News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Federal Reserve Rate Cut in September: Which Three Cryptocurrencies Could Surge?

With the injection of new liquidity, three cryptocurrencies could become the biggest winners this month.

Cryptoticker·2025/09/06 18:52

Bitcoin drop to $108K possible as investors fly to ‘safer’ assets

Cointelegraph·2025/09/06 18:30

AiCoin Daily Report (September 6)

AICoin·2025/09/06 17:42

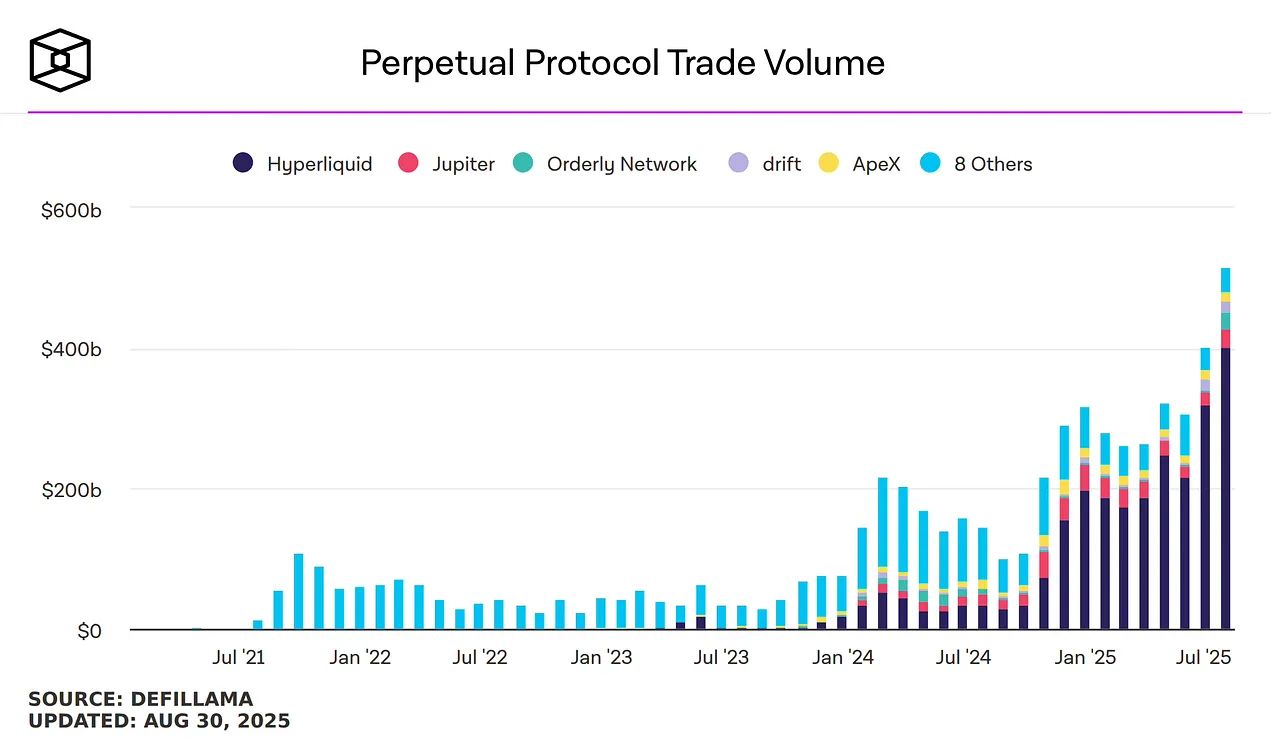

Hyperliquid airdrop project ratings: Which ones are worth participating in?

A wealth of valuable information on the best airdrops coming in the second half of 2025!

深潮·2025/09/06 17:29

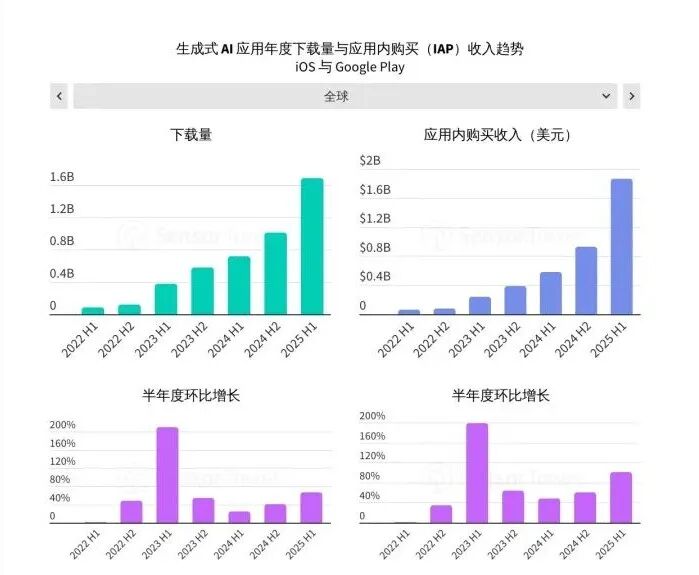

Sensor Tower H1 AI Application Report: Young Male Users Still Dominate, Vertical Apps Face Disruption Pressure

Asia is the largest market for AI application downloads, while the US market leads in AI in-app purchase revenue.

深潮·2025/09/06 17:28

Ten-Year Advice from a16z Partner: In the New Cycle, Just Focus on These Three Things

Persist in doing the difficult but correct things for a bit longer.

BlockBeats·2025/09/06 17:12

Shiba Inu Daily Death Cross Could Indicate Waning Momentum After Brief Golden Cross

Coinotag·2025/09/06 14:25

Bitcoin Cash (BCH) May Sustain $600 Level After 32% Volume Spike and Growing Institutional Interest

Coinotag·2025/09/06 14:25

Flash

- 19:01This week, the net outflow from US spot Ethereum ETFs reached $787.6 million.According to Jinse Finance, monitored by FarsideInvestors, this week the US spot Ethereum ETF saw a net outflow of $787.6 million, and this series of ETFs has experienced net outflows for five consecutive trading days.

- 18:33ScamSniffer: Phishing losses reached $12.17 million in August, up 72% month-on-monthJinse Finance reported that ScamSniffer released its August phishing report, with losses of approximately $12.17 million and 15,230 victims in August; compared to July, losses increased by 72% and the number of victims increased by 67%.

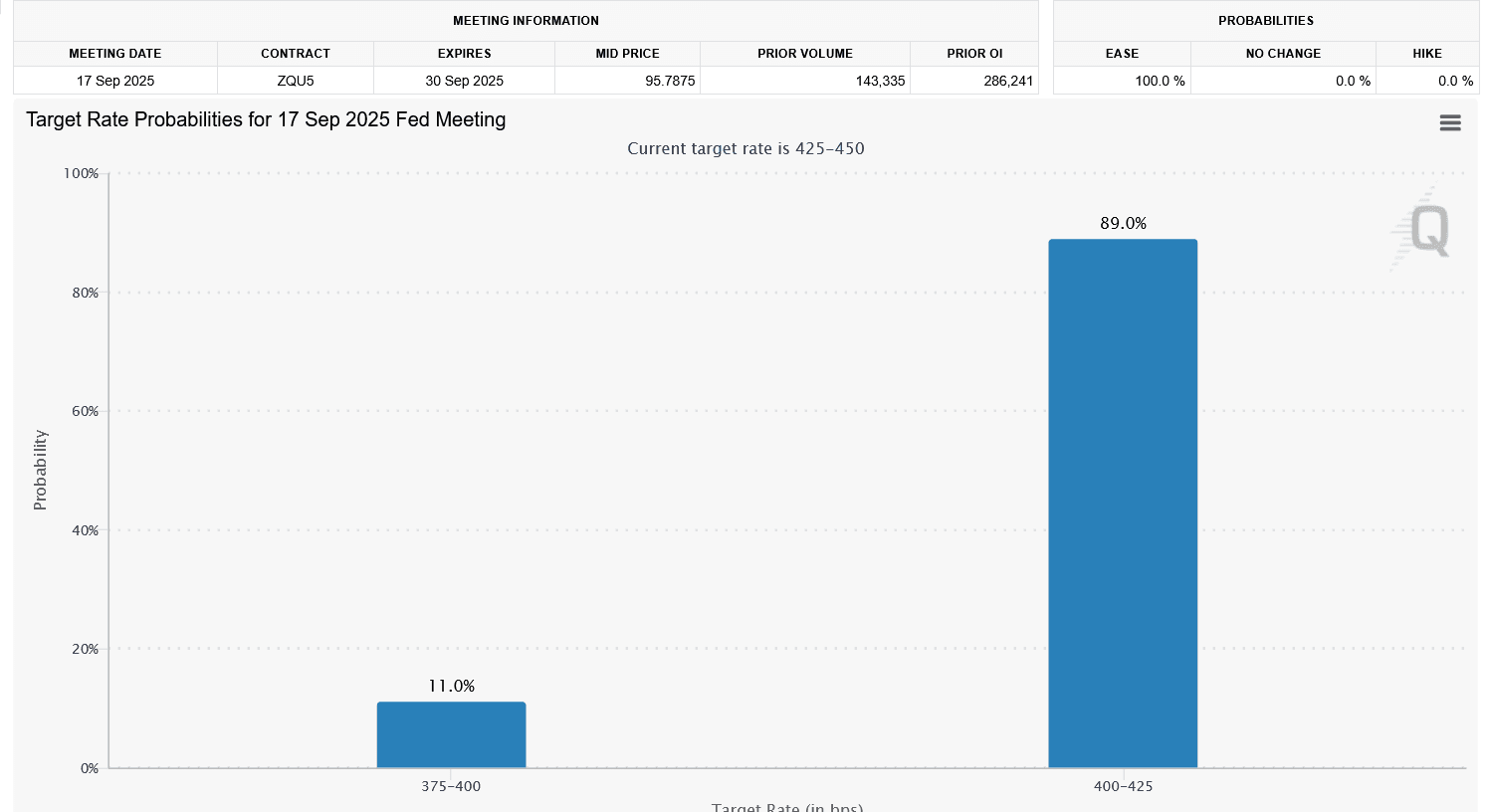

- 16:35Mizuho Bank: The Fed Has Been "Slapped by Reality," Easing Cycle Is About to BeginBlockBeats news, on September 6, Mizuho Bank stated that the US August non-farm employment report further confirmed the weakening tone of the labor market, with employment, working hours, and income growth rates having fallen back to pandemic-era levels. Regardless of inflation, the Federal Reserve is almost certain to cut interest rates at the September meeting. A 25 basis point rate cut is almost a foregone conclusion, but if August inflation is weaker than expected, a 50 basis point cut is even more likely. The Fed's previous inflation forecasts have been "slapped in the face" by reality, and its 2026 unemployment rate forecast now faces the risk of not being fulfilled. Previously, they were too pessimistic about inflation and too optimistic about the labor market. It is expected that the Fed will launch a round of sustained easing, aiming to lower interest rates to what it considers a "neutral level," that is, to around 3% by March 2026. The new Fed chair is likely to further ramp up stimulus measures, bringing rates down to near 2%. However, the risk is that if inflation resurges, at least some of the stimulus measures will be withdrawn by 2027. (Golden Ten Data)