News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Dogecoin Price Prediction 2026-2030: The Realistic Path to $1 Revealed

Bitcoinworld·2025/12/21 07:15

Dark Defender: Fear Not. XRP Has Completed Its Wave 4 correction

TimesTabloid·2025/12/21 07:03

XRP and XLM Solve Different Problems Within the Same Financial System

TimesTabloid·2025/12/21 06:51

XRP ETF’s AUM Hits Big Record

TimesTabloid·2025/12/21 06:30

Fundstrat warning and market upheaval: What are the prospects before 2026?

AIcoin·2025/12/21 05:20

a16z: 17 Exciting New Crypto Directions for 2026

吴说·2025/12/21 05:06

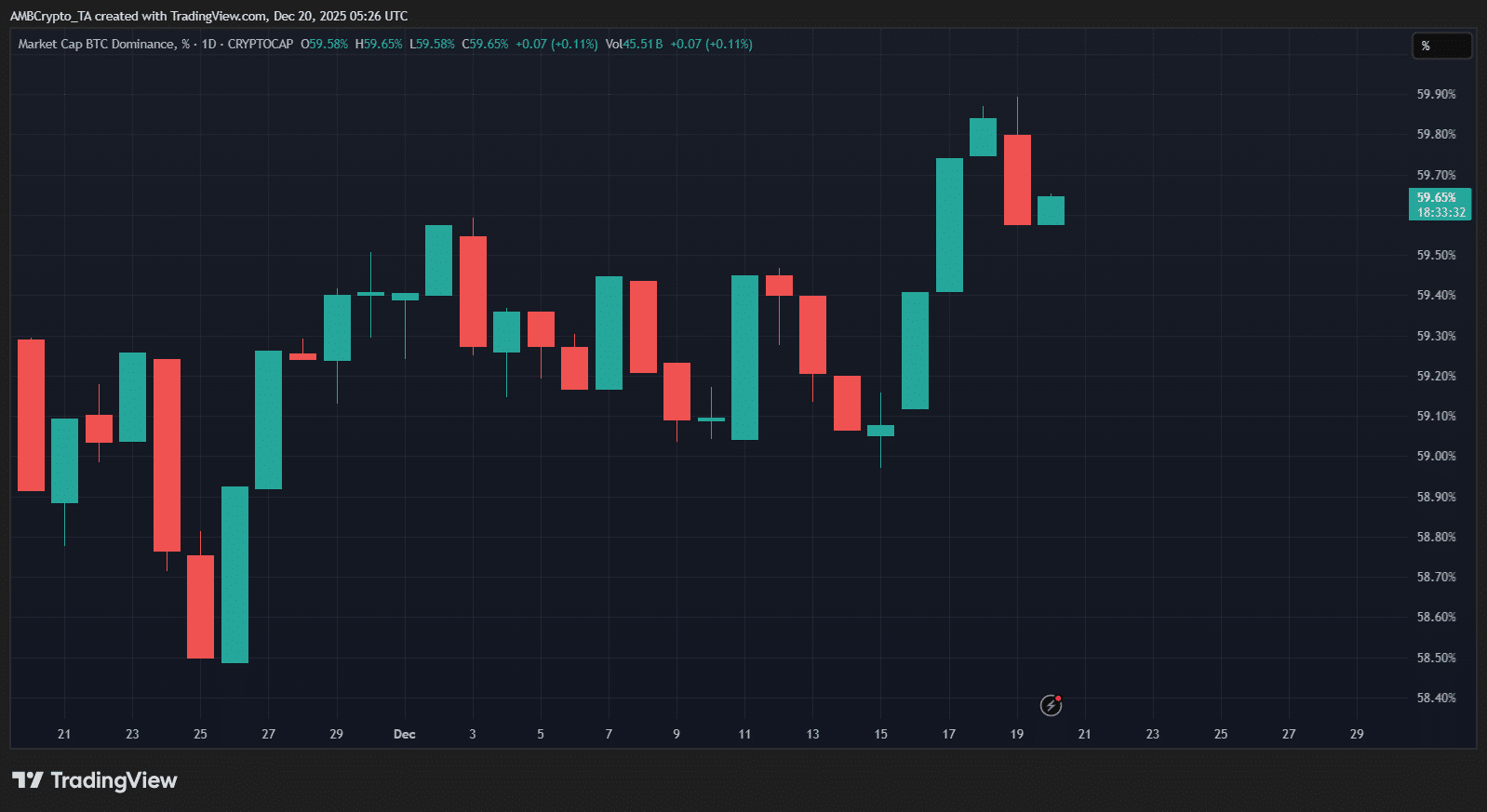

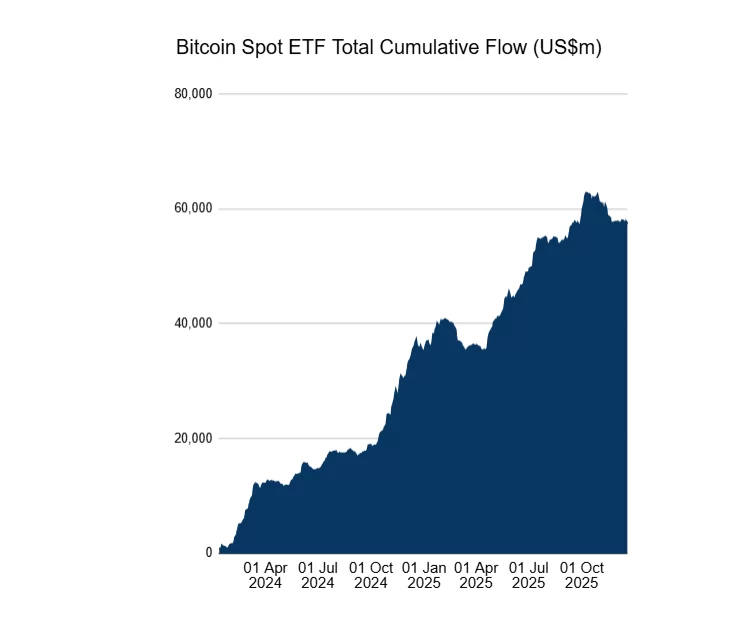

‘Altcoin season isn’t gone’ – Why 2026 may be the year to watch

AMBCrypto·2025/12/21 05:03

Crypto Trends Capture Attention as Market Struggles

Cointurk·2025/12/21 04:12

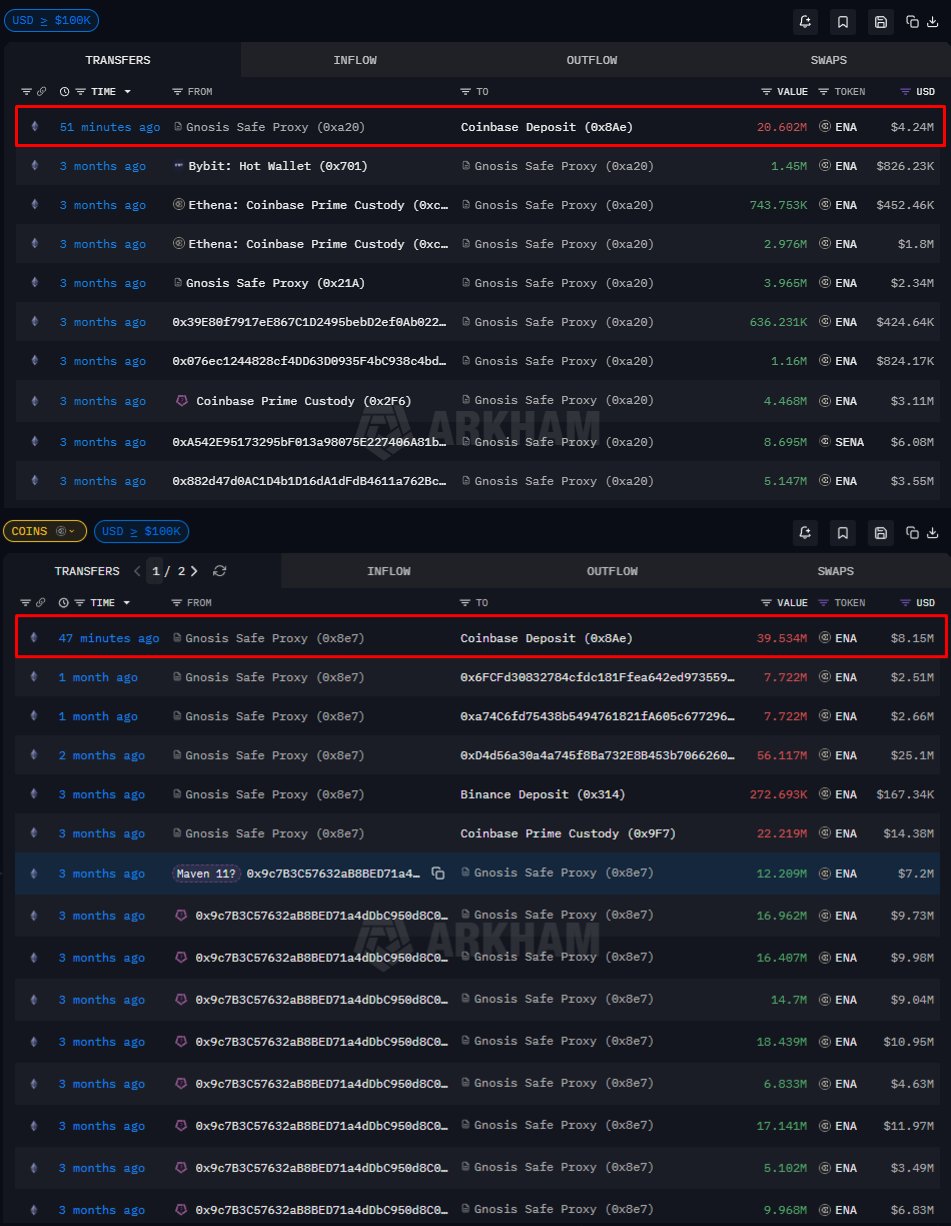

Can Ethena hold $0.20 after 101M ENA flood exchanges?

AMBCrypto·2025/12/21 03:03

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026

BitcoinSistemi·2025/12/21 01:15

Flash

07:23

RHB: COMEX gold futures may attempt to break through the $4,400 resistance level again next weekAccording to a report by Jinse Finance, RHB Investment Bank Bhd stated on Friday that as investors position themselves ahead of key US economic data, COMEX gold futures may once again attempt to break through the resistance level of $4,400 per ounce next week. If a breakout occurs, gold prices may continue their bullish trajectory toward the next resistance level at $4,500. If selling pressure intensifies, prices may fall back to the 20-day simple moving average. Currently, we maintain a positive trading bias.

07:23

Industrial Bank Investment Bank expects that COMEX gold futures may attempt to break through the $4,400 resistance level again next week.RHB Investment Bank Bhd reported that as investors position themselves ahead of the release of key US economic data, COMEX gold futures may once again attempt to break through the resistance level of $4,400 per ounce next week. If a breakout occurs, gold prices may continue their bullish trajectory and move towards the next resistance at $4,500. If selling pressure increases, prices may fall back to the 20-day simple moving average. The bank currently maintains a positive trading outlook.

07:10

Dfinity executive: Blockchain + no-code tools are challenging AWS cloud computing dominanceAccording to TechFlow, on December 21, Cointelegraph reported that Lomesh Dutta, Vice President of Growth at Dfinity Foundation, stated that AI no-code development tools combined with blockchain are challenging Amazon Web Services (AWS)'s dominance in the cloud computing market. These tools allow users to create applications through natural language prompts instead of writing code, and deploy them on decentralized blockchain infrastructure, thereby reducing reliance on centralized cloud servers. When applications are continuously generated and iterated by AI, what is needed is secure, tamper-proof infrastructure that can remain online without ongoing manual maintenance, and decentralized blockchain networks provide a brand new computing paradigm for this purpose. It is reported that currently, a large number of crypto and Web3 projects still heavily rely on centralized cloud services such as AWS for their external applications and websites. In 2025, multiple AWS outages affected many crypto platforms and exchanges. Bitget Wallet CMO Jamie Elkaleh and Uplink co-founder Carlos Lei, among other industry insiders, criticized that while the crypto industry has achieved decentralization at the ledger level, it is still far from meeting the standard at the infrastructure level.

News