News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

If Cook resigns, it would potentially allow Trump to gain four seats, giving him a majority on the seven-member board.

In history, September has usually been one of the worst-performing months for Bitcoin and Ethereum, known as the "September Curse," having occurred multiple times during bull market cycles.

Pantera’s $1.25 billion Solana treasury push has failed to spark gains as SOL slides nearly 10%. Weak futures demand and bearish signals point to further downside risks.

Bitcoin faces a potential correction. It must quickly reclaim $110,800. Failure to do so could trigger a further downturn. Glassnode identified a key metric. $110,800 is the average cost for new investors, based on May through July buyers. During this period, Bitcoin hit new all-time highs. Bitcoin Should Defend $110,800 Glassnode explains that the average … <a href="https://beincrypto.com/110800-bitcoins-new-key-defense-line-glassnode/">Continued</a>

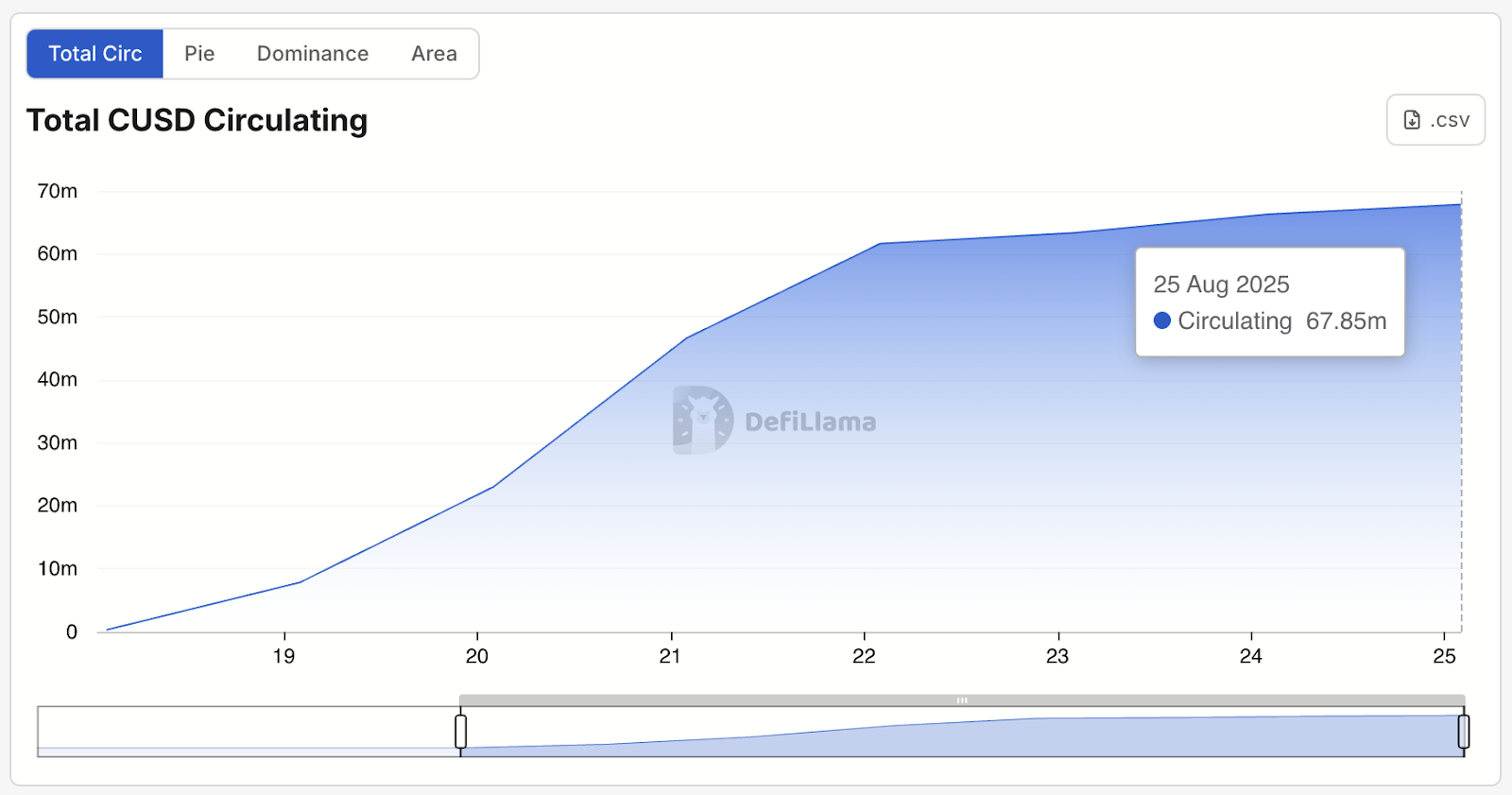

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Bitcoin’s $110,000 support is under pressure as futures and spot traders lean bearish. Without renewed demand, BTC risks sliding to $107,557.