News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Solana (SOL) hits $300 price target as technical indicators show golden cross and ascending triangle patterns with $220 resistance. - $1.72B institutional inflows into Solana treasuries drive staking yields (7-8%) and ETF adoption, with SSK ETF attracting $1.2B in 30 days. - On-chain data reveals $372M whale accumulation, $23M exchange withdrawals (60% staked), and $13.26B derivatives open interest (67% longs). - 99% odds of U.S. spot Solana ETF approval by October 2025 could unlock $5.52B inflows, pushi

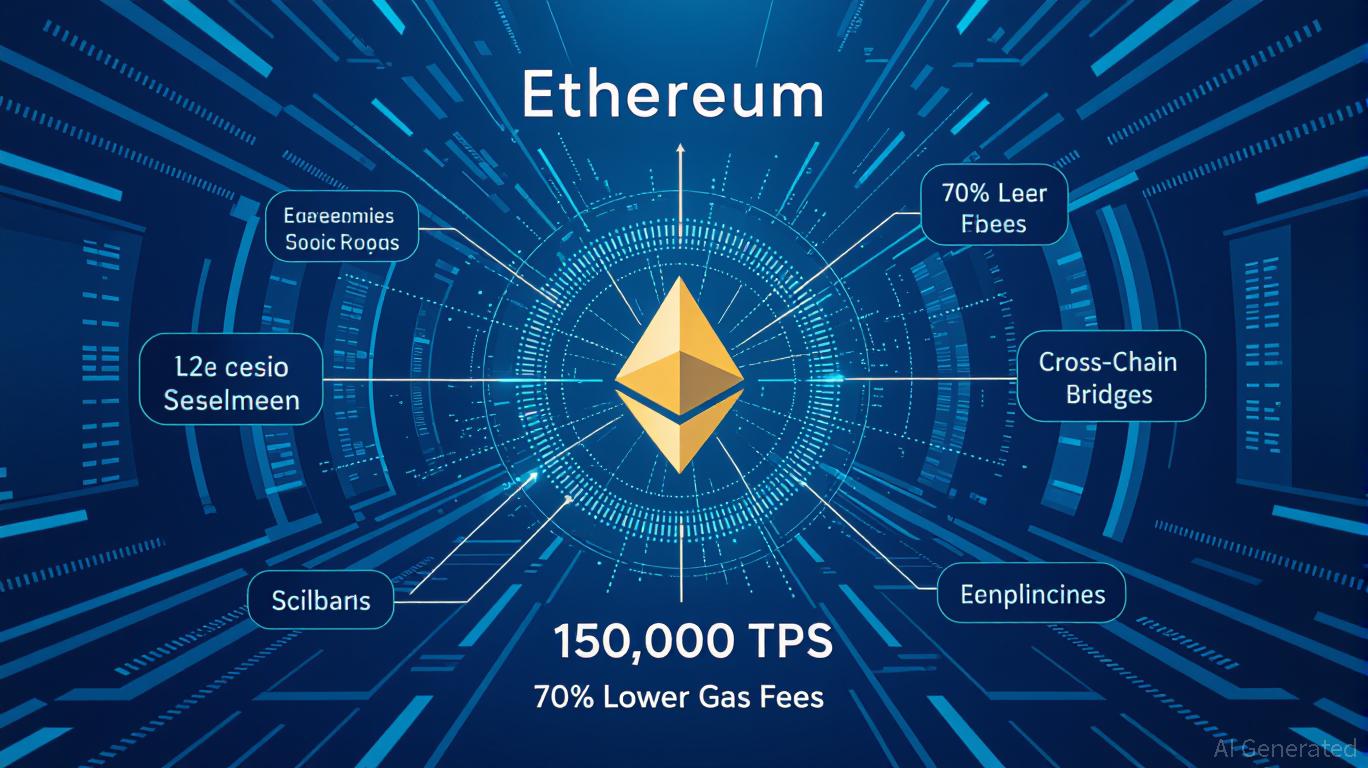

- Ethereum's interoperability layer (EIL) connects 55+ L2 rollups, enabling trustless cross-chain transactions and eliminating centralized bridge vulnerabilities. - Pectra upgrade (May 2025) doubled blob throughput, slashing L2 gas fees by 70%, while upcoming zkEVM (Q2 2026) will cut zk-SNARK verification costs by 80%. - Standardized protocols (ERC-7683/7786) and frameworks like OIF enable seamless cross-chain data/asset transfers, aggregating $42B fragmented liquidity into a unified DeFi ecosystem. - Prot

- Solana Mobile launched Seeker Season on September 8, 2025, merging mobile tech with blockchain to boost Web3 adoption via SKR tokens and hardware-secured devices. - The SKR token incentivizes users and developers, creating a self-sustaining ecosystem with rewards for engagement and dApp innovation. - A Genesis Token, tied to each device, ensures secure onboarding and personalized incentives, targeting mobile users (60% of global internet traffic) to address accessibility gaps. - Strategic partnerships an

- Ethereum's 2025 price outlook remains bullish despite short-term dips, driven by $1.2B ETF inflows, whale accumulation, and Ethereum 2.0's proof-of-stake transition. - High-utility memecoins like Arctic Pablo Coin (APC) and Little Pepe (LILPEPE) offer explosive ROI potential through deflationary models and Layer-2 scalability solutions. - Strategic allocation frameworks recommend 10-15% exposure to high-beta memecoins with real-world infrastructure, while maintaining core Ethereum positions for macro-dri

- BullZilla ($BZIL) launched an Ethereum-based presale with dynamic pricing and deflationary mechanisms to boost early investor value. - Its "Mutation Mechanism" raises token prices every 48 hours or $100k milestone, while "Roar Burn" permanently removes 5% supply at each stage. - The HODL Furnace staking system offers 70% APY on locked tokens, with 20% supply allocated to staking to ensure liquidity and stability. - Structured across 24 stages, the presale aims to redefine meme coin economics through scar

- Flare Networks co-founder Hugo Philion forecasts 5 billion XRP minted by 2026, positioning Flare as a key infrastructure layer for institutional XRP DeFi. - Flare's FAssets and Firelight systems convert XRP to FXRP, enabling lending, staking, and liquidity protocols to expand institutional asset utility. - Partnerships with MoreMarkets (XRP Earn Account) and public companies like Everything Blockchain and VivoPower validate Flare's institutional adoption. - These developments shift XRP from settlement-fo

- A $100M liquidation of "Machi Big Brother's" 25x ETH/40x BTC leveraged positions triggered a $359M crypto derivatives crash in August 2025. - Extreme leverage (146:1 ratios), whale dumping (24,000 BTC), and macro shocks (PPI data, Fed uncertainty) exposed systemic market fragility. - 65% of losses stemmed from BTC/ETH longs, highlighting behavioral risks like overconfidence and FOMO in leveraged trading. - Experts recommend diversification, hedging tools, and regulatory reforms to mitigate cascading liqu

- Ethereum Foundation pauses open grants, shifting to proactive funding for infrastructure, interoperability, and developer tools. - Strategic focus on layer-1 scaling and cross-chain solutions aims to reduce costs and boost DeFi adoption, though financial service projects face exclusion. - Treasury strategy reduces annual spending to 5% over five years, prioritizing GHO stablecoin borrowing and long-term sustainability over short-term liquidity. - This recalibration seeks to strengthen Ethereum’s ecosyste