News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Bitwise Files Spot SUI ETF With SEC, Offering Direct Exposure and Staking Yield to Tap a $5B Token Market

CryptoNinjas·2025/12/20 10:21

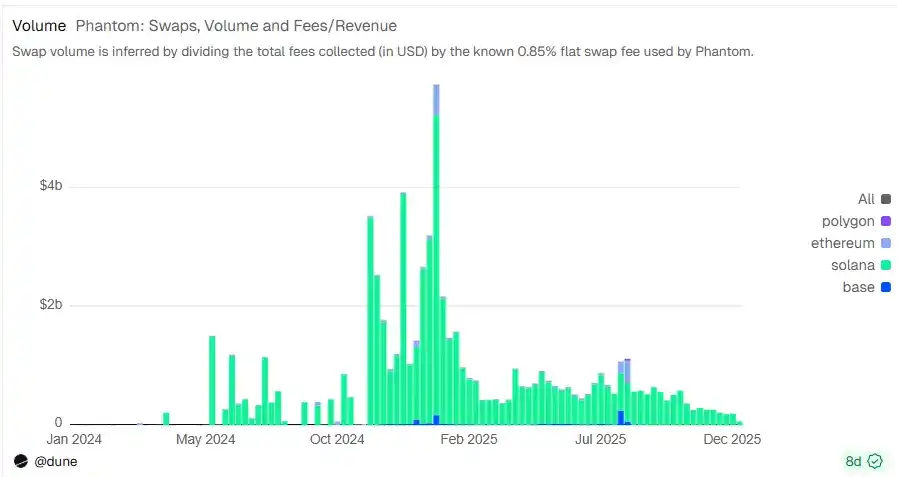

Behind the $3 billion valuation: Phantom's growth anxiety and multi-chain breakout

BlockBeats·2025/12/20 10:02

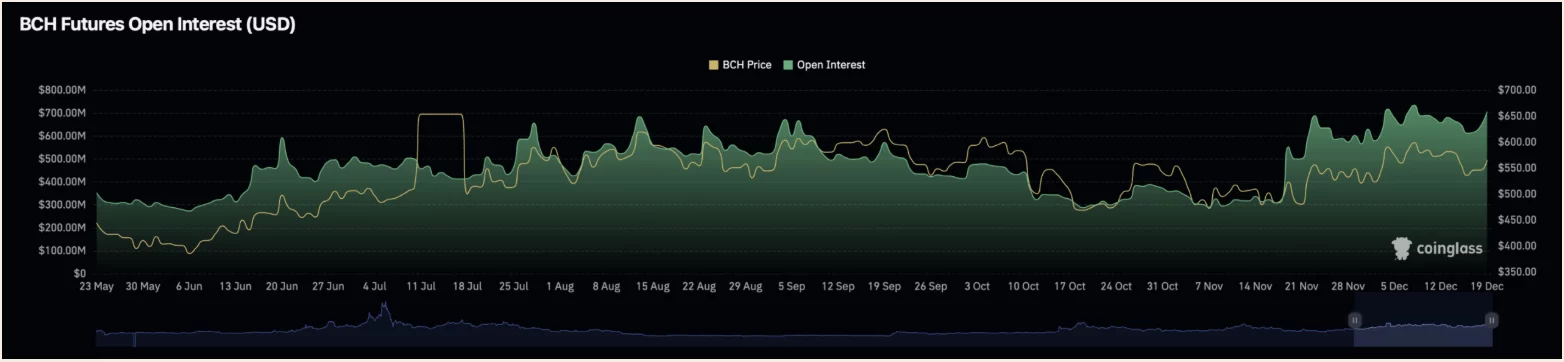

Bitcoin Cash Surges: BCH’s Mixed Market Reaction

Cointurk·2025/12/20 10:01

Pepecoin (PEPE) vs $0.035 DeFi Coin: Which Has the Cleaner Long-Term Setup as Market Conditions Shift?

TimesTabloid·2025/12/20 10:00

DEIN Rolls Out Insurance Marketplace on Arbitrum, Expanding Further to DeFi Ecosystems

BlockchainReporter·2025/12/20 10:00

redphone 2026 prophecy: The Silicon Era arrives, crypto becomes the "last free harbor"

Odaily星球日报·2025/12/20 09:41

Pundit: This Update Is Huge for XRP

TimesTabloid·2025/12/20 09:24

Crypto Hedge Funds Hit Hard as ETF Growth Drains Trading Alpha

Cryptotale·2025/12/20 09:21

Ethereum vs. Bitcoin: What the usage–value split says about prices

AMBCrypto·2025/12/20 09:03

Zcash Price Prediction: ZEC Jumps 10%, Is It The Best Crypto to Buy Now?

Cryptonomist·2025/12/20 09:03

Flash

10:24

A certain whale bought 490,000 HYPE in the past 14 days, worth approximately $12.1 million.According to a report by Jinse Finance, on-chain data monitoring shows that a certain whale purchased 581,000 HYPE tokens (worth approximately $14.4 million) between July and October this year, and subsequently transferred 323,000 HYPE tokens (worth $8 million) to the Hyperliquid platform through a related wallet. In the past 14 days, this whale has bought another 490,000 HYPE tokens (worth $12.1 million), most likely to average down their investment cost.

10:01

BiyaPay analyst: SpaceX makes large purchases of Tesla Cybertrucks, Musk’s operations boost the valuation of both companiesBlockBeats News, December 19, due to weak Cybertruck sales and rising inventory pressure, Tesla is delivering a large number of Cybertrucks to SpaceX (and xAI), both under Musk. SpaceX has already received hundreds of vehicles, and this number may continue to increase; in 2024, about 39,000 Cybertrucks were sold, but subsequent demand is slowing down. BiyaPay analysts believe that "internal coordination" may help smooth deliveries and sentiment in the short term, but it will also raise concerns about related-party transactions, actual end-user demand, and the sustainability of valuations. The stock price still needs to be validated by profitability and core business performance. BiyaPay supports USDT trading for US stocks, Hong Kong stocks, futures, and other assets.

09:52

Data: Brother Machi added 7,000 long positions in HYPE in the past hour, bringing his total long positions to over $17 million. Hyperbot data shows that Brother Maji increased his long position by 7,000 HYPE tokens in the past hour. His positions are as follows: ETH long position worth 15.82 million USD, currently with a floating profit of 220,000 USD; BTC long position worth 970,000 USD; HYPE long position worth 651,000 USD.

News