News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Crypto Market Cap Crashes: 8-Month Low Sparks Panic and Opportunity

Bitcoinworld·2025/12/19 05:06

The New York Times: Trump is pushing cryptocurrency toward a capital frenzy

BlockBeats·2025/12/19 05:04

Metya Joins Forces With 4AIBSC To Power Decentralized AI Agents in Web3 SocialFi Platform

BlockchainReporter·2025/12/19 05:00

Stunning Bitcoin Price Prediction: BOJ Policy Could Catapult BTC to $1 Million, Says Arthur Hayes

Bitcoinworld·2025/12/19 04:55

Spot Ethereum ETFs Face Alarming Sixth Day of Net Outflows: What’s Driving the Exodus?

Bitcoinworld·2025/12/19 04:45

ECB Says Digital Euro Is Ready as Decision Shifts to EU Lawmakers

Decrypt·2025/12/19 04:20

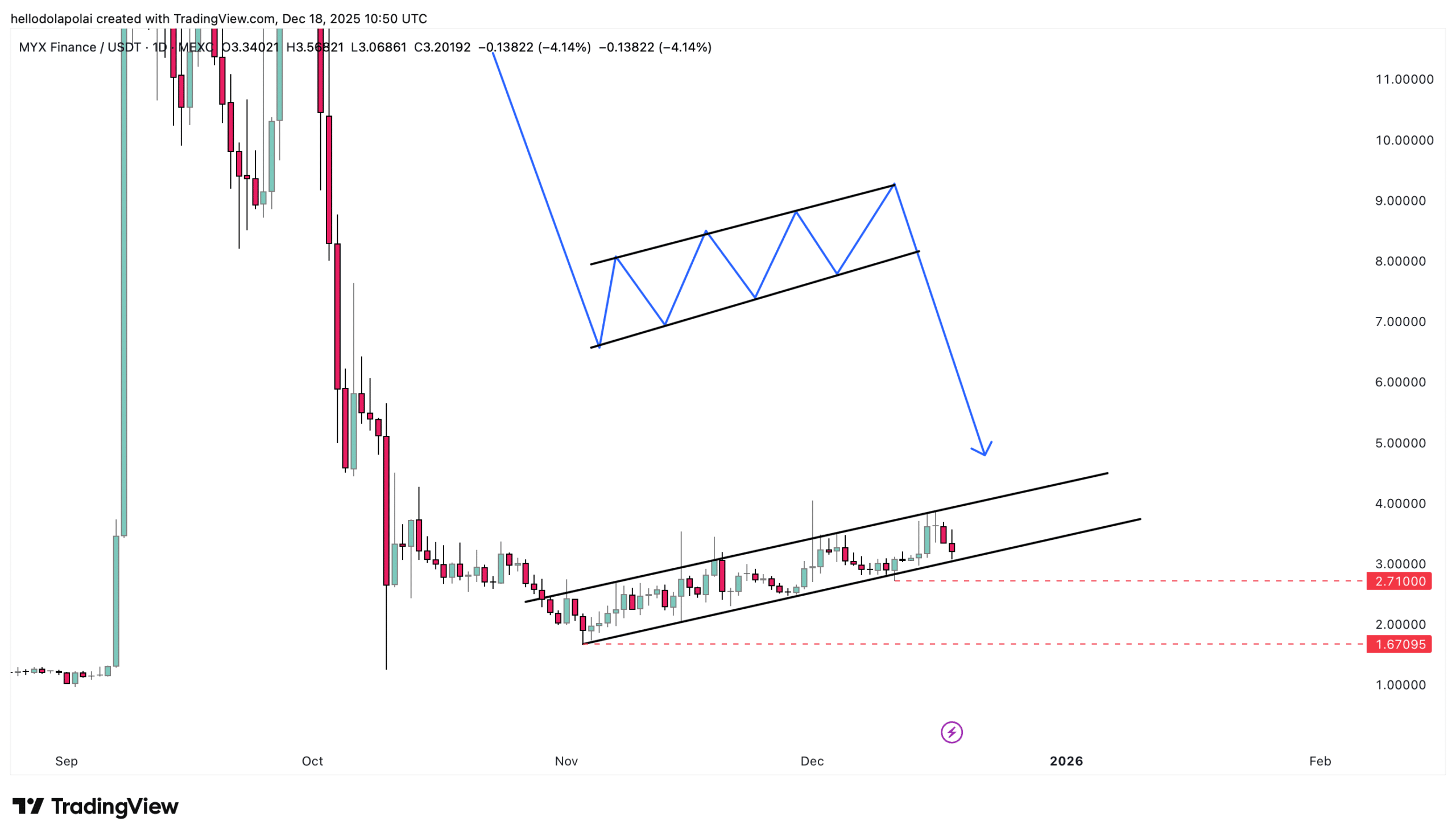

MYX drops 11% as liquidity dries up – Can bulls defend THIS support?

AMBCrypto·2025/12/19 04:03

Take Down OpenAI? The Ambition of the Open-Source AI Platform Sentient Goes Beyond That

Odaily星球日报·2025/12/19 03:44

Historic Shift: Bank of Japan Raises Key Interest Rate to 30-Year High

Bitcoinworld·2025/12/19 03:42

Flash

14:53

VanEck Avalanche ETF plans to trade under the ticker VAVXPANews, December 20 – According to Cryptopolitan, an amended filing submitted by the VanEck Avalanche ETF to the US SEC shows that the ETF intends to trade under the ticker VAVX.

14:47

Vitalik has sold 114,500 KNC, 30.57 million STRAYDOG, and 1.05 billion MUZZ in the past two days. according to Lookonchain monitoring, Vitalik has sold 114,500 KNC (22,300 USD), 30.57 million STRAYDOG (10,300 USD), and 1.05 billion MUZZ (5,600 USD) in the past two days. Vitalik obtained 32,560 USDC and 1.89 ETH (5,600 USD) through the sale of these tokens.

14:47

VanEck submits spot AVAX ETF application to US SECAccording to TechFlow, on December 20, as reported by Cryptopolitan, VanEck has submitted a spot AVAX (Avalanche) ETF registration application to the U.S. Securities and Exchange Commission (SEC). The ETF plans to trade under the ticker symbol VAVX.

News