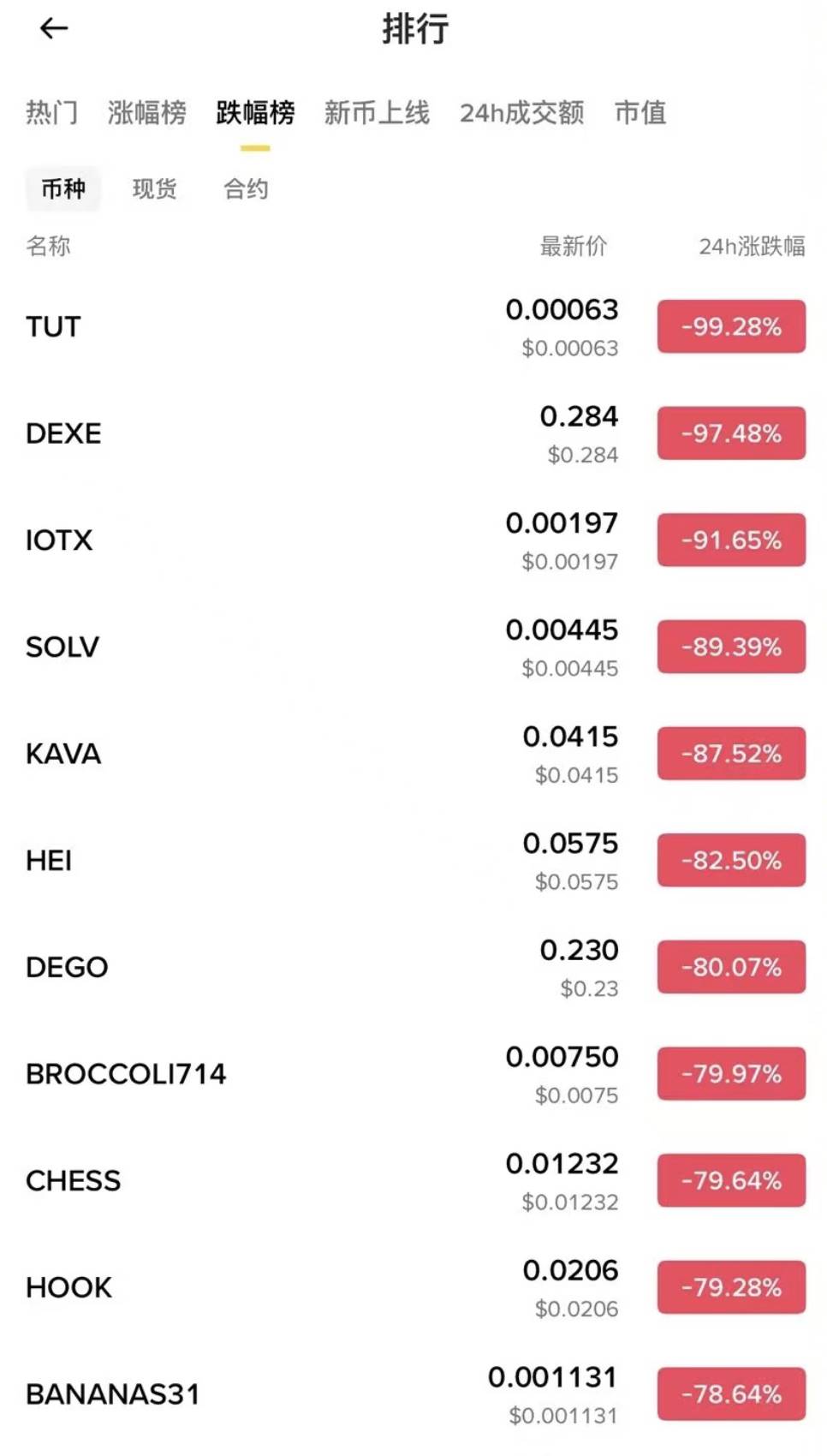

- 05:45Matrixport: This "capitulation sell-off" has completely reshaped the entire crypto market's holding structure.Jinse Finance reported that Matrixport released today’s chart, stating: “Trump’s threat to impose a 100% tariff on China triggered a historically rare crash in the crypto market. This shock coincided with a period of high market leverage and extremely optimistic sentiment. As prices fell, automatic liquidation orders on decentralized exchanges (DEX) began to trigger in succession. Due to insufficient liquidity and sluggish trading volume, these liquidation orders were executed passively, further intensifying market sell-offs. At one point, the Ethereum funding rate plummeted to -39%, marking one of the most severe corrections in recent years and almost completely clearing excessive leveraged positions in the market. Only a very small number of traders benefited from this decline. As volatility gradually subsides, market signals indicate that new long positions are likely to be rebuilt. This historically significant ‘capitulation sell-off’ has completely reshaped the entire crypto market’s position structure.”

- 05:45Circle currently has no plans to issue a Hong Kong dollar-pegged stablecoin.Jinse Finance reported that Chen Qinqi, Vice President of Circle Asia-Pacific, stated that Circle currently has no plans to issue a Hong Kong dollar-denominated stablecoin, and mainly issues two products: the US dollar stablecoin USDC and the euro stablecoin EURC. In terms of its layout in Asia, Circle has obtained a Major Payment Institution license in Singapore, allowing professional investors to obtain USDC directly from Circle. In Japan, USDC is the first stablecoin approved by regulators to be offered to the public by licensed operators. Regarding its business in Hong Kong, Chen Qinqi revealed that Circle currently does not have an office in Hong Kong but will continue to evaluate office locations. As for cooperation with Hong Kong dollar stablecoins, Circle maintains an open attitude and has already discussed and shared expertise with multiple companies. Chen Qinqi expects that more stablecoins denominated in different currencies will emerge in the future, but emphasized that there is a huge global demand for the US dollar, with 75% of Asia’s trade denominated in US dollars.