News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

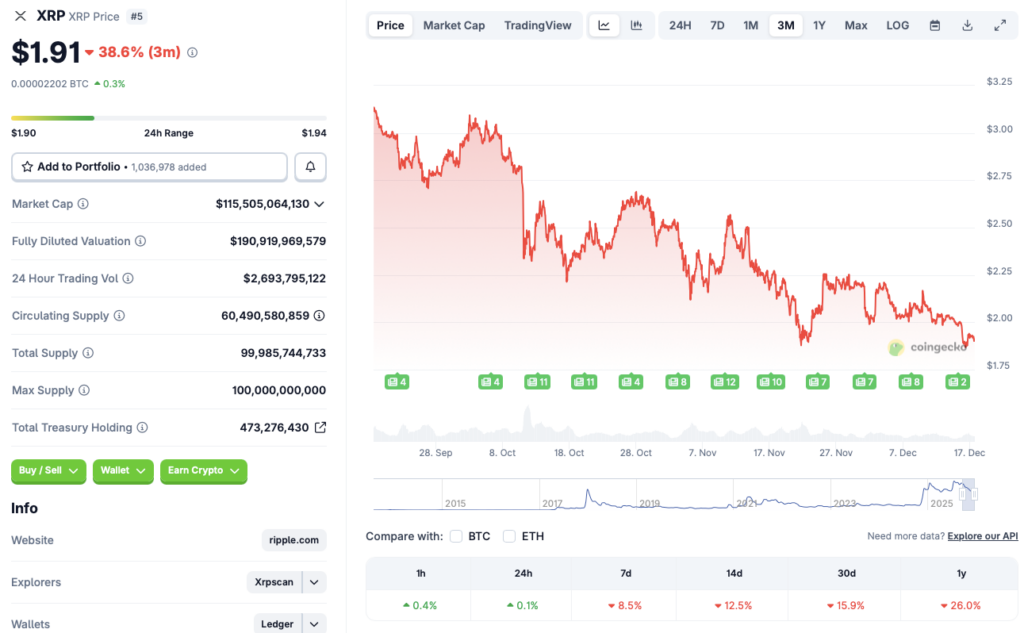

XRP may fall below $1 as whales sell: Here’s what you need to know

币界网·2025/12/17 16:29

Stunning Bitcoin Whale Transfer: $380 Million in BTC Vanishes Into New Wallet

Bitcoinworld·2025/12/17 16:27

Bitcoin Price Plummets: BTC Falls Below $88,000 in Sharp Market Correction

Bitcoinworld·2025/12/17 16:12

DOGE Hangs on $0.074 “Supply Wall” as Traders Watch for a Bounce

BlockchainReporter·2025/12/17 16:12

Bitcoin Miner Hut 8's Stock Soars After Inking $7 Billion Google-Backed AI Deal

Decrypt·2025/12/17 16:12

Analyst Who Accurately Forecasted XRP Price Crash to $1.88 Sets Next Price Target

TimesTabloid·2025/12/17 16:06

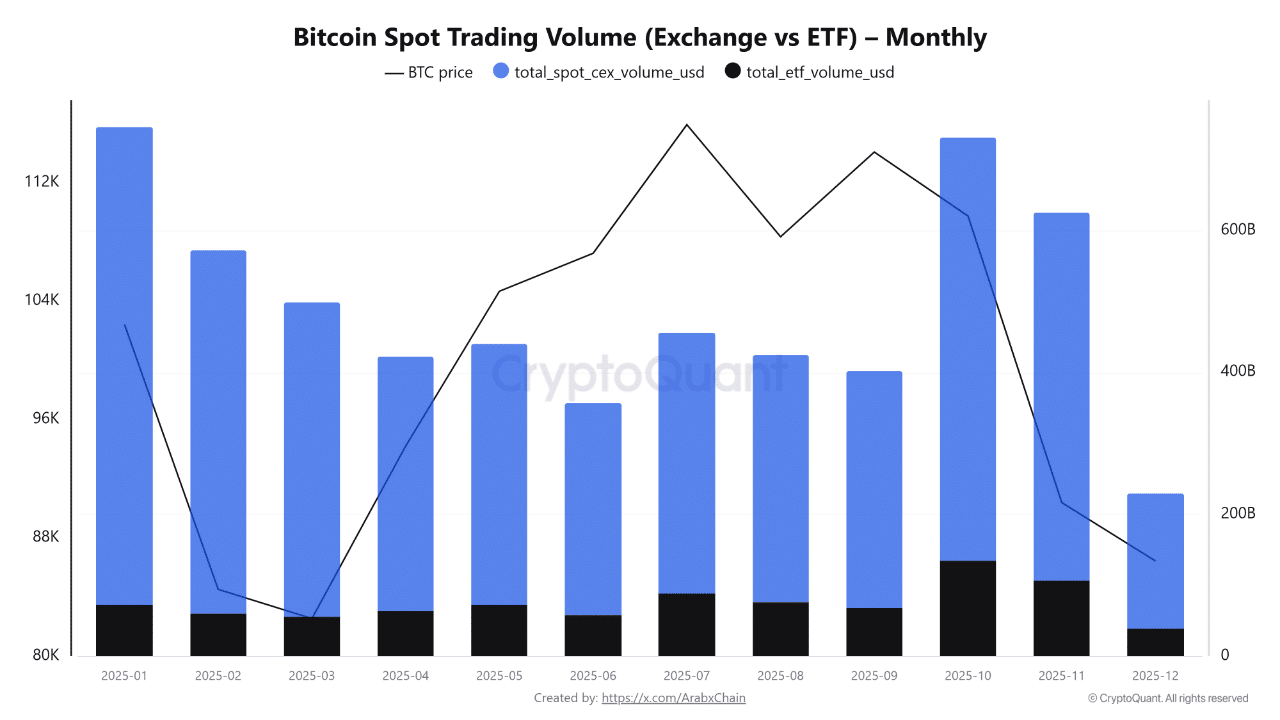

Mapping Bitcoin’s year-end slowdown as leverage exits the market

AMBCrypto·2025/12/17 16:03

Two Key Reasons Why Bitcoin Has Entered a Bear Market: Wall Street Veteran

币界网·2025/12/17 16:02

Bitcoin bears scramble to retreat as BTC surges

AIcoin·2025/12/17 16:02

Top Crypto Presales With Rising Search Volume IPO Genie ($IPO) Gains Global Attention

BlockchainReporter·2025/12/17 16:00

Flash

20:23

BlackRock Chief Investment Officer Rick Rieder will interview for the position of Federal Reserve Chairman at Mar-a-Lago.Jinse Finance reported that BlackRock Chief Investment Officer Rick Rieder will be interviewed for the position of Federal Reserve Chairman at Mar-a-Lago. Other candidates include Kevin Hassett, Kevin Warsh, and Federal Reserve Governor Christopher Waller.

19:12

VanEck updates Avalanche ETF application to include staking rewardsVanEck has updated its application for the Avalanche ETF (VAVX) to include staking rewards, planning to stake up to 70% of its AVAX holdings. The fund will use a certain exchange's Crypto Services as the initial staking service provider and pay a 4% service fee. The rewards will belong to the fund and be reflected in its net asset value. If approved, the fund will be traded on Nasdaq under the VAVX ticker, track the price of AVAX through a custom index, and be custodied by regulated providers such as Anchorage Digital and a certain exchange's Custody.

19:05

Ethereum Glamsterdam upgrade planned for 2026 aims to address MEV fairnessAfter completing last month's Fusaka upgrade, which reduced node costs, Ethereum developers are now advancing the planning of the next major change, Glamsterdam. Glamsterdam is an upgrade that will take place simultaneously on both of Ethereum's core layers, with key features including ePBS and Block-level Access Lists. Developers have not yet finalized the full scope of Glamsterdam, but the goal is to launch it in 2026.

News