News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.25)|Mt. Gox Hacker May Have Sold 1,300 BTC Within 7 Days; Metaplanet Plans to Accumulate 210,000 BTC by End-2027; U.S. Initial Jobless Claims Come in at 214,0002Where Did the Funds Go After the Meme Craze? Deep Dive into the Prediction Market Track and the Top 5 Dark Horses on the BNB Chain3 BTC Price Holds Firm as Altcoins Bleed—Is the Capital Rotating Back to Bitcoin?

Bitcoin hikes volatility into ‘tricky’ FOMC as $93.5K yearly open fails

Cointelegraph·2025/12/10 16:36

New Ethereum Privacy Infrastructure: In-depth Analysis of How Aztec Achieves "Programmable Privacy"

From the Noir language to Ignition Chain: a comprehensive breakdown of Ethereum's full-stack privacy architecture.

ChainFeeds·2025/12/10 16:34

CARV In-depth Analysis: Cashie 2.0 Integrates x402, Transforming Social Capital into On-chain Value

Today, Cashie has evolved into a programmable execution layer, enabling AI agents, creators, and communities not only to participate in the market, but also to actively initiate and drive the building and growth of markets.

BlockBeats·2025/12/10 16:15

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

A once-in-a-century major transformation is taking place in the U.S. financial system.

BlockBeats·2025/12/10 16:13

Gensyn launches two initiatives: A quick look at the AI token public sale and the model prediction market Delphi

Gensyn previously raised over 50 million dollars in total through its seed and Series A rounds, led by Eden Block and a16z, respectively.

BlockBeats·2025/12/10 16:12

Verse8's Story: How to Support Creative Expression in the Age of AI

Creativity will continue to increase in value through collaboration, remixing, and shared ownership.

BlockBeats·2025/12/10 16:12

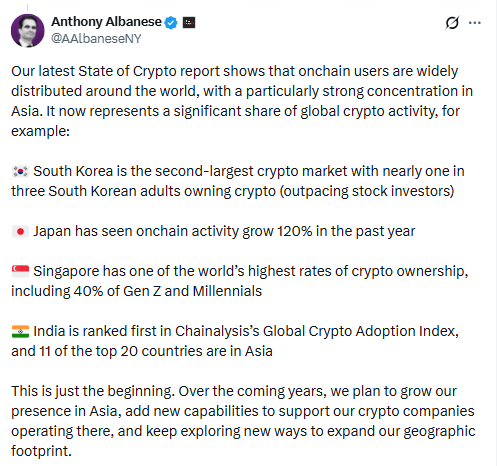

A16z Crypto Targets Asia With New Seoul Crypto Office

Kriptoworld·2025/12/10 16:00

$70,000 Incoming? Trader Who Nailed 2021 Bitcoin Collapse Says ‘Stress Test’ Could Hammer BTC

Daily Hodl·2025/12/10 16:00

Wall Street vs. Crypto: The Battle for Tokenized Stocks Hits Fever Pitch

Kriptoworld·2025/12/10 16:00

Memecoins Hit the Ice Age: Dominance Craters to 2022 Zombie Levels

Kriptoworld·2025/12/10 16:00

Flash

13:46

The whale holding $107 million worth of ETH has withdrawn 5,500 ETH from a certain exchange again after 3 days.According to Odaily, monitored by Ai Yi, one hour ago, a certain whale once again withdrew 5,500 ETH from an exchange, valued at approximately $16.09 million. Since December 5, this address has cumulatively withdrawn 34,415.46 ETH from exchanges, with a total holding value of $107 million and an average cost of $3,131.11. Currently, this address has an unrealized loss of $7.162 million.

13:44

A whale withdrew 5500 ETH from an exchange again 1 hour agoBlockBeats News, December 25th, according to on-chain analyst Ai Auntie (@ai_9684xtpa), a whale has started to accumulate ETH again after three days. One hour ago, he withdrew another 5500 ETH from an exchange (about $16.09 million). From December 5th to date, he has withdrawn a total of 34,415.46 ETH from exchanges, with a total value of $107 million. The average cost is $3131.11 per ETH, and he is currently at a floating loss of $7.162 million.

13:41

Yilihua: USD1 will become the leading stablecoin, WLFI remains a long-term major holding projectAccording to Odaily, Liquid Capital founder Jack Yi posted on X, stating that USD1 is a good start. Stablecoins are the most important sector in the industry and serve as a bridge for crypto technology to enter financial services for billions of people. Jack Yi believes that USD1 can become a leading stablecoin in the future, which is also the reason for his continued heavy investment in WLFI, and he will continue to provide investment and various forms of support. Previous news: WLFI: USD1 market cap has surpassed $3 billion

News